Overview

Based on recent user behavior in the USDT and USDC BNB Core markets, Chaos Labs proposes adjustments to the IRMs to support healthier utilization levels while ensuring no additional risk is introduced to the protocol. Below, we present our analysis and the recommended IRM changes.

Recent Market Developments

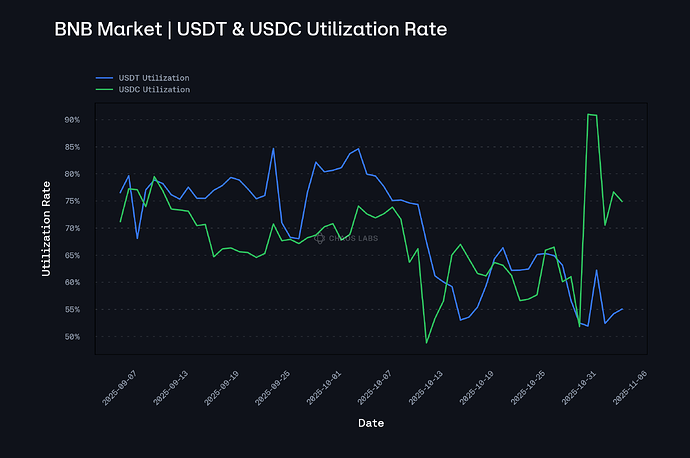

Over the past two months, utilization in the USDT and USDC markets has shown a declining trend, which became more pronounced in the last month. Specifically, the average utilization rate for both USDT and USDC has been around 65%. Based on this demand profile, we recommend lowering the borrowing costs for USDT and USDC to encourage a healthier utilization level.

USDT & USDC IRM

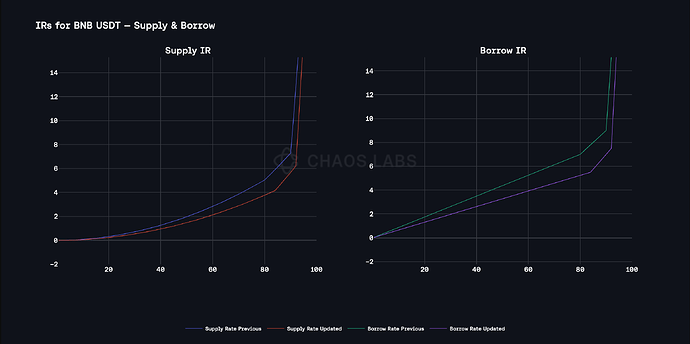

We propose the following changes to the USDT and USDC IRMs:

- USDC: Set the first kink at 84% with a target rate of 5.5%, the second kink at 92% with a target rate of 7.5%, and a maximum rate of 40% at full utilization.

- USDT: Set the first kink at 84% with a target rate of 5.5%, the second kink at 92% with a target rate of 7.5%, and a maximum rate of 40% at full utilization.

We expect the proposed IRM changes will encourage higher utilization and move the markets toward a healthier balance. As shown in the figure, with lower target borrow rates at both Kink 1 and Kink 2, the IRM curves for USDT and USDC become effectively flatter. In practice, this adjustment makes borrowing more capital-efficient and is expected to create stronger incentives for users to increase utilization.

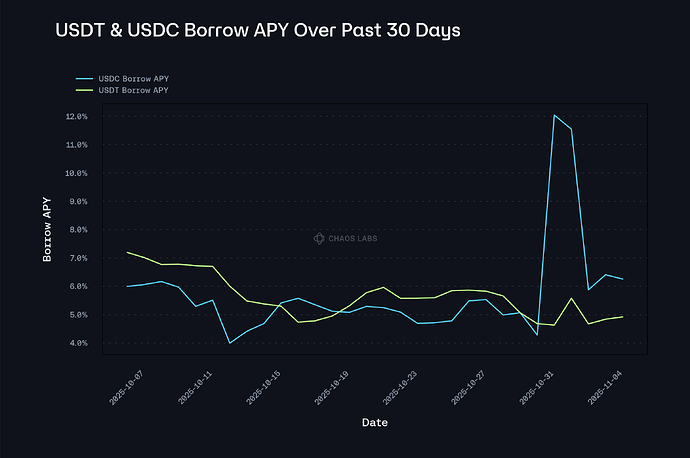

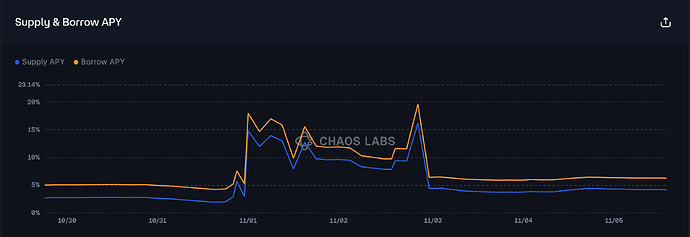

From a risk perspective, we do not expect these changes to create liquidity stress. As shown in the figure below, the average borrowing APY for both USDT and USDC has remained consistently below 6% over the past 30 days. Although USDC experienced a brief rate spike at the end of October, this was caused by several large withdrawals rather than a sustained change in market conditions. Given this demand profile, we do not expect the lowered IRM curve to result in utilization remaining persistently above Kink2, thus causing liquidity stress.

In addition, we believe this IRM change will help mitigate the risk associated with borrow rate volatility through the implementation of the two-kink model. The following section outlines the key trade-offs of the two-kink model and explains why the Venus markets are particularly well suited to this framework.

Trade-Off Between the Single-Kink and Double-Kink Models

When deciding whether to adopt a double kink model, the main trade-off lies between utilization and borrow rate stability. A single kink model can lower the pre-kink borrow rate and drive utilization quickly toward or near the kink. However, the downside is that as utilization approaches the kink, the borrow rate becomes highly volatile and unpredictable. The double kink model addresses this issue by smoothing rate discovery and preventing abrupt rate spikes. At the same time, it comes with the broader buffer zone between Kink 1 and 100% utilization.

The figure below illustrates the volatility dynamics described above. Under a single-kink model, where the target borrow rate at 90% utilization is 5.5%, our observation of the past two months suggests that the market would likely operate around that utilization level. In this setup, even minor shifts in supply or borrowing demand can trigger large utilization swings, causing sharp rate volatility that rapidly pushes borrowing costs higher.

For instance, a small 2% increase in utilization (from 90% to 92%) can raise the borrowing rate by 6.9% (from 5.5% to 12.4%). In contrast, the two-kink model introduces a gradual rate increase once utilization exceeds 84%, resulting in a 2% rate rise over a 8% utilization range. This structure produces a smoother, more predictable borrowing environment and allows users to manage rate expectations more effectively.

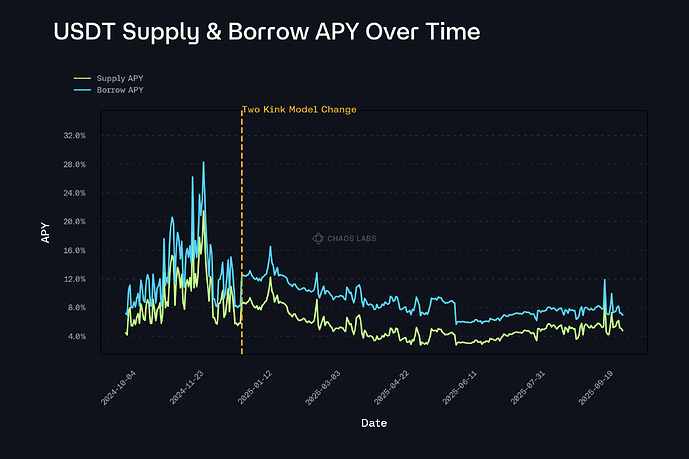

Empirically, the implementation of the double kink model has also proven effective. As outlined in our initial Two Kink Model proposal, the borrow rates for USDT and USDC in Venus’s BNB Core Pool had shown extreme volatility, with daily fluctuations exceeding 200% at times in late 2024. However, after implementing the double kink model, this volatility was significantly reduced. As shown below, after implementing the two-kink model, the USDT borrow rate became far more stable, with none of the extreme volatility observed at the end of 2024.

Rationale for Venus’s Adoption of the Double Kink Model

Understanding the benefits and trade-offs of the double kink structure, the key question becomes how to strike the right balance for Venus. We believe this depends on several factors, and each protocol and asset behaves differently. For Venus’s USDT and USDC markets, we believe the double kink model is particularly well suited because of the following reasons.

First, with the launch of the Stablecoin E-mode, maintaining stable and predictable borrowing conditions becomes especially important. The two-kink model supports yield loopers—users who borrow correlated assets against yield-bearing collateral, such as staking sUSDe and borrowing stablecoins—in managing their positions more effectively. Historical data shows that these users typically operate with narrow spreads between borrowing rates and yields to maximize returns. In this environment, unexpected rate fluctuations can quickly erode profits or turn positions unprofitable, leading to sudden deleveraging.

The heat map below illustrates the potential losses faced by sUSDe leverage loopers under different USDT borrow rate scenarios. As shown, higher USDT interest rates can generate significant losses driven solely by interest accrual. The chart reflects a 9.52x leveraged position, which represents the maximum leverage possible under the Stablecoin E-Mode configuration.

The following chart illustrates how sensitive the single kink model is to small changes in utilization. When utilization rises slightly from 90% to 92%, the borrow rate jumps from 5.5% to 12.5%, which can sharply reduce the profitability of sUSDe leverage loopers. Under the single kink model, the market tends to remain near 90% utilization, making it highly susceptible to rate spikes triggered by moderate borrowing or withdrawals. Once the borrow rate exceeds the yield earned by loopers, their positions quickly become unprofitable. As losses accumulate through interest accrual, borrowers are forced to unwind their positions, creating additional volatility in the market.

The introduction of the double kink model effectively helps mitigate this risk. First, between 84% and 92% utilization, borrowers experience a smoother and more predictable rise in rates, giving leveraged loopers the ability to manage their debt proactively. They can adjust their positions early as rates begin to climb or as utilization approaches the upper range, thereby avoiding sudden spikes in borrowing costs. Second, based on the above mentioned observations of USDT and USDC borrowers over past month, applying a double kink model with the current calibration is expected to naturally stabilize utilization near or around 86%. This significantly reduces the likelihood of utilization breaching the jumpMultiplier zone, effectively minimizing the risk of extreme rate volatility at its source.

Second, the concentration of large whale suppliers in the USDT and USDC markets makes the double kink model particularly appropriate. When a few dominant suppliers control a significant share of total liquidity, even a single withdrawal can push utilization sharply higher, triggering abrupt and volatile rate increases described above. This risk is amplified in the current market structure, where 7 of the top 10 USDT suppliers each hold more than $10M in deposits.

This argument is supported by user behavior in the USDC market. On October 31, 2025, more than $47M of USDC supply was withdrawn, causing utilization to surge from 51.8% to 90.9% within a single day, while the borrowing rate spiked from 5.2% to 17.9%.

Among these redemptions, the top three whale addresses accounted for over $20M in total withdrawals. Notably, address 0x28553bac9ef481e2042da16af8cdad506694385f alone redeemed $17M in a single day, confirming the supplier concentration issue in the Venus USDC and USDT markets and its potential to trigger significant borrow rate volatility.

The double-kink model helps mitigate this risk by allowing utilization to remain balanced between 86% and 92%. This additional liquidity buffer contains borrow rate volatility even during large supplier withdrawals like those described above. In practice, its effect is most pronounced in moderating smaller withdrawals that raise utilization by less than 5%, where the two-kink structure prevents utilization from hovering tightly around 90%, avoiding sudden jumps in the rate multiplier and maintaining a more stable and predictable borrowing environment for users.

Specification

USDT Interest Rate

| Parameter | Current | Recommended |

|---|---|---|

| Base Rate | 0 | 0 |

| Borrow Rate(APR) at Kink 1 | 7% | 5.5% |

| Kink 1 | 80% | 84% |

| Borrow rate(APR) at Kink 2 | 9% | 7.5% |

| Kink 2 | 90% | 92% |

| Borrow Rate(APR) at 100% | 40% | 40% |

| Reserve Factor | 10% | 10% |

USDC Interest Rate

| Parameter | Current | Recommended |

|---|---|---|

| Base Rate | 0 | 0 |

| Borrow Rate(APR) at Kink 1 | 6.5% | 5.5% |

| Kink 1 | 80% | 84% |

| Borrow Rate(APR) at Kink 2 | 8.5% | 7.5% |

| Kink 2 | 90% | 92% |

| Borrow Rate(APR) at 100% | 40% | 40% |

| Reserve Factor | 10% | 10% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.