Summary

Fluid proposes to launch Venus X (final name tbc), which will consist of the lending market and DEX on BNB Chain, powered by Fluid. This upgrade transforms Venus into a safer, more profitable, and future-proof protocol, while keeping the Venus brand and BNB chain distribution intact.

Context

Fluid is a liquidity protocol that reached a $6B TVL in 18 months, merging lending, borrowing, and trading into a unified system. It can support an entire ecosystem of financial products on top of it. Today, we already have two major components live:

-

Fluid Lending offers the highest liquidation thresholds as high as 98%, and the lowest Liquidation Penalties, as low as 0.1%, in the industry. No other protocol can match the risk parameters we’ve engineered, and that translates to better conditions for users.

-

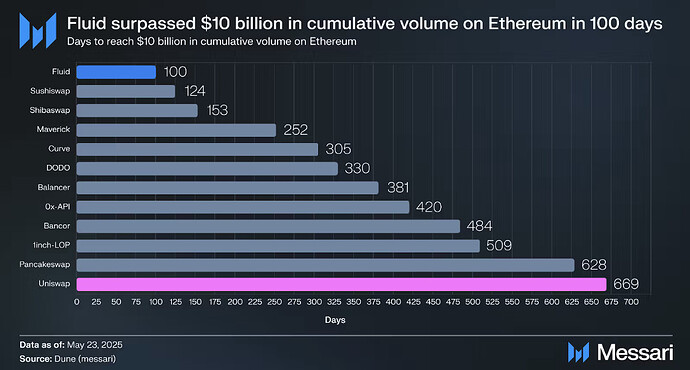

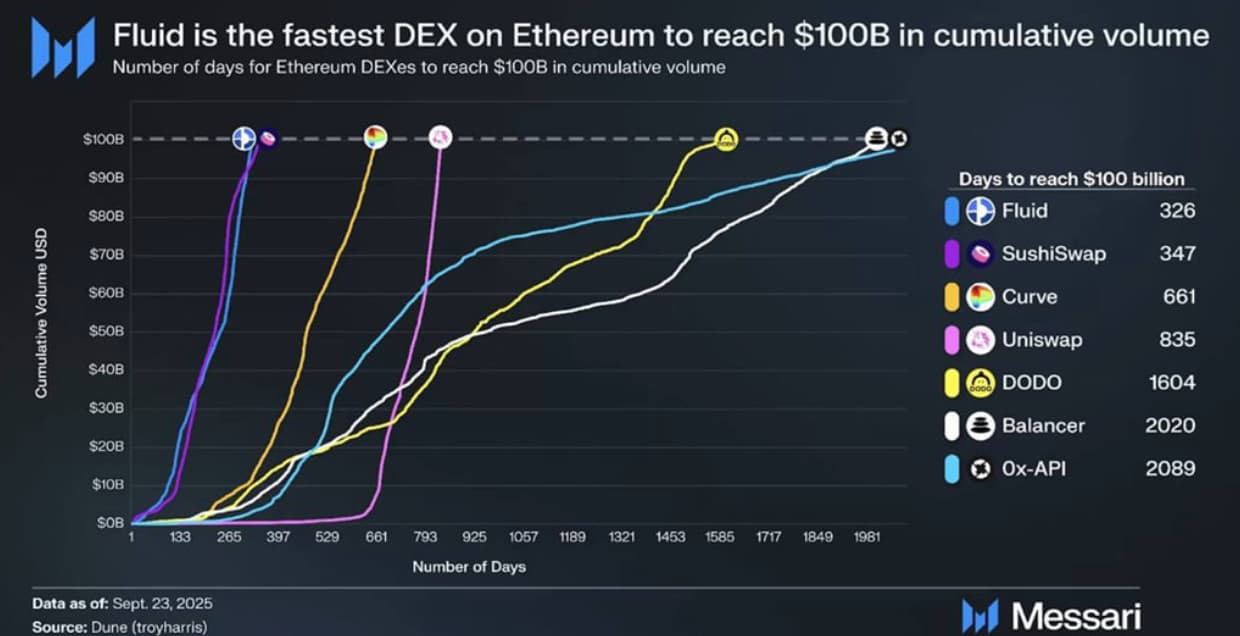

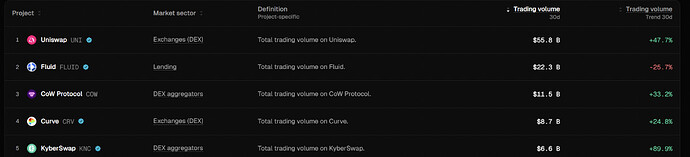

Fluid DEX is the fastest-growing and most capital-efficient on the market. It’s built directly on top of our liquidity layer, which means bootstrapping is much easier and more sustainable. Our goal is to be the largest DEX by volume across all chains combined within the next 6 months.

Fluid solves DeFi liquidity fragmentation with a unified architecture that integrates lending, borrowing, and trading into one shared liquidity system. This positions Fluid as the most effective protocol to bootstrap liquidity, users, and volume, while delivering a superior UX.

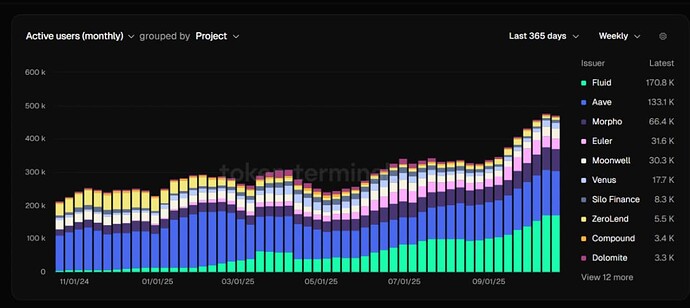

For example, Fluid already has the most users among all lending markets in DeFi.

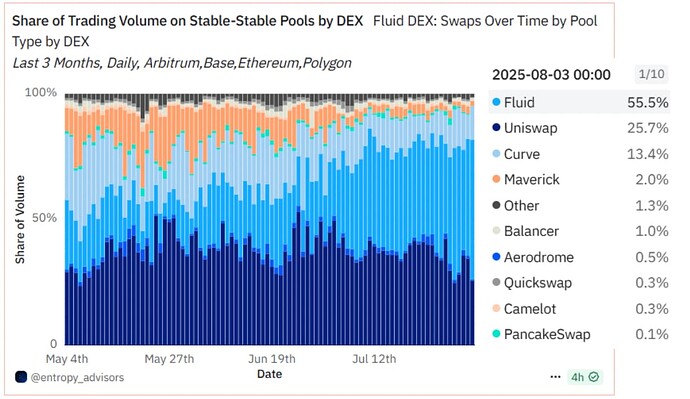

Fluid generates more volume on the correlated pairs on Ethereum, Arbitrum, Base, and Polygon than all other DEXs combined by leveraging debt-based liquidity. We believe Smart Debt will power on-chain Forex, making it ideal for Binance Pay infrastructure.

Overall, Fluid is the second biggest DEX by volume on Ethereum, aiming to become the biggest DEX by volume after the DEX v2 launch.

What’s Coming Next

-

We’re not stopping at lending and trading. In fact, we have recently launched the first credit-based protocol on Fluid - uncollateralized borrowing directly from our liquidity layer. This opens up some really interesting potential:

-

Users on BNB could eventually access on-chain credit lines.

-

We could integrate this directly with payment solutions, giving users a more “bank-like” UX while staying fully decentralized.

We’re also working on these protocols, and at least one of them is expected to be launched next year:

- Permissionless lending markets for institutional and private credit.

- Fixed rates protocol.

- A perps market on top of the same liquidity base, meaning more protocol fees and stronger incentives for LPs.

Proposal

- Fluid will deploy Lending market and DEX smart contracts on the BNB chain under the existing Venus branding.

- A tier-based revenue split approach that will not reduce Venus DAO revenue.

- Fluid will maintain and continue developing the technical stack of the protocol.

- Protocol will implement a dual governance model by XVS and FLUID token holders.

- Fluid and Venus will provide incentives in a 50:50 proportion for growth initiatives of Venus X on the BNB chain.

Motivation

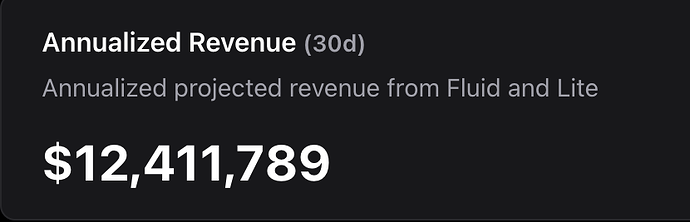

Venus is the biggest, most popular, and well-known lending protocol in the BNB ecosystem, but it utilizes outdated Compound v2 tech underneath, which can not provide the optimal UX or maximize revenue. Current TVL of Venus on the BNB chain is $2.8B, while the revenue is only ~$5M per year.

If Venus implements Fluid tech underneath, it will be able to generate more fees, revenue, and attract more TVL via enhanced user experience and more product offerings, such as DEX. For comparison, Fluid earns $12M in revenue on Ethereum with a similar TVL. With the introduction of the DEX v2, we expect to grow the revenue to $100M+ annually, which will significantly increase Venus DAO revenue.

Fluid has already proven the model of combining Fluid’s tech stack with a powerful distribution partner in collaboration with Jupiter. Juplend powered by Fluid, reached $1B TVL in only 8 days after launch.

Conclusion

Why Venus X powered by Fluid, is beneficial for the Venus DAO and BNB chain

- Battle-tested tech for lending and trading, with more protocols on the way.

- Extremely high capital efficiency and liquidity reusability.

- The best infrastructure for Forex markets.

- An experienced team that’s been in the space for 7+ years, with up to $15B in TVL managed, 4 products launched, and $0 in users’ funds ever lost.

- Venus DAO will increase its revenue, TVL, and product offerings.

- BNB chain users will benefit from the better lending UX and DEX liquidity.

Additional resources

https://messari.io/report/understanding-fluid-a-comprehensive-overview

[cyber•Fund | Demystifying Fluid, Part I: Liquidity Layer and Liquidations