Summary

GMX Contributors would like to propose the addition of gmETH – the deep ETH/USDC liquidity pool token of GMX V2 – to Venus Protocol due to its popularity and significant benefits for Venus users.

Background: GMX V2

GMX V2 was set in motion with discussion on the GMX forums starting in mid-2022 about the next iteration and direction of GMX. Over time, the constraints of a product like GLP (the GMX V1 Liquidity Pool Token), designed for a particular set of assets and size, limited its ability to fully leverage its potential at scale.

V2 is a more ambitious concept; learning from what worked with the V1 model and what did not work. GMX contributors set out to make a new product built from the ground up to enhance the experience of both traders and liquidity providers.

GLP proved that there was a desire for community owned liquidity that would provide the foundation of a deep perp market on-chain. This meant there wasn’t a need to rely on professional market makers who, on CEXs and even in DeFi, would do so mainly on the basis of preferential deals and extract value from the ecosystem. GMX helped pioneer the idea that Oracles could effectively support price discovery of assets, and be utilised to provide liquidity providers with a more equitable return on capital by not bleeding excess value to MEV.

GMX’s results over the last two years show a fundamental demand from traders to have sovereignty over their assets, control of their positions, transparent pricing, assured protocol solvency (always 100% backed, verifiable on-chain), and isolated risk (as traders only have the funds of a specific position exposed to the GMX protocol, while they continue to have the flexibility to interact with the rest of the vibrant DeFi ecosystem on Arbitrum.)

Arbitrum is an environment built to support the best of Ethereum DeFi. One protocol after another integrated with GMX, showing a strong need for yield-generating assets, capital-efficient trading, hedging on-chain, and supporting a wide range of strategies.

V2 is powered by new low-latency Oracles that were designed over the last year working with Chainlink, and launched first on Arbitrum powering GMX V2. They provide a whole range of additional data streams and exceptionally low-latency trading, giving GMX real-time price updates and faster on-chain execution. The result is stronger and more efficient protocol performance and data security, plus help with mitigating frontrunning risks.

V2 liquidity pools are isolated to each market/asset (now referred to as GM), thus allowing the support of a multitude of markets without adding collective risk. This provides more flexibility for liquidity providers to support the markets they want, and for market forces to scale up new markets that traders are interested in by committing liquidity (since liquidity providers can earn with enhanced trading volumes relative to the asset base).

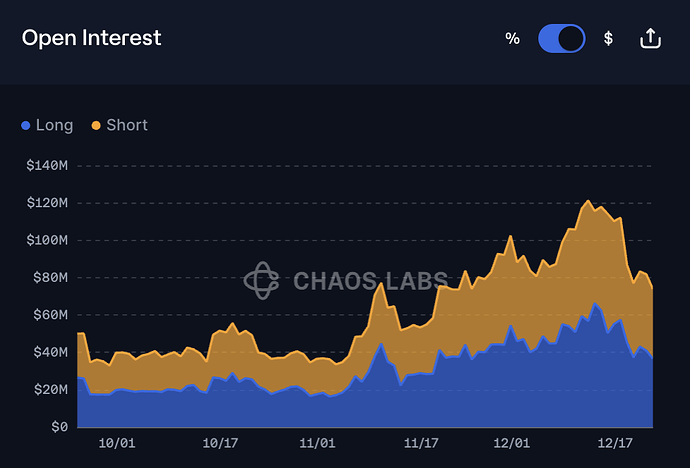

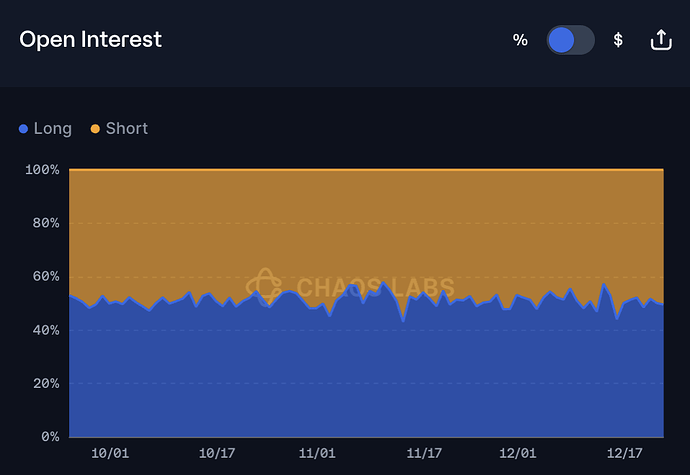

For traders and protocols, in addition to lower trading fees, GMX V2 has a robust set of market parameters that encourage more balanced open interest. These parameters include differential trading fees based on market balance, the ability to configure borrow fees for over-/underweight open interest, and the opportunity to also earn funding fees. This results in more liquid markets, allowing trades of substantial size in any market conditions, and making GMX a preferred venue to trade, hedge and earn.

Benefits of Adding gmETH to Venus Protocol

- Increased demand for borrowable assets on Venus Protocol due to gmETH’s popularity and low-volatility nature.

- gmETH’s low beta properties make it an ideal asset to borrow against.

- Integration with Chainlink Data Streams in GMX V2 reduces risks of front-running and price manipulation.

- $210.47 million of gmETH has already been minted on Arbitrum. This demonstrates the asset’s popularity.

- The APR of this gmETH pool stands at 37.97% (as of the time of writing); a very respectable yield

- There are more than 4,715 Liquidity Providers holding the gmETH token: a healthy, decentralised distribution

- Chainlink oracles are available for GMX’s GM tokens, providing best-in-class pricing.

- GMX V2 and its GM tokens are highly composable, and were designed with that in mind.

- gmETH is already being integrated into various DeFi protocols and being successfully used as collateral in multiple money markets: Dolomite, Solv, Abra, Radiant, Rodeo, Silo, and Deltaprime come to mind.

Motivation

GMX is one of the largest decentralised finance applications, allowing users to buy spot crypto and trade perpetuals on many of the top crypto assets. The introduction of several new features in GMX V2, including the integration with Chainlink Data Streams, has significantly reduced the risks of front-running and price manipulation.

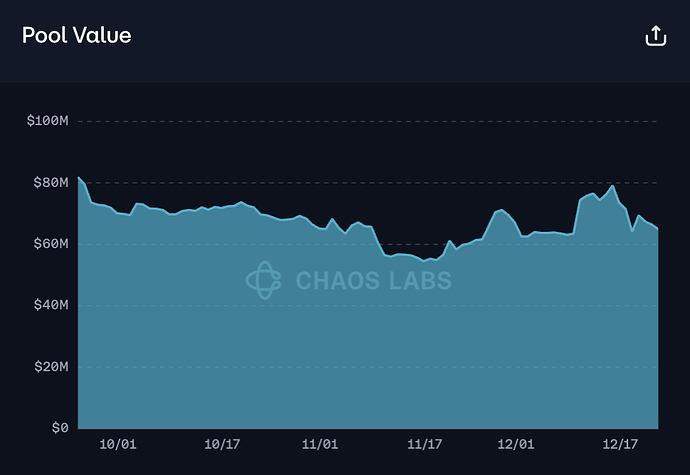

gmETH is a ETH-USDC Liquidity Token on the GMX V2 platform and earns fees from leveraged trading, borrowing fees, and swaps. More than $56.06 million in liquidity has been committed to gmETH by DeFi users, underlining the asset’s massive popularity.

Integrating gmETH as a collateral asset in the Venus Arbitrum Pool has the potential to create new demand for borrowable assets on Venus; gmETH has a proven track record of being a low-volatility asset that does not fluctuate greatly as compared to the broader market. The low beta properties of gmETH make it an ideal asset to borrow against.

Specification

Ticker: gmETH

Contract Address: 0x70d95587d40A2caf56bd97485aB3Eec10Bee6336

Chainlink Oracle: 0xfB3264D1129824933a52374c2C1696F4470D041e

Reference

Project: https://gmx.io/#/

GitHub: gmx-io · GitHub

Docs: GMX | GMX Docs

Audit: gmx-synthetics/audits at main · gmx-io/gmx-synthetics · GitHub

Twitter: https://twitter.com/GMX_IO

Telegram: @GMX_IO

Discord: GMX

Next Steps

We invite the community to consider this application for listing the gmETH market, and welcome suggestions in this direction and any related feedback.

Disclaimer

This proposal is provided for informational purposes only and does not constitute any form of legal commitment or agreement between GMX,Venus Protocol, or any other parties. The listing and parameters for such allocation are subject to the approval and discretion of Venus Protocol. GMX or any other parties makes no warranties or representations regarding the accuracy, completeness, or suitability of the information presented, and will not be liable for any losses, damages, or adverse consequences that may arise in relation to this proposal. All parties are advised to conduct their own due diligence and seek independent legal advice before making any decisions or commitments based on this proposal.

GMX DAO is supported by Labs as voted on in Snapshot: (Snapshot 7)