Summary

A proposal to increase gmETH and gmBTC’s Collateral Factor and Liquidation Threshold.

All recommended increases are backed by Chaos Labs’ risk simulations, which consider the user behavior, on-chain liquidity, and price impact, ensuring that the new parameters do not introduce additional risk to the platform.

Motivation

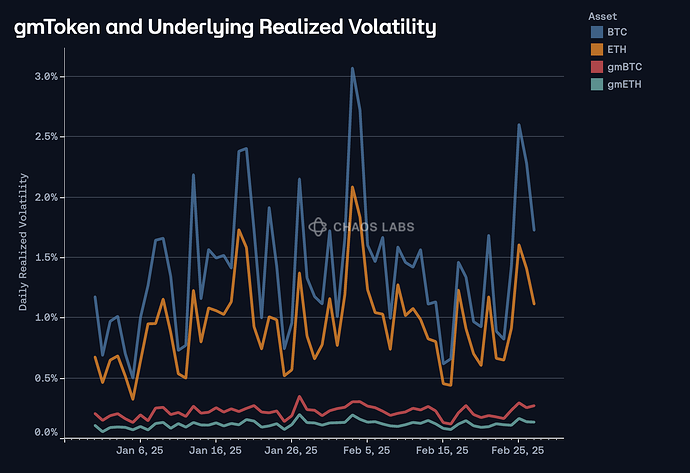

As described in our asset listing recommendations, the gmTokens listed on Venus are composed 50/50 of the underlying asset and USDC, creating lower delta exposure relative to the underlying. As plotted below, this is represented in the gmTokens’ volatility, where both gmBTC and gmETH have displayed a realized volatility of about half that of their associated asset.

Given this lower volatility, as well as a longer history with which to judge their usage on Venus, it is possible to increase the CF and LT for these assets to improve their capital efficiency.

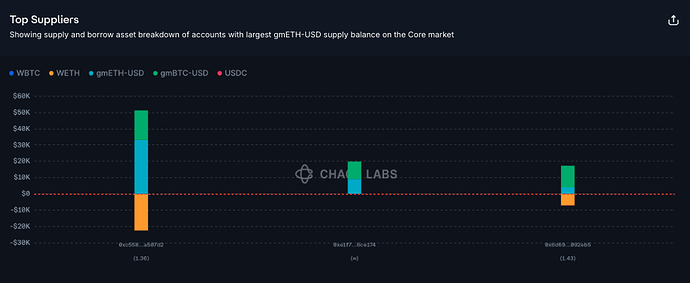

gmETH Supply Distribution

There is under $50K of gmETH deposited on Venus, and it is currently being used to borrow almost exclusively WETH.

This aligns with the anticipated use case described in our listing recommendation, in which users manipulate their delta exposure, in this case, hedging exposure to ETH. This does not present a risk to the protocol, though the user’s borrowing could be liquidated if ETH’s price increases sufficiently.

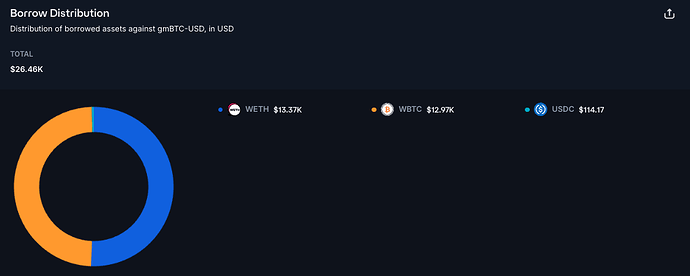

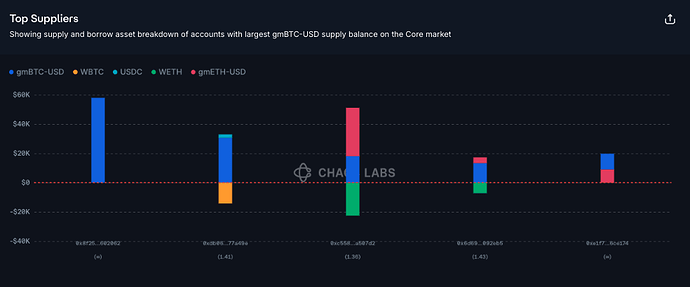

gmBTC Supply Distribution

There is $130K gmBTC on Venus, borrowing a roughly even mix of WETH and WBTC.

This activity is spread across five users, with the largest maintaining a deposit-only position.

While uncorrelated borrowing of WETH using gmBTC does present a higher risk of liquidation, the activity in this market does not preclude us from recommending an increase to the asset’s CF and LT.

Recommendation

Given user behavior and the price action of the gmTokens, we recommend increasing the Collateral Factor and Liquidation Threshold to 70% and 75%, respectively, for both assets. These values are each 5 percentage points lower than the associated tokens (WETH and WBTC), reflecting the gmTokens’ complexity, including the potential for non-atomic withdrawals, which could increase liquidation risks.

Specification

| Asset | Network | Pool | Current CF | Rec. CF | Current LT | Rec. LT |

|---|---|---|---|---|---|---|

| gmETH | Arbitrum | Core | 55.00% | 70.00% | 60.00% | 75.00% |

| gmBTC | Arbitrum | Core | 55.00% | 70.00% | 60.00% | 75.00% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.