Overview

In light of recent events affecting both the ALPACA and rsETH assets, Chaos Labs and Venus team paused both markets on the Venus BNB DeFi instance and Venus ETH Ethereum-Correlated instance respectively.

ALPACA

After Chaos Labs’ previous post recommending a reduction of ALPACA supply cap, the asset continued undergoing extreme and sudden volatility, culminating in a price surge to $1.20, representing a 30x increase over the span of a week. This rapid price appreciation was followed by another abrupt drop of over 65% within an hour.

These events are strongly correlated with Binance’s recent delisting announcement of the ALPACA token, which likely caused cascading liquidation of the opened short positions on the market, with limited ability to open new positions and hence, mitigate volatility. Following the announcement and the price surge, liquidity on DEX and CEX alike significantly deteriorated, which exacerbated the effect of the cascading liquidations.

The ALPACA market on Venus is currently at 100% utilization. This limits the ability of users to withdraw and hampers liquidators’ ability to act on positions, even if they become eligible for liquidation.

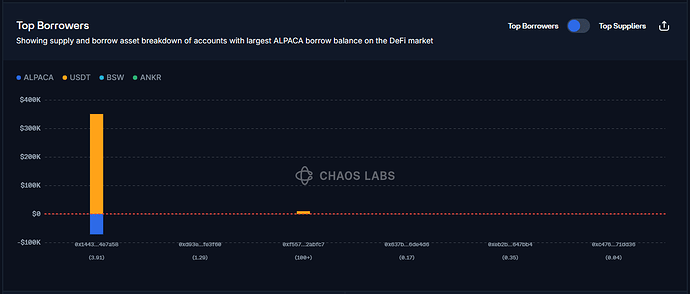

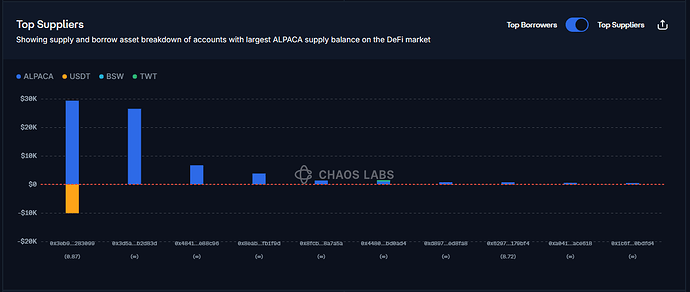

At present, two types of positions dominate the risk profile of the ALPACA market.

On one side, a user supplying roughly $350,000 in USDT as collateral is borrowing 100% of the ALPACA supply on Venus, valued at $70,000. This account remains healthy with no risk of liquidation, even under significant price changes.

On the other side, a user has deposited approximately $30,000 worth of ALPACA as collateral and borrowed $10,000 in USDT. This position is currently eligible for liquidation, and currently maintains a health score of 0.87, however given the market’s inability to absorb liquidation flow at current liquidity levels, the position remains open.

That said, the protocol exposure remains minimal thanks to the very limited size of the position in question, and bad debt would only occur if the position can get liquidated while the price of ALPACA drops below approximately $0.26.

However, given the high volatility, lack of liquidity, and inability to safely unwind positions, we recommended that the Guardian take immediate action to freeze the ALPACA market and prevent additional ALPACA collateralized debt from being taken.

This entails preventing new borrows, while allowing for new supply, and disabling ALPACA as a collateral asset by setting its LTV to zero. These measures will ensure that no new risk accumulates under distressed or manipulated market conditions. Once liquidity normalizes and the market stabilizes around a more organic price, activity can be reinstated following reassessment.

rsETH

In parallel, we also recommended the immediate freezing of the rsETH market across all Venus deployments as a precautionary measure in response to a critical issue identified on the rsETH smart contract infrastructure by Kelp DAO.

A flaw in the minting logic was discovered, resulting in an over-minting of rsETH to a fee recipient address under the control of Kelp DAO. More details on this can be found in the official communications from Kelp DAO.

Our analysis confirms that Venus is not impacted. The rsETH token’s exchange rate remains unaffected in practice, and the faulty mint has not cascaded into protocol-level risks. Nevertheless, as a proactive risk mitigation step, we advised that all new supplying, borrowing, and collateralization involving rsETH be halted.

Kelp DAO has already halted minting, burning, and exchange rate updates temporarily, further stabilizing the situation. We will continue monitoring the event closely and provide updated recommendations as soon as the situation is resolved.