Thanks @Hiromatsu

While @Fat is right to raise the VAI peg issue, this “print and dump” is just wrong.

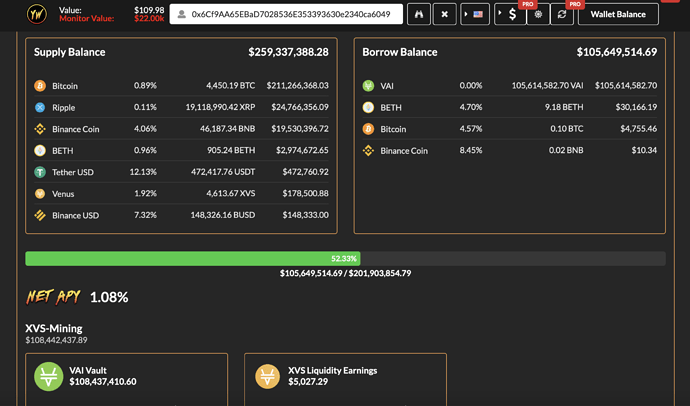

The whale minted

50M: tx=0xce16403cda833f76addf1bee36d05f6b214614e2a54ba2b620041d2dffd1b796

later 40M tx=0x6b883a6bb1e0f55b501b0de42f885772bbc6d4814f53de5358177efbe021e911

from normal deposits. Plus a few extra millions.

For him, this is all normal: had you millions and think Venus is the only decent place to store your coins, so you deposit and, to get a few extra yield with no more risk, so you Mint and stake in the VAI Vault.

Also the VAI liquidation works, for example tx=0x06fc4f3a5b9321e1396f1a49f03c4cfa183ffc15eb6bdf65f2f57859bbe00f37 we see the de-collateralized VAI is bought back from PancakeSwap V2 and burnt.

The concern is for VAI holders (not minters) who now have coins with value to low to be sold (we’re at all-time low), a ridiculous yield and no place to use it as collateral. Not in Venus itself, and Cream has a 0% collateral factor with negligible amounts for VAI.

VAI rewards were 1500 XVS/day back then. It had been lowered to 500 because at that time, the 20% were 3x higher than the BUSD rate ~7%, considered too high.

And later still divided by 2, to 250.

With a Vault TLV of 168M the 250 XVS/day is now ridiculously low.

Btw, while I understand who mints and who stakes, I can’t get those who actually sell for $0.8

If one minted, he’ll have to buy it back, potentially for more, in theory for $1, and he could better just borrow BUSD

If one bought, so he bought for more since we’re at all-time low, and selling would cause a loss.

So, who sells? Why?

Except for the Vault, free-floating VAI is mostly in Pancake, in Binance CEX, in Biswap, and some more in Acryptos, Wault and Pantherswap.

Acryptos staking forwards to the Vault, so I don’t include it on purpose. Other like SwipeSwap are negligible.

The issue can be fixed simply by enabling the Stability Fee from DAI, which VAI is an explicit clone of. The code already exists in DAI git and the fees would go to the devs. Free and legit money by copy-pasting existing code, what are they waiting for?

Otherwise they could lower the VAI mint factor to force minters to buy back, like they did for XVS borrowers.