Overview

Following the recent volatility of the ALPACA token, we recommend reducing the supply caps to better represent the available liquidity of the asset.

Motivation

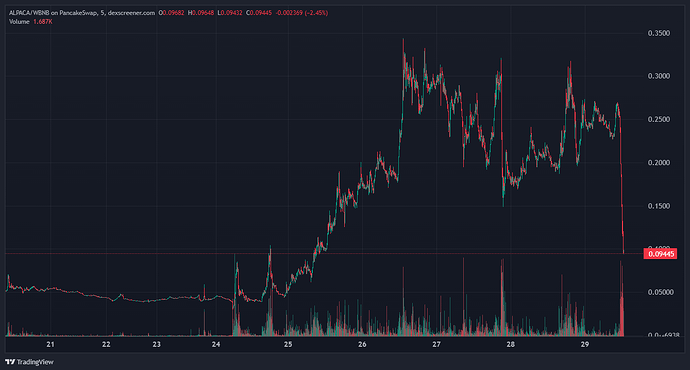

The ALPACA token’s price has risen substantially over the last week, from $0.04 to a peak of $0.37, and subsequently dropped 65% in the span of an hour.

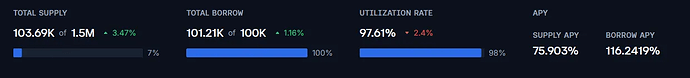

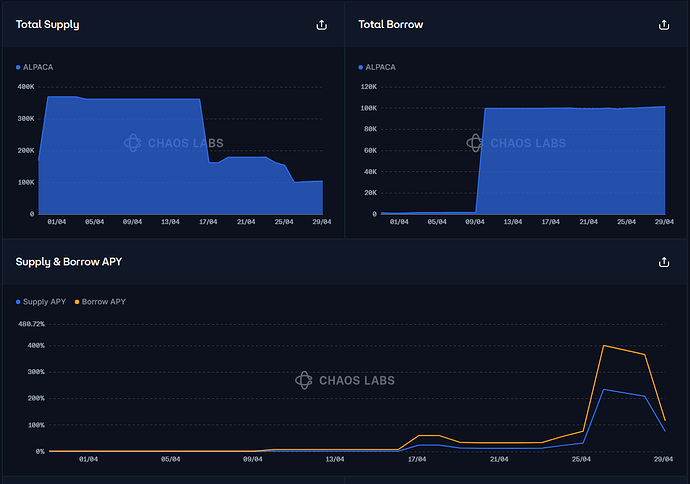

This price rise has caused a meaningful outflow from Venus, with its supply decreasing from 350,000 to 100,000, and utilization of the market reaching 100% for a sustained period. While this creates a lack of withdrawal liquidity, it caused a significant spike in the borrowing rate, incentivizing additional deposits.

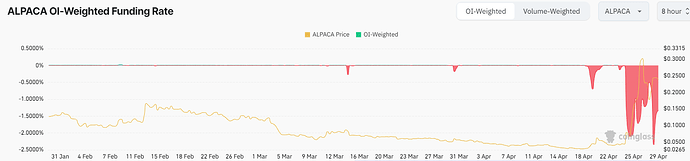

Over the same period of time, the ALPACA funding rate on Perpetual CEX has spiked to over 2% every 8 hours, or over 2000% annualized.

Meanwhile, the market’s 100% utilization means withdrawal liquidity is severely constrained for the users supplying the market and for the liquidators. Liquidations are unlikely to be performed because of the time risk involved.

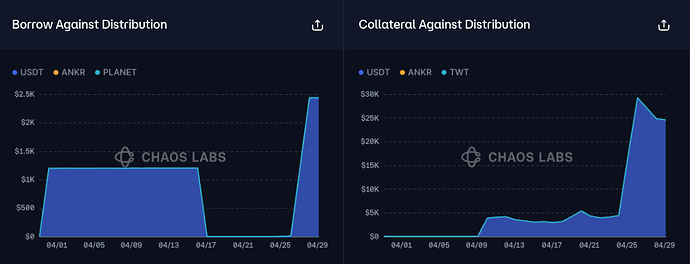

As such, the current top supplier of ALPACA, which maintains a $4000 collateral position and a $2500 USDT borrow position, is currently eligible for liquidation. However, the market’s 100% utilization means that the position cannot be liquidated at the moment. Given the conservative LT of the asset, the position is safe from accruing bad debt. This user represents the aggregate borrow against distribution within the market, as observed below, minimizing outstanding collateralized debt.

ALPACA’s top borrow position is collateralized with USDT, and it maintains a health score of 5, ensuring no bad debt can be caused.

However, given the asset’s high volatility, the dollar value of the supply caps has fluctuated significantly over the last week.

To ensure that liquidations remain profitable following drastic changes in DEX liquidity, we recommend reducing the supply cap of ALPACA on the Venus BNB Defi instance to 200,000 ALPACA.

Specifications

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| BNB DeFi | ALPACA | 1,500,000 | 200,000 | 100,000 | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.