Financial Highlights

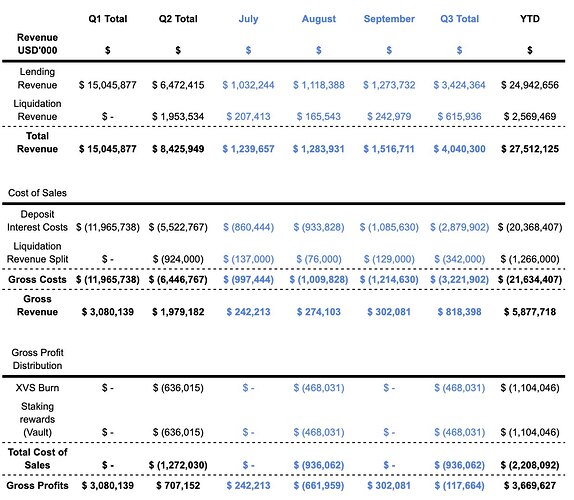

The gross revenue of the protocol for Q3 and YTD is as follows:

-

Q3 Gross revenue from Lending: $ 273,936

-

Q3 Gross revenue from Liquidations: $ 544,462

-

Q3 Gross revenue: $ 818,398

-

YTD Gross revenue from Lending: $ 4,574,249

-

YTD Gross revenue from Liquidations: $ 1,303,469

-

YTD Gross revenue: $ 5,877,718

The monthly average supply TVL for Venus Protocol decreased 41% for Q3 from $1.7Bn to $1.0Bn. Borrow TVL decreased by 37% from $585M to $366M. However, because borrow amounts had a lower proportional decrease than supply, the average utilization rate increased from 33.9% to 35.2% in Q3

The protocol also had a 36.4% average growth on new monthly users increasing from 1.1k to 1.5k and bringing the total number of active users to 11k for Q3.

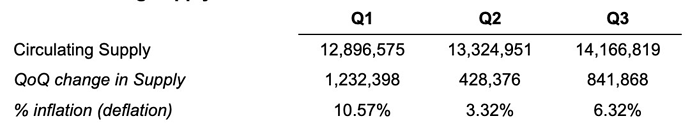

The amount of XVS staked increased dramatically this quarter, from 3.9M to 5.1M. This 26% increase brings the total XVS staked amount to represent 41% of the total circulating supply.

Treasury Liabilities: Markets Shortfall

- Number of insolvent accounts: 1619

- Total value: $51.33M (as of 24 November 2022)

- Denominated In BTC and ETH

Key Q3 Governance Decisions

- VIP-65 Hedgey Finance:

The role of Hedgey Finance will be to advise, provide due diligence, and best practices and expertise as it relates to the various subtasks laid out in this proposal: Venus Proposal: Treasury & Tokenomics Advisor Addition

- Venus Ambassador Program:

Venus Stars, is a program aimed at “Generating adoption of Decentralized Finance, (DeFi) and more specifically in Venus Protocol”. It is based on three main areas, education, information and guidance, and each of them has a general objective from which several activities emerge.

- VIP-71 AutoFarm Refund and New Collaboration with Venus:

There was an incident on the Autofarm platform that resulted in a loss of tokens for users leveraging the Autofarm Venus vaults and created a long-lasting issue between the protocols. Venus returned 85% of the affected assets.

- VIP-72 Gauntlet Market Risk Management

Signed Gauntlet Networks risk management services for continuous market risk management to optimize yield, capital efficiency, and mitigate depositor losses.

- VIP-73 Stop collateralizing XVS for some accounts & optimize fees

In VIP-60, we introduced the “collateralizing the rewards” feature that allows anyone to collateralize XVS rewards for accounts with a shortfall. Liquidators could then liquidate these rewards to cover the account’s debt. This VIP blocks these accounts from claiming the rewards, even to collateral, until the debt Refinancing solution is launched. (Bonds)

Roadmap for Q4

Launch and evaluate Tokenomics V3

- V3 Tokenomics to go into development and effect

- Evaluate the success of the tokenomics based on increased protocol usage, and other key KPIs that are observed to determine the effectiveness of the tokenomics

Reduce XVS emissions and incentives

- XVS emissions reduction by 50% across all markets (Successfully done in November)

- Evaluate impacts to TVL and markets usage

- Evaluate impacts to XVS and token holder feedback

- Determine whether additional emission reductions are required to achieve desired results

Deployment of the Venus Protocol v4 Upgrade

- Isolated Markets Integration

- Stable Rate Borrowing

- DEX Integration

- New Risk Management

- VAI Stability Fee

- Updated Governance Process

- Venus Bonds to cover shortfall

Gross Revenue Report:

(Net Yearly Report will be published by Messari in Q1 2023)

XVS circulating supply:

Protocol Performance