Overview

Chaos Labs recommends the listing of xSolvBTC within Venus Protocol’s BNB Core Pool, below are our analysis and recommendations for initial risk parameters.

Technical Overview

Solv Protocol

Solv Protocol is a Bitcoin focused DeFi platform designed to unlock the potential of idle Bitcoin. It allows users to deposit native BTC or supported wrapped BTC tokens such as WBTC, tBTC, and cbBTC in exchange for either SolvBTC, a 1:1 BTC pegged token, or BTC LSTs like xSolvBTC (formerly SolvBTC.BBN), SolvBTC.BERA, and SolvBTC.JUP, depending on their staking preferences.

solvBTC is a non-yield-bearing token that is not staked in any DeFi protocol, and therefore avoids risks associated with DeFi staking, such as slashing or protocol-level exploits. However, it is still exposed to risks at the asset management and infrastructure level, such as potential minting contract vulnerabilities or loss of backing due to theft. These foundational risks also extend to solvBTC.LSTs like xSolvBTC, which inherit solvBTC’s base exposure in addition to their own DeFi staking risks, such as smart contract risks or potential slashing events.

xSolvBTC

xSolvBTC is a yield-bearing LST developed by Solv Protocol, representing staked BTC within the Babylon ecosystem. xSolvBTC is issued through Solv Protocol’s Staking Abstraction Layer (SAL), a modular infrastructure that abstracts the complexities of staking Bitcoin. It was previously known as SolvBTC.BBN, and was rebranded to xSolvBTC to better reflect its role as a cross-chain, yield-accruing representation of staked BTC.

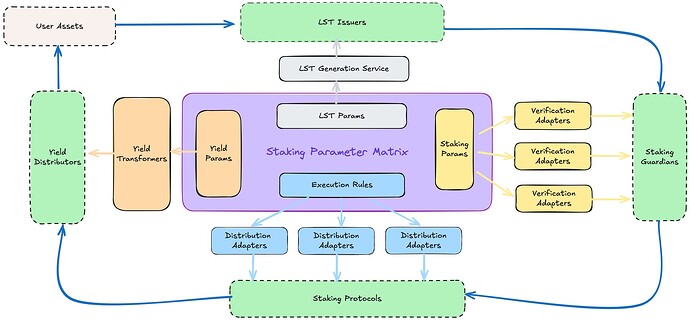

The SAL is built around the Staking Abstraction Matrix (SAM), a unified data schema that defines Bitcoin script configurations, staking parameters, LST contract logic, and yield distribution rules. SAL coordinates interactions among four primary roles: LST issuers, staking protocols, staking guardians, and yield distributors. Its architecture comprises several core services. The LST Generation Service ensures a 1:1 correspondence between staked BTC and issued LSTs. The Staking Validation Service, executed by staking guardians, verifies transaction correctness before broadcasting to the Bitcoin network. The Transaction Generation Service constructs protocol-specific transactions based on SAM-defined parameters. Finally, the Yield Distribution Service calculates and distributes staking rewards to users through token price appreciation, airdrops, or point-based mechanisms.

SAL Architecture

Minting & Redeeming

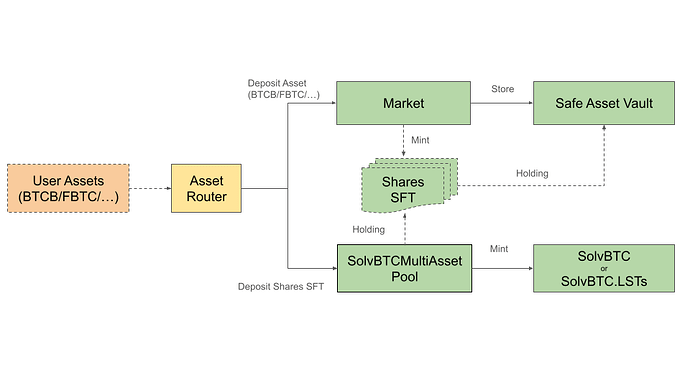

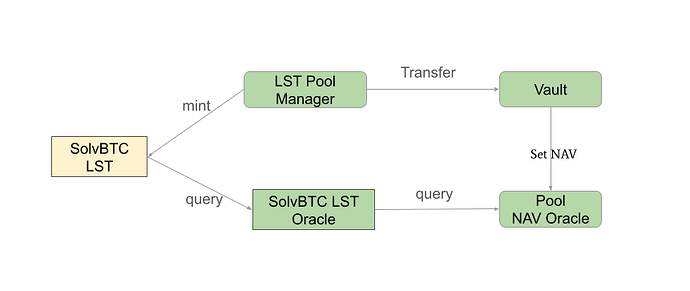

Theminting of xSolvBTC is coordinated through the SolvBTCRouter contract, which serves as the user-facing gateway to the SolvBTC minting system. Depending on the entry path, xSolvBTC can be minted either via direct deposit into the SolvBTCMultiAssetPool or through the subscription flow using createSubscription(). In the latter case, the router invokes OpenFundMarket.subscribe(), which calculates the amount of value to mint based on the Net Asset Value (NAV). If the minting occurs before the pool’s valueDate, the NAV defaults to 1 (normalized by token decimals); otherwise, it is fetched from an external oracle via getSubscribeNav(). Once the corresponding ERC-3525 SFT is minted, it is deposited into the multi-asset pool, which holds the SOLVBTC_MINTER_ROLE and calls mint() on the xSolvBTC contract to issue an equal amount of tokens. This process is guarded by role-based access control and reentrancy protections. Currently, xSolvBTC can only be minted by staking SolvBTC.

Solv Protocol Architecture

The xSolvBTC redemption process begins when a user calls unstake() on the SolvBTCRouter contract to convert their xSolvBTC back into a BTC-backed SFT. The router verifies that the specified SFT slot is eligible for withdrawal, transfers the xSolvBTC from the user, and calls the withdraw() function on the SolvBTCMultiAssetPool. This triggers a burn of the user’s tokens through the burn() function on the xSolvBTC contract, which is restricted by the SOLVBTC_MINTER_ROLE and callable only by trusted contracts like the pool. Once the burn is complete, the pool returns the equivalent value in the form of an SFT using ERC3525TransferHelper, either by minting a new token (doTransferOut) or crediting an existing one (doTransfer).

However, this process is not atomic or immediate. Redemption requests are queued and processed in batches according to Solv’s predefined schedule: requests submitted from the 1st–9th are processed on the 20th, those from the 10th–19th on the end of the month, and those from the 20th to the end of the month on the 10th of the following month, with a 0.2% redemption fee applied at settlement.

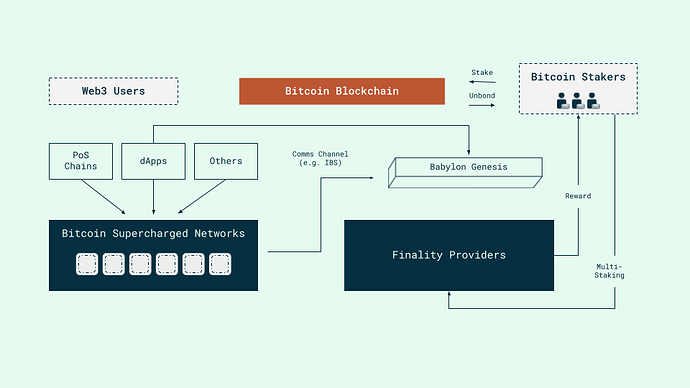

Babylon Staking Layer

Babylon is a Bitcoin staking protocol that allows native BTC to secure external PoS networks, called Bitcoin Supercharged Networks (BSNs), without wrapping or bridging. It does this by locking BTC directly on the Bitcoin mainnet using specially constructed Bitcoin transactions. These transactions include time-lock conditions, which prevent the BTC from being moved until a certain block height is reached. They also embed custom logic that enables slashing: if a validator misbehaves, Babylon can redirect the staked BTC to a penalty address.

To finalize blocks on its Cosmos-based chain, Babylon uses a second layer of consensus involving permissioned Finality Providers. These participants sign finality votes, which are cryptographic signatures confirming the correctness of specific blocks. Signing a vote binds their staked BTC to that block’s validity. If a provider signs two conflicting blocks at the same height (a double-sign), Babylon uses Extractable One-Time Signatures (EOTS) to reveal their private key, which authorizes slashing the BTC they staked.

Because xSolvBTC is backed by BTC staked through Solv Protocol into Babylon, it inherits the slashing risk associated with this system. If the Finality Provider delegated by Solv behaves maliciously or violates Babylon’s consensus rules, the underlying BTC could be slashed, reducing the collateral behind xSolvBTC.

Market Cap & Liquidity

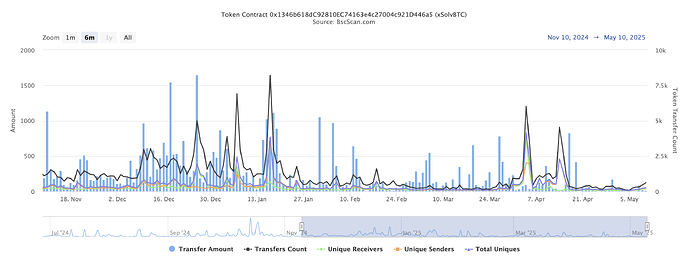

The total supply of xSolvBTC has shown a declining trend over the past six months but has stabilized in the past month. As of this writing, the total supply of xSolvBTC on BNB Chain stands at 768, translating to a $79.73M market cap.

xSolvBTC’s on-chain activity saw a notable spike in April 2025, reaching a peak of 828.61 xSolvBTC transferred in a single day. Over the past month, daily transfer volume has averaged around 100 xSolvBTC, indicating a steady level of usage.

xSolvBTC On-Chain Activity

xSolvBTC’s liquidity is concentrated in the SolvBTC.BBN / SolvBTC trading pair on PancakeSwap. As of this writing, the pool holds 50 SolvBTC and 75 xSolvBTC, translating to a total TVL of $10.37M. Below, we present the aggregate DEX liquidity for xSolvBTC since October 2024.

Volatility

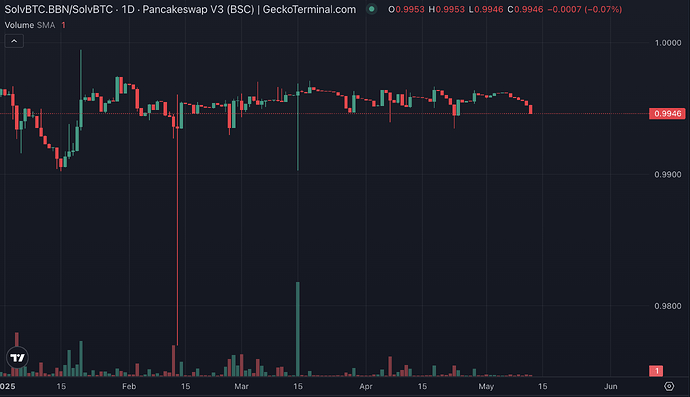

Compared to SolvBTC, xSolvBTC has exhibited relatively low volatility within the SolvBTC.BBN/SolvBTC PancakeSwap pool, maintaining a stable trend over the past three months. As shown in the chart, its maximum drawdown during this period did not exceed 100bps.

Collateral Factor

xSolvBTC’s supply volume, solid DEX liquidity, and low volatility offer a strong basis for assigning relatively high risk parameters. However, its reliance on external staking protocols introduces additional risk not present in SolvBTC, resulting in potential instability. As such, we recommend setting xSolvBTC’s initial parameters slightly more conservatively than those of SolvBTC, with a CF of 72%.

Supply & Borrow Caps

Our standard approach for setting supply caps generally relies on calculating twice the available liquidity below the liquidation bonus threshold. Applying this methodology, we propose an initial supply cap of 100 xSolvBTC.

Considering xSolvBTC’s yield-bearing design and its expected limited use in borrowing, we recommend classifying xSolvBTC as a non-borrowable asset at this stage.

Oracle

The xSolvBTC contract uses an external oracle to determine the current Net Asset Value (NAV) per share, which governs how many tokens are minted or redeemed. This oracle is accessed via getOracle(), which returns the address of the SolvBTCYieldTokenOracleForSFT contract. When a user calls getValueByShares or getSharesByValue, xSolvBTC queries the oracle’s getNav(address) function, which retrieves the latest NAV for that token. This NAV reflects the current value per share based on underlying yield. Once retrieved, this NAV is used to compute conversions:

- Minting**:**

shares = value * 10^decimals / nav (via getSharesByValue)

- Redemption**:**

value = shares * nav / 10^decimals (via getValueByShares)

Therefore, to price xSolvBTC, we recommend using the Fundamental Rate Redstone Oracle available at this address to determine the conversion rate between xSolvBTC and SolvBTC, and multiplying that rate by BTC/USD Chainlink Price Feed as recommended in this post.

Recommendation

| Asset |

xSolvBTC |

| Chain |

BNB |

| Pool |

Core |

| Collateral Factor |

72% |

| Liquidation Incentive |

10% |

| Supply Cap |

100 |

| Borrow Cap |

- |

| Kink |

- |

| Base |

- |

| Multiplier |

- |

| Jump Multiplier |

- |

| Reserve Factor |

- |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.