VENUS PROTOCOL IN THE BEARISH MARKET

WHAT IS THE BEARISH MARKET?

Bear market is a term used for all financial markets, not just crypto. This expression is used to express the tendencies of the investors. In this period, the expectation is that the markets are pessimistic and that the prices will be in a downward trend for a long time. It was transformed into a metaphor about the act of attacking the bear’s victim, thus remaining a term for financial markets.

Bearish markets can be triggered by epidemics, wars, major drops in a major crypto, ‘hacking’, ‘Rug Pull’ situations that can be experienced in DeFis or stagnation of global economies, various geopolitical crises. And since it is unpredictable how long it will continue, this pessimism causes deep and appetite to go down.

INVESTOR EFFECT OF THE BEARISH MARKET

Since the bearish market is a market in which sellers dominate, rising prices do not gain continuity and permanence, and pessimistic news comes one after another, it is much more difficult to invest or not to sell the crypto value in hand than in other periods. It will be very difficult for the trader to accept that the trend is turning up based on the movements in the bearish market, because the sellers will exert stronger pressure.

THE ROLE OF VENUS PROTOCOL

Due to the reasons mentioned above in a bearish market, the risk of losing the asset in the hands of the investor is quite normal. The high volatility, especially in the crypto exchange we are in, initiates situations that will cause the investor, who will actually make big gains in a few weeks if the trend turns, to panic. This is where Venus Protocol’s passive income products come into play.

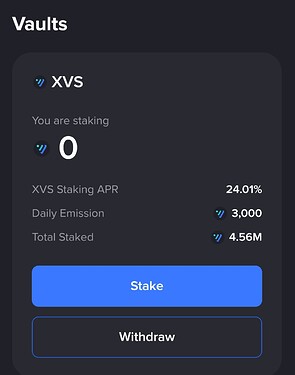

It is possible to generate income every second in Venus Protocol’s safe, which has passed all audits successfully. At the time of this writing, Venus Protocol users have locked 4.56 million XVS in the vault and are rewarded every second with 24.01% APR (Venus Protocol). This reflects on the morale of the investor as the bearish market continues. It is vital to generate passive income while you wait, as the investor with the best accumulative will deliver the highest returns until the bull market will dominate.

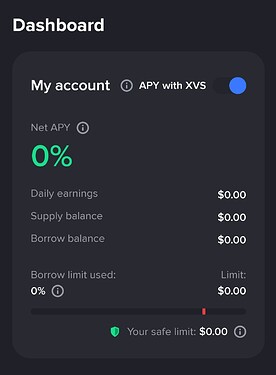

Other products in Venus Protocol are Supply and Borrow products. Users currently hold over $1 Billion worth of equivalent assets in these products (app.venus.io/markets). Investor can earn APR (Supply) by supporting liquidity pools on Venus Protocol. Since he does not want to sell, he can take a loan with negative interest by showing this value, which he defines as Supply, as collateral. He not only earns APR without selling his crypto, but also increases the opportunity to accumulate better in the bearish market by borrowing. Venus Protocol’s user-friendly interface has a wonderful, personalized dashboard that is updated all the time to protect the investor. Here, statistics and charts showing borrowing and safe limit zones provide maximum support for the user to stay in the safe zone.

It is possible to get support at any time about these issues and more through the official Turkish channels on the Turkish blog, Telegram and Discord.

Thank you for reading.