Venus Protocol’s Advantages Compared to Traditional Banks,

Traditional Banks,

The banking sector has been the center of financial services and the main source of money flow since its first establishment . People use the products of this sector to generate passive income for cash investments or to increase the cash flow with credit.

No matter how digital traditional banks have become over time, customers still have to visit the physical location for many procedures. When they want to get a loan, they have to prove their solvency, they are included in a grading system, and the mortgage transactions and procedure become so complicated that it becomes inextricable, and a situation is encountered where all information is required as well as social, cultural and geographical. In addition to these, high loan rates and high prices in product costs put customers in a dead end.

As the urbanized population lives by adapting to innovations rather than traditions, services are shifting to decentralized structures that can be easily performed and simplified from anywhere, instead of outdated branches.

This is where the comfort of traditional banking ends and DeFi will take its place.

Venus Protocol,

Venus Protocol is a type of digital financial service provider, among other benefits. It does not have a physical branch and serves completely through the application. Venus Protocol has gone through the process of auditing independent organizations. It is a decentralized money market system that serves its users without any third party centralized institutions overseeing or exercising greater control over the funds. It is generally seen as a low risk activity as all loans on the platform are collateralised. Because it runs on BNBChain, low commission fees and its speed set Venus Protocol apart from its competitors.

Users can borrow money at negative interest rates in seconds without being stuck with traditional banker procedures, and Venus Protocol does not offer a repayment schedule. In the table below, the repayment interest rates can be seen in an incomparable advantage compared to traditional banks.

The user can repay the debt he has taken months or even years later. In addition, the user can earn passive income by investing cryptocurrencies in the liquidity pool where the debts are used and receiving interest in return. Venus Protocol debit services work on an algorithmic basis that eliminates risks, as funds are held in smart contracts.

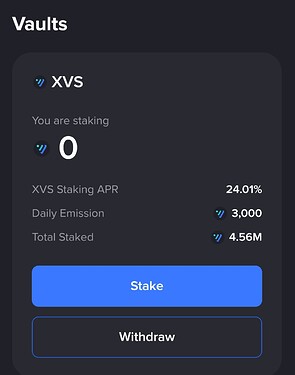

In addition, Venus Protocol users can stake Protocol’s management token XVS in vetted Venus Vaults, earning passive income well above the interest given by traditional banks in return. While writing this article, users keep 4.56 million XVS in their Venus vault and earn 24% interest.

DeFi’s future is here. Thank you for reading.