wsuperOETHb as a collateral asset on Venus Protocol BASE Core Pool

Summary:

Origin contributors would like to propose the addition of a Wrapped Super OETH (wsuperOETHb) market to Venus Protocol as a core market on the upcoming Base launch

Motivation:

Origin is a leading LST and yield generating platform. Integrating wsuperOETHb on Venus as a launch partner for the Base deployment will provide a high yielding collateral and new defi use cases to Venus users on Base, while aligning interests and creating a strong relationship between the two protocols.

Benefits

- Venus users will be able to take advantage of wsuperOETHb as a collateral asset, which currently offers 9-11% APY in ETH.

- This partnership will enable Venus to capitalize on our growth and allow both Origin and Venus users to capitalize on advanced defi strategies such as looping & leverage for the benefit of both protocols.

About Origin

Origin Protocol is a decentralized platform offering various yield generating products such as wsuperOETHb, OUSD, OETH & ARM. Origin has been building in the web3 space since 2017:

Website: https://www.originprotocol.com/

Twitter: https://x.com/OriginProtocol

Discord: Origin Protocol

Telegram: Telegram: Contact @originprotocol

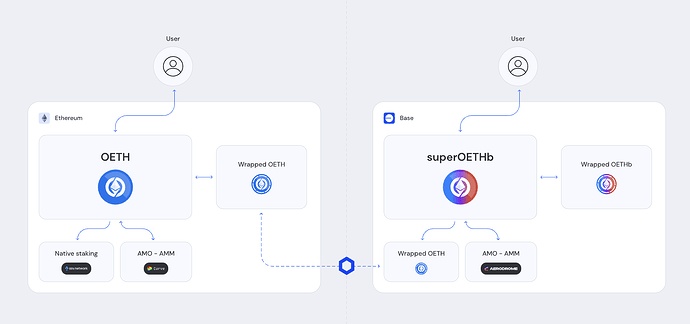

About Super OETH

Super OETH (superOETHb) is the next iteration of OETH, a superior LST with an extremely tight peg and high yields thanks to a combination of the OETH AMO and DVT direct staking through SSV/P2p. superOETHb yields are able to reach double digit levels, making it an exceptionally perfect token for lending as collateral. superOETHb was built reusing 90% of the code from OETH, for which the codebase has already been audited 12+ times.

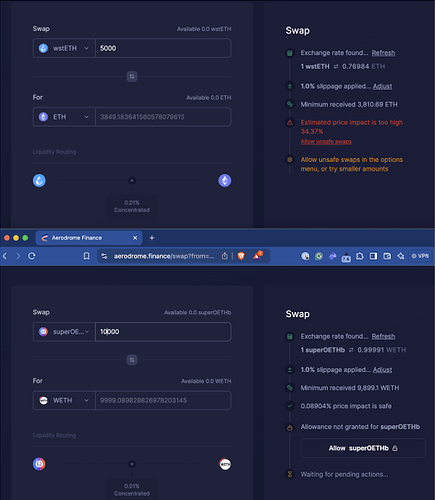

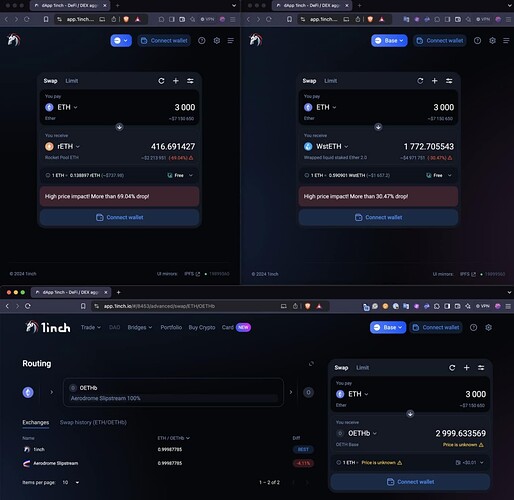

Super OETH is the first token in a new category of liquid staking: Supercharged LSTs. Supercharged LSTs will have materially higher yield while being designed for L2s, with a similar risk profile to mainnet LSTs. Ethereum liquid staking is amplified with chain-specific, auto-compounded incentives. Deep concentrated liquidity pools guarantee exits with minimal costs - users will never lose ability to convert back to ETH.

Using Super OETH on Venus will produce higher yield than the other top LSTs and have a near perfect ETH peg. Utilizing a concentrated Aerodrome liquidity pool with the tightest tick possible helps make Super OETH the most pegged L2 LST currently available, while being able to reach double digit yields. Our vision for Super OETH is for it to become the most trusted LST for those seeking to use an LST for leveraged staking.

Obtaining Super OETH is seamless, users can convert from ETH or wETH via any of the following methods:

- Minting on the Super OETH dapp

- Swapping on WETH/superOETHb

- Swapping on OGN/superOETHb

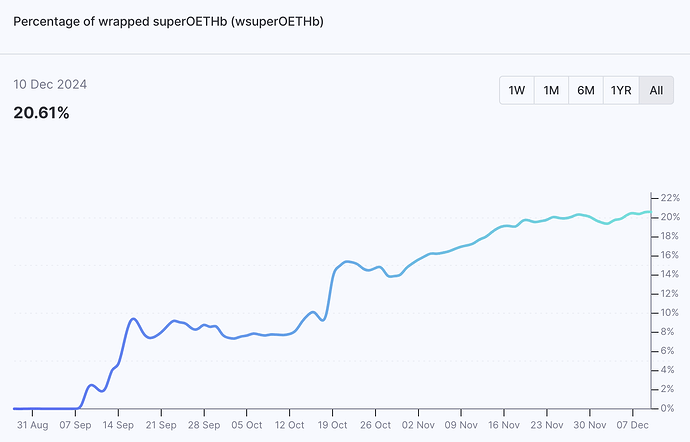

wsuperOETHb is a ERC-4626 tokenized vault designed to accrue yield in price rather than in quantity. When you wrap superOETHb, you get back a fixed number of wsuperOETHb tokens. This number will not go up - you will have the same number of wsuperOETHb tokens tomorrow as you have today. However, the number of superOETHb tokens that you can unwrap to will go up over time, as wsuperOETHb earns yield at the same rate as standard superOETHb. The wsuperOETHb to superOETHb exchange rate can be read from the contract (function number 16), or via the OETH dapp.

Current exchange rate as of 11/22/24: 1 wsuperOETHb = 1.02905839 superOETHb

Performance

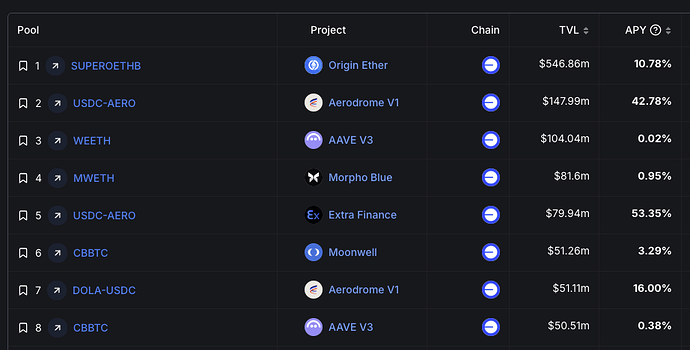

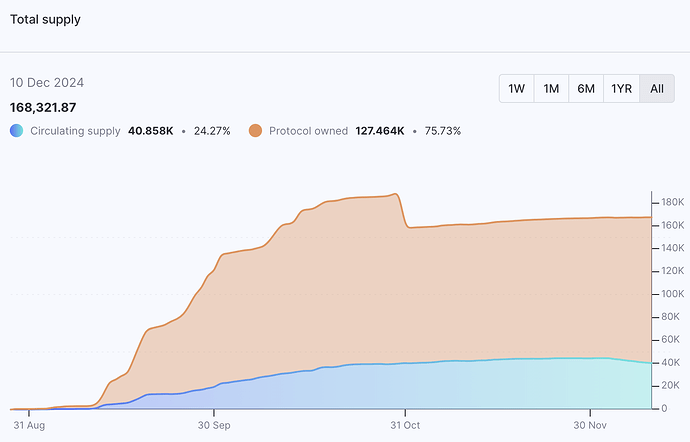

Super OETH has seen incredible growth since launch. Proof of Yield tracks the distribution of each Super OETH rebase event and displays the compounded yield on an annualized basis each day. The current Super OETH TVL sits at $546.8m (166k ETH) with a native yield of 10.78% APY. Super OETH has reached the number one spot by TVL on Defillama for yield projects on Base and accounts for a large amount of the Aerodrome Slipstream TVL:

Risk Mitigation

superOETHb and wsuperOETHb were built reusing 90% of the OETH code, which was built reusing 95% of the OUSD code, of which many audits have been done since 2020. Not that long ago, OUSD reached a market cap of $300m without breaking, and without diminishing the APY it was capable of generating. All OETH audits can be found in the audits section of the OETH docs. We have recently retained yAudit to look at our PRs as we code, and OpenZeppelin is also held on retainer to review 100% of the OETH and OUSD smart contract changes. Origin maintains an active bug bounty with rewards ranging in size from $100 OUSD for minor issues to $1,000,000 OUSD for major critical vulnerabilities. The bug bounty program is currently administered by Immunefi, where Origin maintains a median resolution time of 6 hours.

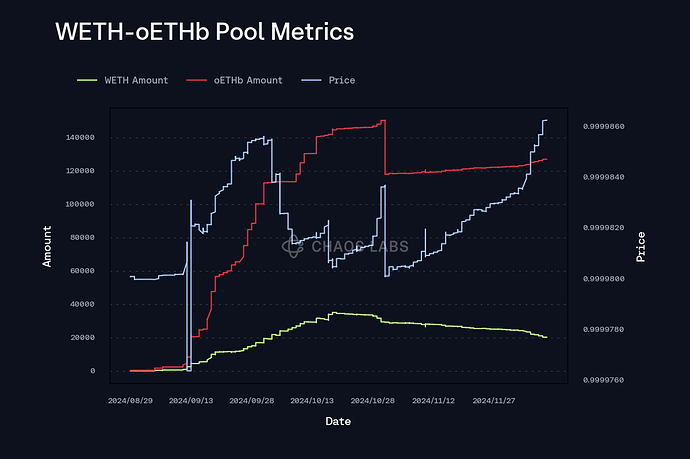

Through its integration with Aerodrome, Super OETH is able to ensure a 1:1 peg with ETH at any scale. The Super OETH AMO holds a portion of the protocol’s underlying collateral in a concentrated liquidity pool with an extremely tight price range within a single tick above 1.0000 WETH. This allows anyone to sell superOETHb into the pool for at least 1 WETH (minus swap fees). The Aerodrome TWAP quoter, which works the same as the Uniswap TWAP oracle, can be used to derive the price of superOETHb on chain. SuperOETHb Tellor and Dia Data oracles are also available. superOETHb is derived from OETH, which has mainnet oracles from Chainlink, Tellor, and Dia Data.

It has actually been recommended that protocols treat superOETHb to be 1:1 with ETH rather than use an oracle, as Aave has done with stETH. Morpho, Ionic, Silo, and Zerolend have all done this with their wsuperOETHb markets, and have not encountered any issues.

By design, superOETHb is the most pegged L2 LST:

Specifications

Contract Addresses:

- superOETHb: 0xDBFeFD2e8460a6Ee4955A68582F85708BAEA60A3

- wsuperOETHb: 0x7FcD174E80f264448ebeE8c88a7C4476AAF58Ea6

Optional Oracle & Price Feeds:

- Dia Data: CDR #057: OUSD Price Feed - #6 by pete - CDRs - Custom Delivery Requests - DIA Forum | Cross-Chain Oracles for Web3

- Tellor: https://basescan.org/address/0x34fae97547e990ef0e05e05286c51e4645bf1a85

Next Steps

We would be happy to answer any questions on Origin Protocol, Super OETH, or the proposal itself. The Origin team can be reached at any time via the Origin Discord server.