Disclaimer – I am employed by Terraform Labs Pte. Ltd. (“TFL”)

Rationale

Adding UST & LUNA as markets to the Venus protocol will contribute towards TVL growth, bring new users into the Venus ecosystem, and expand the range of markets that Venus Protocol supports which will drive utilization and adoption.

References

- Terra

- Whitepaper

- Docs

- Terra github

- Audits: CertiK Security Leaderboard - Terra

- Communities:

Summary

Both TerraUSD (UST) and LUNA are tokens with a strong team, vibrant and growing community, sizable market caps, and strong use cases to drive borrowing and lending on the Venus Protocol. Adding them as markets on Venus will onboard new users, grow TVL, and expand Venus Protocol’s reach in the DeFi space.

Motivations

The Terra community is always looking for vibrant borrowing and lending markets for UST & LUNA on all chains where UST and LUNA are supported.

UST is supported by major dApps including Curve, Uniswap, Sushi Onsen, Harvest, and more and can be used as a currency in the open DeFi ecosystem affording users with censorship-resistance, instant settlement, cross-border payments, and price stability.

LUNA is fundamental in keeping Terra’s stablecoins steady through the usage of arbitrage incentives. When the peg of Terra stablecoins like UST deviates, users are incentivized to use the market module on Terra to bring the peg back to parity by swapping LUNA and UST. You can read more about that here. This affords users with low-risk profit opportunities whenever the peg is not 1-to-1 with the underlying fiat currency the stablecoin is pegged to.

In addition, LUNA holders can also stake their LUNA to earn a yield on Terra to receive a percentage of transaction fees from the network, or use it to vote on governance proposals. These use cases for UST and LUNA provide sufficient demand for borrowing and lending.

Over the last few years, the Terra team has implemented significant changes to lower the previous risks associated with UST & LUNA while increasing their adoption.

Specifications

Both LUNA and TerraUSD (UST) were created by the Terra (LUNA) team. Do Kwon and Daniel Shin founded Terra (LUNA) in April 2019.

Terra has also incubated successful projects on Terra such as Anchor and Mirror Protocol. Today, Mirror has roughly $1.6B in TVL and does ~$11.2M in daily volume, and Anchor boasts ~$13.7B in TVL.

UST Specifics:

TerraUSD (UST) is a decentralized, algorithmic, scalable, and censorship-resistant stablecoin on the Terra blockchain with a price pegged to the US Dollar. TerraUSD was created to deliver value to the Terra community and offer decentralized money to a decentralized economy. Unlike centralized or collateralized stablecoins like USDT, USDC, or DAI, UST protects its users from insolvency, collateralization, and censorship risks.

UST was launched in September 2020 and has since gained a reputation as the most scalable money in DeFi. One can use UST on most of the major dApps including Curve, Uniswap, Harvest, Sushi, and more. as well as on Terra protocols such as Anchor, Prism, and Astroport.

UST Market data (Market Cap, 24h Volume, Exchanges) (March 4th, 2022)

Market cap: $13,575,495,405.33

24 hour volume: $544,199,627.05

Exchanges: Curve, Sushiswap, Uniswap, Balancer, Kucoin, Bittrex, Terraswap, Coinbase, MEXC, Gemini, Bitfinex, Binance and more

LUNA Specifics:

Terra is a blockchain protocol that uses algorithmic, fiat-pegged stablecoins to power price-stable global payments systems. According to its whitepaper, Terra combines the price stability and wide adoption of fiat currencies with the censorship-resistance of Bitcoin (BTC) and offers fast and affordable settlements.

Development on Terra began in January 2018, and its mainnet officially launched in April 2019. As of September 2021, it offers stablecoins pegged to the U.S. dollar, South Korean won, Mongolian Tugrik, and the International Monetary Fund’s Special Drawing Rights basket of currencies — and it intends to roll out additional options.

Terra’s native token, LUNA, is used to stabilize the price of the protocol’s stablecoins. LUNA holders are also able to submit and vote on governance proposals or stake it to earn a yield.

LUNA Market data (Market Cap, 24h Volume, Exchanges) (March 4th, 2022)

Market cap: $31,711,583,607

24 hour volume: $3,373,593,189

Exchanges: Binance, Kucoin, Crypto.com, Kraken, FTX, Huobi, Bitfinex, and more

LUNA Rate Model:

UST Rate Model:

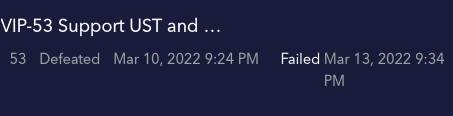

Voting Options

For - I agree that UST & LUNA would be good markets to add to Venus Protocol

Against - I do not think UST & LUNA should be added to Venus Protocol

Abstain - I am indifferent to whether UST & LUNA should be added to Venus Protocol