Overview

Chaos Labs supports the creation of a BTC E-Mode with the inclusion of BTCB, SolvBTC, and xSolvBTC. Given the structural linkages between these assets, we believe this will significantly enhance capital efficiency for users while not introducing additional risks. Below, we present our analysis and initial risk parameter recommendations.

At this stage, we do not support the inclusion of PT-SolvBTC.BNB-18DEC2025 and PT-xSolvBTC-18DEC2025 in the newly established BTC E-Mode. Our rationale is outlined in the second half of this post.

BTCB & SolvBTC & xSolvBTC

Given the structural linkage between SolvBTC, xSolvBTC, and BTCB, we expect their valuations to remain highly correlated, and therefore consider more permissive risk parameters between them unlikely to introduce additional systemic risk.

SolvBTC

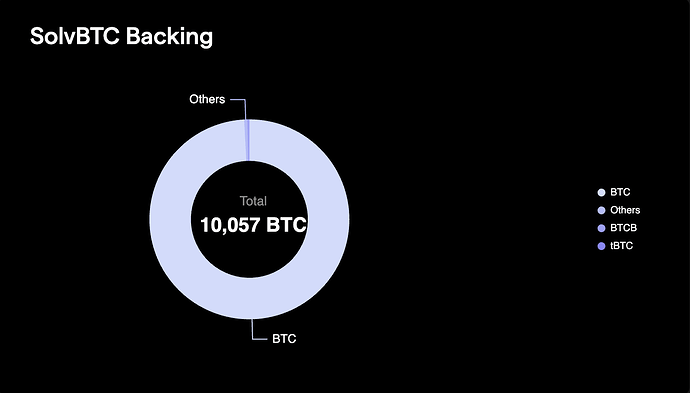

SolvBTC is a non-yield-bearing reserve token issued by Solv Protocol to represent BTC across EVM-compatible chains. Unlike LRT, SolvBTC is not deployed into external protocols and would therefore insulated from smart contract exploits, slashing penalties, or validator failures. Its primary role is to serve as the foundational BTC wrapper within Solv Protocol’s infrastructure and as the base asset for minting xSolvBTC. As of this writing, SolvBTC is backed 1:1 by reserves composed of approximately 99% native BTC held in verifiable custody. Solv Protocol utilizes the Staking Abstraction Layer (SAL) to standardize and secure the cross-chain minting process: SAL monitors Bitcoin mainnet for valid deposits, generates cryptographic deposit proofs, and relays them to EVM chains where the minting contracts validate the proof and issue SolvBTC.

SolvBTC Transparency Dashboard

Because SolvBTC is designed to mirror the value of native BTC and is secured through verifiable custody and SAL’s cross-chain infrastructure, it behaves similarly to other major BTC wrappers like BTCB, which is issued by Binance and backed by BTC under its own custody model. Given that both SolvBTC and BTCB are pegged 1:1 to native BTC and rely on custodial reserves for integrity, their market values are expected to remain tightly aligned.

xSolvBTC

As we previously analyzed in this post, xSolvBTC is a yield-bearing LRT issued by Solv Protocol, representing BTC staked to the Babylon network and secured through the SAL. Unlike our earlier analysis, following recent contract upgrades, xSolvBTC now supports atomic minting and redemption via the XSolvBTCPool contract, where SolvBTC is burned to mint xSolvBTC, and vice versa, in a single transaction. SolvBTC and xSolvBTC are therefore tightly coupled through this mechanism, as SolvBTC is the sole asset used for both entry and exit.

Although xSolvBTC maintains close price tracking to SolvBTC under normal conditions, it introduces additional risk through its exposure to Babylon’s validator slashing. xSolvBTC derives yield from BTC staked via Babylon, and validator misbehavior, specifically double-signing (equivocation), can trigger a slashing event that permanently reduces the underlying collateral, thereby lowering xSolvBTC’s NAV. However, Babylon’s slashing framework is deliberately narrow and capped: penalties are currently limited to 0.1% of the BTC delegated to the offending Finality Provider and do not apply to downtime or missed votes. The current fixed slashing scope ensures that price deviation between xSolvBTC and SolvBTC remains small and contained, preserving their tight price alignment under most conditions. However, as Babylon’s implementation of restaking remains in its infancy, the future staking penalty could change.

Reccomendation

Given the high correlation between the three assets and the strong demand shown on the Venus market for SolvBTC and xSolvBTC looping with BTC.b we recommend the creation of a BTC E-Mode, including the three previously mentioned assets. However, given the uncertainty regarding future changes to the Babylon protocol’s slashing rules and the presence of atomic conversions between SolvBTC and xSolvBTC, which presents the risk that the backing of the two assets may be partially intertwined during the unstaking process, we recommend initially adopting slightly conservative parameters for the E-Mode.

PT-SolvBTC.BNB-18DEC2025

SolvBTC.BNB

SolvBTC.BNB is a Solv Vault strategy on BNB Chain that uses SolvBTC as collateral to borrow BNB and deploy it into Aster’s asBNB module, which aggregates Launchpool, Megadrop, and HODL-er rewards. The vault combines these returns by periodically converting earned BNB-based rewards back into SolvBTC to increase the vault’s NAV while distributing protocol incentive tokens as airdrops when applicable. This structure exposes depositors to SolvBTC’s base collateral plus the added yield and smart contract risks from leveraged BNB deployment and Aster’s reward mechanisms.

To mint SolvBTC.BNB, users deposit BTCB or SolvBTC via the Solv Protocol frontend. Behind the scenes, this triggers a subscription to an OpenFundMarket pool, which mints an ERC-3525 Semi-Fungible Token (SFT), specifically, an OpenFundShare, representing ownership in a yield-bearing BNB strategy. This SFT includes both a tokenId and a slot, where the slot identifies the strategy type, and the token’s balance reflects the user’s share. The SFT is then deposited into the SolvBTCMultiAssetPool via the SolvBTCRouter. This router validates that the SFT belongs to a whitelisted slot and meets minimum balance criteria before allowing minting. Once validated, SolvBTC.BNB is minted 1:1 to the user’s wallet. This entire process is atomic, meaning the subscription, SFT creation, deposit, and token minting all happen in a single transaction.

To redeem SolvBTC.BNB, users initiate a redemption request through the Solv Protocol interface. The token is burned upon submission, and the corresponding yield-bearing OpenFundShare (ERC-3525 SFT) is transferred back to the user, representing their claim on the underlying BNB strategy. However, redemptions are not atomic: instead of immediate settlement, redemptions are queued and processed in batch cycles three times per month. The redemption windows are based on the date the request is submitted, and fulfillment occurs on the 10th, 20th, or end of each month (or the next business day). Behind the scenes, the SFT is redeemed through the OpenFundMarket and OpenFundRedemption contracts, where its NAV is calculated and settled based on the most recent valuation of the strategy.

Importantly, at the time of writing, there is no on-chain liquidity for SolvBTC.BNB. And since protocol redemptions are non-atomic and follow a fixed processing schedule, there is currently no way to exit the position immediately.

PT-SolvBTC.BNB

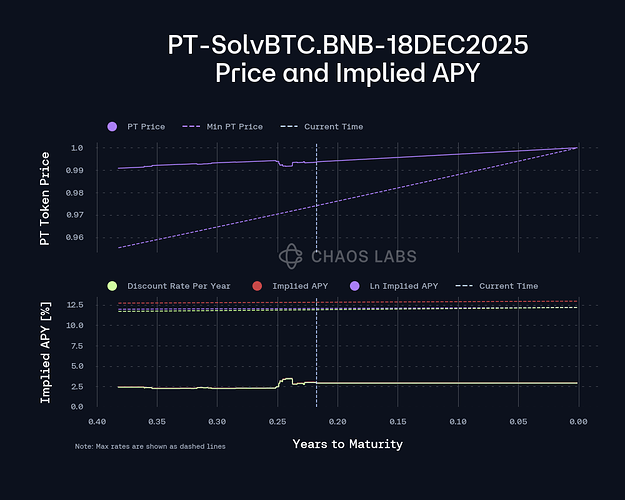

Like other Pendle PTs, PT-SolvBTC.BNB represents the discounted principal value of its underlying, converging to 1 at maturity on December 18, 2025. This convergence reflects the guaranteed redemption path of the underlying SolvBTC.BNB, with the pricing shaped by the implied yield and the time remaining to maturity. As with all PT tokens, the Pendle AMM progressively concentrates liquidity closer to parity as expiry approaches, ensuring more efficient pricing and reduced slippage near maturity.

As shown in the figure, the minimum PT price is approximately 0.975, with a remaining 0.23 years to maturity. This indicates the presence of a moderate level of duration risk, meaning that yield movements over the remaining time still have a material impact on PT pricing.

Recommendation

Based on the analysis above, we do not recommend listing PT-SolvBTC.BNB-18DEC2025 or including it in BTC E-Mode at this time. As the underlying asset of this PT, SolvBTC.BNB presents several concerns—primarily due to its complex yield strategy that involves interacting with multiple protocols, each carrying its own distinct risk profile. More importantly, the asset currently lacks the liquidity required to function safely as collateral.

As of this writing, Pendle AMM shows strong on-chain liquidity for the PT itself, allowing trades of nearly 1,000 PT-SolvBTC.BNB with low slippage. However, in stressed market conditions, the correct exit path for PT holders is: PT → underlying asset → base asset (e.g., BTC). As detailed in our previous analysis, SolvBTC.BNB, the underlying asset, has no native on-chain liquidity, and its redemption process back to SolvBTC is non-atomic and subject to a fixed redemption schedule. In practice, this means there is no immediate exit route for the collateral under volatile conditions, which may prevent timely liquidations and increase the risk of bad debt.

Given these factors, we recommend withholding the listing of PT-SolvBTC.BNB for now. Should the underlying asset’s liquidity improve, we will re-evaluate its eligibility based on market conditions and protocol safety.

PT-xSolvBTC-18DEC2025

Recommendation

We do not recommend listing PT-xSolvBTC-18DEC2025 or including it in BTC E-Mode at this time. As of this writing, the PT-xSolvBTC market is extremely small, with an outstanding supply of only two PT tokens. Additionally the liquidity on the market is limited, with around $1M in total liquidity, approximately 81% of which sits in SY tokens. Thie combination of limited liquidity and low outstanding PT supply indicates a lack of demand for the market. As such we recommend holding off on listing PT-xSolvBTC as of now.

Specification

BTC E-mode

| Parameter | Value | Value | Value |

|---|---|---|---|

| Asset | xSolvBTC | SolvBTC | BTCB |

| Collateral | Yes | Yes | No |

| Borrowable | No | No | Yes |

| Collateral Factor | 81% | 83% | - |

| Liquidation Threshold | 83% | 85% | - |

| Liquidation Incentive | 4% | 4% | - |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.