Summary

-

TUSD

- Increase supply cap to 5,000,000

- Increase borrow cap to 4,000,000

-

SnBNB (Liquid Staked BNB Pool)

- Recommendations for launch parameters

Asset Collateral Factor Liquidation Threshold Supply Cap Borrow Cap Base Kink Multiplier Jump Multiplier Reserve Factor SnBNB 87% 90% 1,000 100 0.02 0.5 0.2 3 25%

Analysis

Supply and Borrow Cap Updates

TUSD

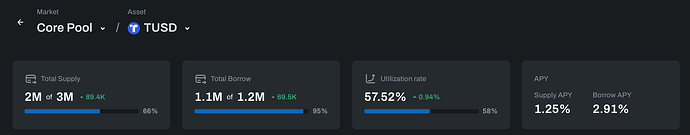

TUSD (Core Pool) Supply and Borrow Cap Utilization have reached 66% and 95%, respectively:

By utilizing our stress test framework, we conclude that doubling the supply cap does not increase the VaR of the system. However, given current demand and utilization, we recommend a more modest increase in the supply cap to 5M, allowing significant room for growth. In addition, we recommend increasing the borrow cap to 4M.

SnBNB Listing (Liquid Staked BNB Pool)

Overview

Chaos Labs supports listing SnBNB in Venus Isolated Liquid Staked BNB Pool as part of an overarching strategy to increase the offering of Venus protocol with diversified assets.

We want to emphasize that the asset has a very limited history, with the first transaction occurring just two months ago. Typically, we do not advocate for listing assets at such an early stage. However, should the community opt to proceed with the listing, please refer to our detailed recommendation analysis provided below.

Following are our analysis and risk parameter recommendations for the initial listing utilizing the methodology we shared for the Isolated Pools.

Liquidity and Market Cap

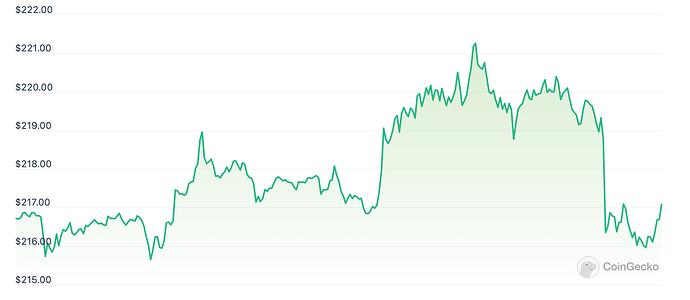

When analyzing market cap and trading volumes of assets for listing, we usually look at data from the past 180 days, but as this asset is only one month old, we have limited historical data. The average market cap of SnBNB over the past 30 days was ~$30M, and the average daily trading volume was ~$150K (CeFi & DeFi).

Collateral Factor

We recommend aligning the Liquidation Threshold of SnBNB to the other Liquid Staked BNB assets setting in the pool, we recommend setting a Liquidation Threshold of 90%. For LSTs, we recommend implementing a 3% buffer between the CF and LT, deriving a Collateral Factor of 87%.

Supply Cap and Borrow Cap

Considering the relatively short history of SnBNB, our recommendation is to initiate with conservative caps. These caps can be adjusted upward once we’ve had the opportunity to assess the level of usage on Venus. For the launch, we propose a supply cap of 1,000 SnBNB and a borrow cap of 100 SnBNB.

IR Curves

We recommend the following setting for the isolated markets, which may be adjusted after analyzing the usage of the assets post-launch.

- Base - 0.02

- Kink - 0.5

- Multiplier - 0.2

- Jump Multiplier - 3

- Reserve factor- 0.25

Recommendations:

| Parameter | Value |

|---|---|

| Borrowable | Yes |

| Collateral Enabled | Yes |

| Supply Cap (SnBNB) | 1,000 |

| Borrow Cap (SnBNB) | 100 |

| Liquidation Threshold | 90% |

| Collateral Factor | 87% |

| IR (Base) | 2.00% |

| IR (Multiplier) | 20% |

| IR (JumpMultiplier) | 300% |

| IR (Kink) | 50% |

| Reserve Factor | 25% |