I think a small % of liquidation fee should/could be given to XVS holders periodically (perhaps it initially gets added to the reserves, and then some of the reserves get paid out to holders)…

@CryptoEllis I’m going to start a discussion thread on this basic multi tier staking Idea, so we can discuss variants. The idea of the double reward pool seems me nice and probably simplifies some calculation, One thing i think it is very important to achieve is expressing the satke as a percentage of the other coin supplied, differently form credit cards we do not have identity verification, so different users could use the same small amount of coins to get privileges on a billion dollar supply. They could build a DAO managed wallet. I think that basing on VIP status one could get discounts also on VAI stability fees, contribution to reserves and every possible fee/cost/income of the platform

Excellent!

Having thought about it a little more perhaps it is not as difficult as I might have thought. I mean, we already have total balance supplied, total borrowed amount, total vai minted, and I guess by definition we have total value of XVS. The only thing that remains is agreeing on numbers and math!

Regarding discount on VAI fee, don’t we already incentivise that via XVS rewards. The XVS bonus could apply to VAI as well. That said I am not necessarily opposed to a minting discount either.

The Celsius tokenomics and flywheel is very very good - perhaps the best tokenomics of any crytpo I know, so anything that we can take from their approach (and improve) gets my vote.

Thanks for giving this consideration

CE

I started another thread, because here we should discuss the excel table. Also a different split of the pools is good.

Forgot to mention, if you apply fixed % to all assets then you’ll have to recalculate and change protocol every time when you add new asset to it which is not convenient.

Let’s not try and reinvent the wheel, Comp use the same speed settings just different distribution rates, You can’t simply just propose a change you have to have that ability to make the code changes and also implement them.

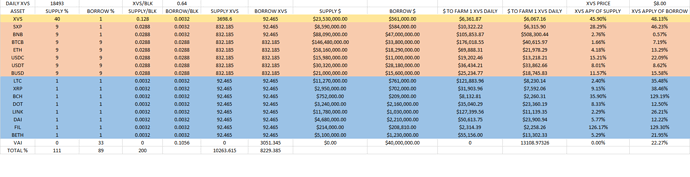

For those who have no clue about the APY, here is it:

One thing I concern is that the XVS distribution weighting of FIL. FIL has a market cap of around 1 billion (#40 on coinmarketcap.com), do we need to consider to lower its weighting further?

We have to focus on other hotter assets like top 10 altcoins by market cap. Altcoins with lower market cap should not be incentivized too much unless we intend to boost them.

Thank you all for your valuable input, we are going to take it into consideration and share an updated recommendation shortly.