Summary

A proposal to:

- Increase USDC’s supply and borrow caps on Venus’s BNB Core deployment.

- Increase sUSDe’s supply caps on Venus’s BNB Core deploymen.

USDC (BNB Core)

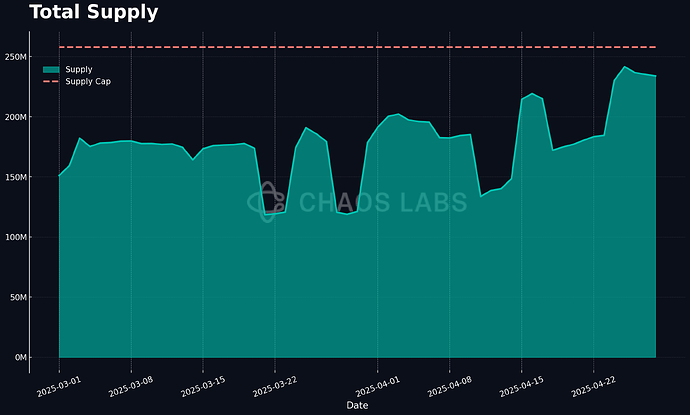

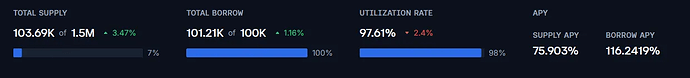

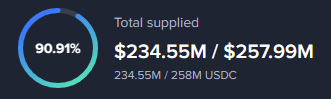

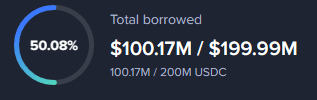

USDC’s supply cap utilization has reached 90.6%, with 233.8M USDC supplied out of a total cap of 258M.

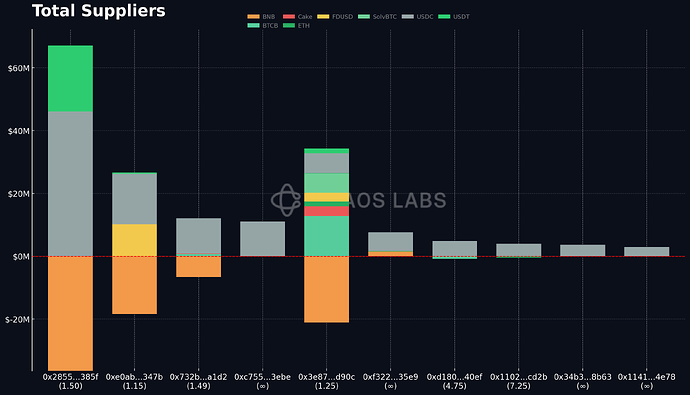

Supply Distribution

The supply of USDC is highly distributed among top suppliers, minimizing concentration risk. The largest individual supplier accounts for 19.4% of the total supply and maintains a moderately strong health factor of 1.5, indicating a relatively stable collateral position.

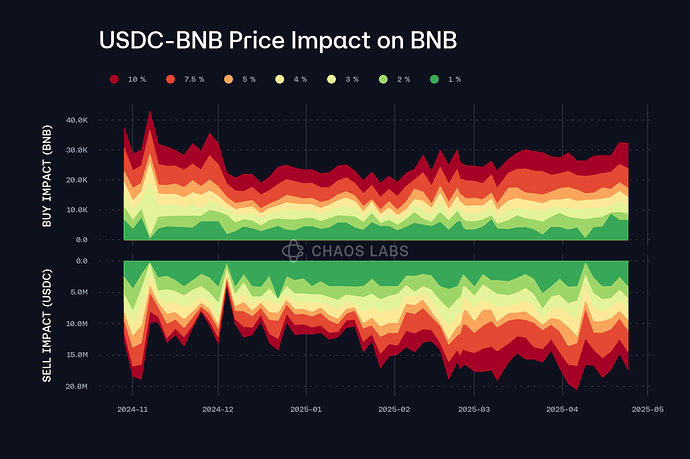

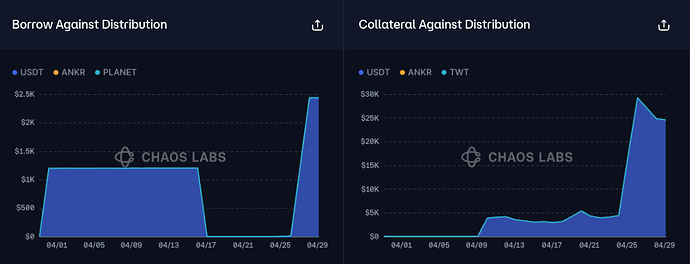

Liquidity

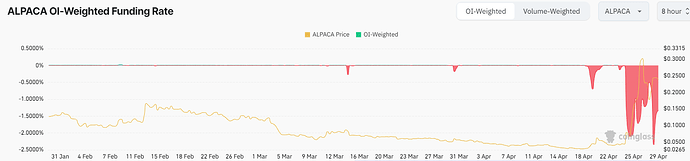

USDC is primarily utilized as collateral for borrowing BNB. When examining the BNB-USDC liquidity path, it shows consistent and stable liquidity, indicating healthy on-chain market depth and low volatility risks for borrowers and lenders.

Recommendation

Given the highly distributed nature of USDC supply among suppliers, the absence of significant concentration risk, and the strong liquidity conditions in the BNB-USDC market, we recommend increasing the USDC supply and borrow cap on the BNB Core deployment.

sUSDe (BNB Core)

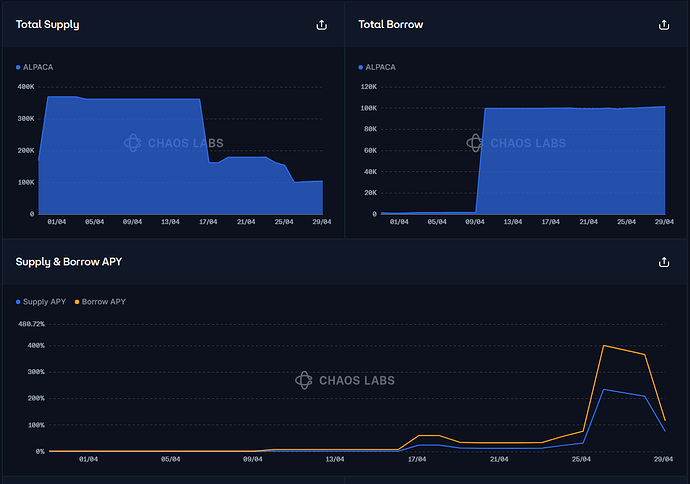

sUSDe’s supply cap utilization has reached 100% with total of 2 million sUSDe deposited into Venus.

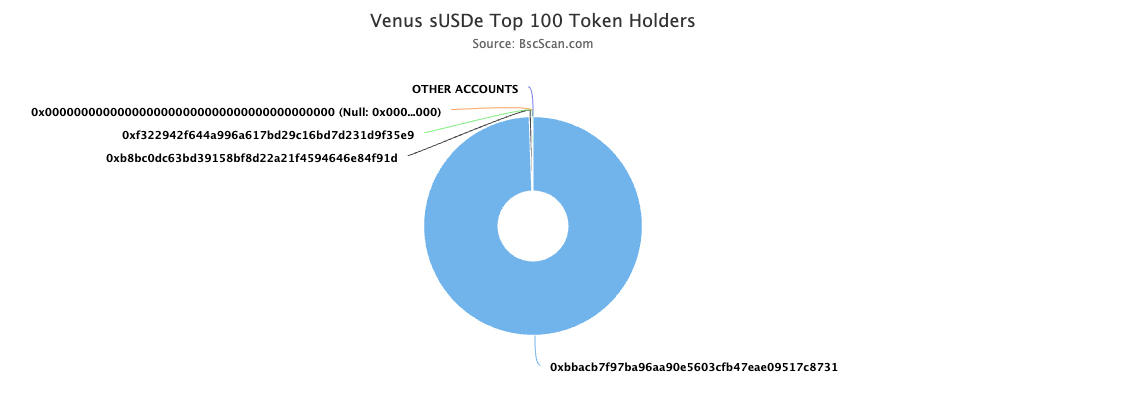

Supply Distribution

Currently, almost all of the supply is provided by a single user, and it is supply-only, which is not unusual given the low current supply cap.

Recommendation

The sUSDe market on Venus’s BNB Core is still in its early stages. Currently, all deposited sUSDe is supply-only, and we do not observe material risk under the current conditions.

Given that increasing the supply cap could help attract additional participation and drive more sUSDe liquidity onto the chain, we recommend raising the supply cap to support the market’s early growth.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| BNB Core Pool | USDC | 258,000,000 | 360,000,000 | 200,000,000 | 324,000,000 |

| BNB Core Pool | sUSDe | 2,000,000 | 4,000,000 | - | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.