Summary

-

THE (DeFi Isolated Pool)

- recommendations for launch parameters

Asset Collateral Factor Liquidation Threshold Supply Cap Borrow Cap Base Kink Multiplier Jump Multiplier Reserve Factor THE 0% 0% 2,000,000 1,000,000 0.02 0.5 0.2 3 25% -

TWT (DeFi Isolated Pool)

- recommendations for launch parameters

Asset Collateral Factor Liquidation Threshold Supply Cap Borrow Cap Base Kink Multiplier Jump Multiplier Reserve Factor TWT 50% 60% 1,000,000 500,000 0.02 0.5 0.2 3 25% -

TUSD

- Increase supply and borrow cap to 1,500,000 and 1,200,000, respectively

Analysis

TWT

Overview

Chaos Labs provides risk parameter recommendations for the addition of TWT to the Venus DeFi Isolated Pool, should the Venus community decide on its addition. Following are our analysis and risk parameter recommendations for the initial listing.

Liquidity and Market Cap

When analyzing market cap and trading volumes of assets for listing, we look at data from the past 180 days. The average market cap of TWT over the past 180 days was ~$450M, and the average daily trading volume was ~$22.7M (CeFi & DeFi).

Liquidation Threshold

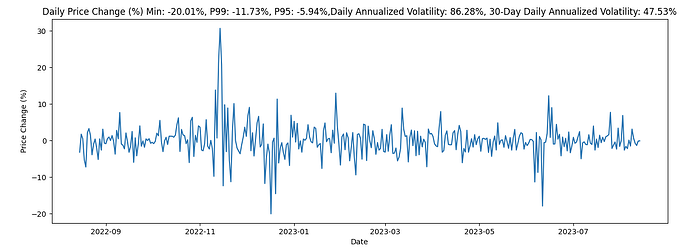

Analyzing TWT price volatility over the past, we observed daily annualized volatility of 86.28% and 30-day annualized volatility of 47.53%. Considering this volatility, we recommend setting a Liquidation Threshold of 60%.

Supply and Borrow Cap

Applying Chaos Labs’ approach to setting initial supply caps for new assets, we propose setting the supply cap at 2X the on-chain liquidity available under the Liquidation Incentive (configured to 10%) price impact.

Given the concentrated liquidity of TWT we recommend a derived supply cap of 1,000,000 TWT, and a borrow cap of 500,000 TWT.

IR Curves

We recommend the following setting for the initial listing, which may be adjusted after analyzing the usage of the assets post-launch.

- Base - 0.02

- Kink - 0.5

- Multiplier - 0.2

- Jump Multiplier - 3

- Reserve factor- 0.25

THE

Overview

Given the proposed long-term relationship between Venus and THENA, and after the positive Snapshot vote to list THE, we recommend launching with conservative risk parameters in the DeFi Isolated Pool.

Following are our analysis and risk parameter recommendations for the initial listing utilizing the methodology we shared for the Isolated Pools.

Liquidity and Market Cap

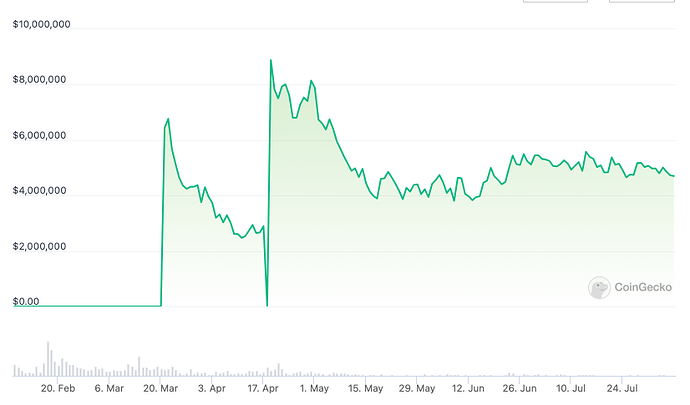

When analyzing market cap and trading volumes of assets for listing, we look at data from the past 180 days. The average market cap of THE over the past 180 days was ~$3.7M, and the average daily trading volume was ~$600K (CeFi & DeFi). It should be noted that the token market cap is relatively low. For comparison - the market cap of Alpaca, which is the lowest market cap token in the Defi pool, is $22M.

Liquidation Threshold

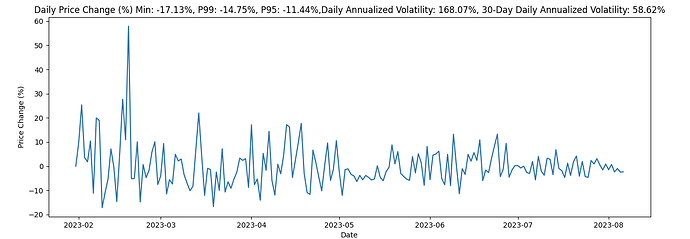

Analyzing THE price volatility over the past, we observed a daily annualized volatility of 168.07% and a 30-day annualized volatility of 58.62%. Considering this volatility and the very low market cap of the asset, we recommend launching with LT=0, meaning the asset will not be utilized as collateral at launch.

Supply and Borrow Cap

Applying Chaos Labs’ approach to setting initial supply caps for new assets, we propose setting the supply cap at 2X the on-chain liquidity available under the Liquidation Incentive (configured to 10%) price impact. Additionally, for the launch, we advise setting a restriction such that the supply cap does not exceed 25% of the total circulating on-chain supply for each asset.

Given the concentrated liquidity of THE, we recommend a derived supply cap of 2,000,000 THE, and a borrow cap of 1,000,000 THE.

IR Curves

We recommend the following setting for the isolated markets, which may be adjusted after analyzing the usage of the assets post-launch.

- Base - 0.02

- Kink - 0.5

- Multiplier - 0.2

- Jump Multiplier - 3

- Reserve factor- 0.25

TUSD

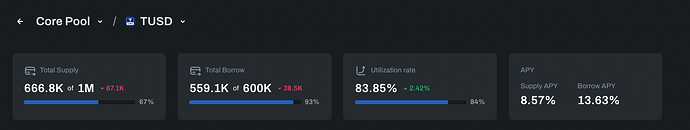

At the time of publishing this post, the TUSD supply cap has reached over 67%, and the borrow cap has reached over 93% utilization, respectively.

Utilizing our supply and borrow cap methodology, and given current on-chain liquidity, we recommend increasing the supply cap to 1.5M and the borrow cap to 1.2M.

We are actively monitoring the supply and borrow caps as well as the borrow usage and on-chain liquidity, and any significant changes in this aspect are promptly communicated to the community through the Alerts section on the Chaos Labs’ Risk Hub as well as through the dedicated Chaos Labs <> Venus Alerts Telegram channel.