Overview

Chaos Labs supports listing gmETH on Venus’s Arbitrum Core pool as part of a strategy to enhance its offering with a greater diversity of assets.

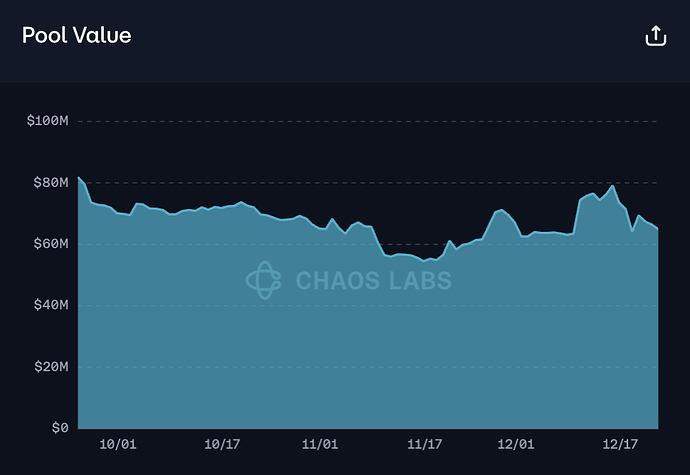

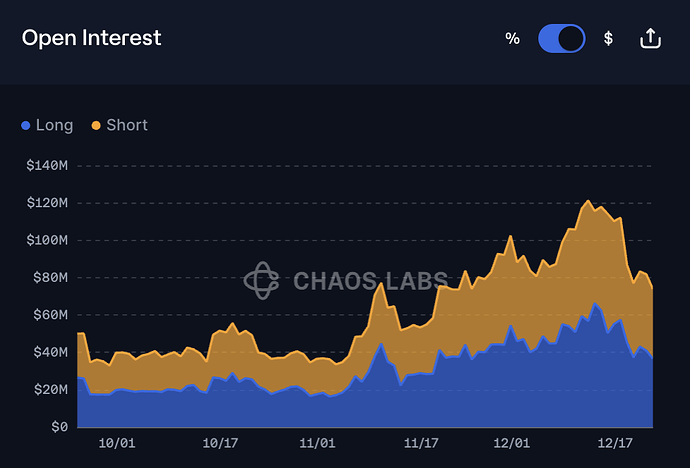

Liquidity and Market Cap

The pool value of gmETH has remained steady between $60M and $80M since the start of December.

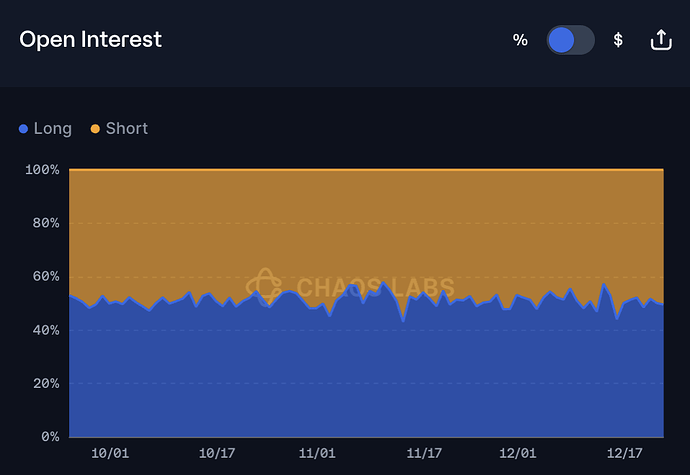

Its open interest is $36.8M long and $37.5M short.

Analysis

Integrating gmETH as a collateral asset can create new demand for borrowable assets, particularly WETH and stablecoins. A primary use case will likely be borrowing the underlying asset (ETH) to hedge delta exposure associated with holding gmETH. Liquidations can occur if the underlying debt asset scales in price while the collateral asset (gmToken) maintains a delta of approximately 0.5. This is due to the gmToken being composed of 50/50 ETH and USDC, assuming the distribution of OI is sufficiently balanced.

Another use case may be borrowing stables to increase delta exposure when supplying liquidity in gmPools. For example, supplying gmAsset as collateral, borrowing USDC, depositing single-sided USDC into gmAsset pool, and attempting to create a delta exposure of ~1. If the price of the gmToken, i.e., the underlying asset drops 50%, liquidations can occur.

Liquidation Bonus, Collateral Factor, and Liquidation Threshold

Like other assets listed on Venus, the liquidating and withdrawing of gmTokens from the pool can be performed atomically, carrying an additional 50 bps fee. There also exists a scenario where liquidations may not occur if the collateral received by the liquidator is greater than the liquidity available to be withdrawn or redeemed (based on the pool’s reserve factor).

We recommend setting the LT to 60% to ensure a sufficient buffer below the point where bad debt would accrue based on the LB (0.91). We recommend setting the CF 5 percentage points below the LT to reduce the likelihood of liquidations.

Supply and Borrow Caps

Each GMX Market has a reserve factor that caps open interest at a percentage of pool size, reducing both the impact of short positions’ profits and the risk that long positions cannot be fully paid out.

GMX has two separate parameters for reserve factor:

- Open Interest Reserve Factor (OIRF): it is impossible to open a position if the new OI > (Pool Size * OIRF)

- Reserve Factor: gmTokens cannot be redeemed if Current OI > (Pool Size After Withdrawal * Reserve Factor)

For gmETH, the Reserve Factor is 275%, and OIFR is 270%.

Thus, to quantify the initial supply cap, we first take the difference between the Reserve Factor and OIRF: 5%. Effectively, we assume the worst-case scenario concerning the gmToken’s ability to be liquidated and withdrawn based on the parameter values set. Put differently, in the scenario of a fully utilized pool encompassing both long and short positions and factoring in the OIRF; our methodology ensures that the protocol can manage the flow effectively. Even in a scenario in which all positions are liquidated, and collateral is recovered, the protocol can still manage its operational needs. However, it is important to recognize that not all borrowers are expected to employ identical strategies, contrary to this assumption.

Furthermore, the full utilization of the OIRF on both sides suggests a lack of significant market movement in the underlying asset. Typically, in the presence of strong market fluctuations, either short or long positions on GMX will be closed out. The largest observed daily imbalance in the last three months was on November 11, when longs represented nearly 58% of the total open interest.

This observation is inversely correlated with the anticipated demand for gmETH as collateral, implying that substantial market movements would be required for liquidation on Venus due to the 0.5 delta.

Given that the pool is valued in USD terms, taking the median pool value over the last 90 days ($68.1M) and multiplying by our 5% margin comes out to 2M ($3.4M) for gmETH. The additional risks associated with this asset lead us to recommend against allowing the asset to be borrowed.

Specification

gmETH

| Parameter | Value |

|---|---|

| Network | Arbitrum |

| Pool | Core |

| Enable Borrowing | No |

| LTV | 55.00% |

| LT | 60.00% |

| Liquidation Incentive | 10.00% |

| Supply Cap | 2,000,000 |

| Borrow Cap | - |

| Kink | - |

| Base | - |

| Multiplier | - |

| JumpMultiplier | - |

| Reserve Factor | - |

| Token Address | 0x70d95587d40A2caf56bd97485aB3Eec10Bee6336 |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0