Overview

Chaos Labs supports the deprecation and delisting of the legacy USDD from the Venus GameFi, DeFi, Stablecoin, and Tron Pools while facilitating the listing of the new USDD 2.0 as a deposit-only asset in the Venus Core Pool. Below, we present our analysis and parameter recommendations to support this transition.

Motivation

USDD recently began its migration from the version listed on Venus (referred to as USDDOLD in their documentation, and henceforth in this recommendation) to USDD 2.0. As a result, it is necessary to reassess the currently listed USDD markets on Venus and begin their deprecation.

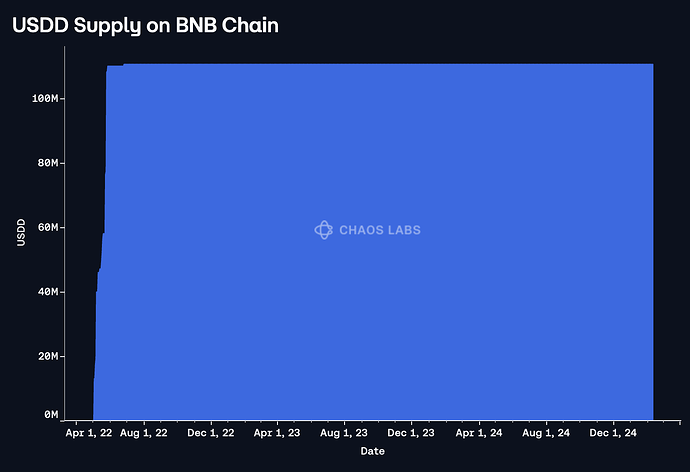

USDDOLD has exhibited virtually no supply growth on BNB Chain since shortly after it was first introduced to the network, with a current total supply of 110M.

Additionally, 99.5% of USDDOLD is held in BitTorrent’s MintableERC20PredicateProxy contract. Reflecting this limited activity, all of USDD’s markets on Venus have had no new growth in recent months.

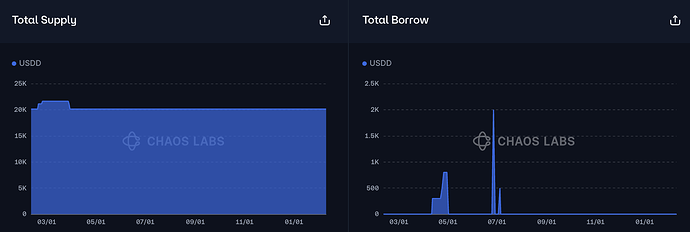

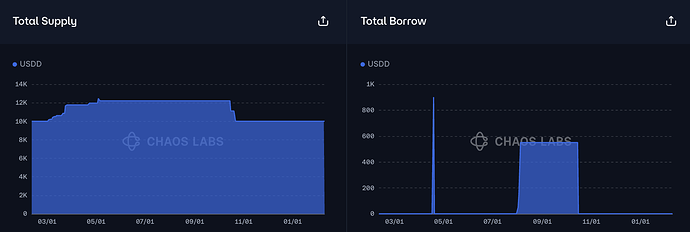

Tron

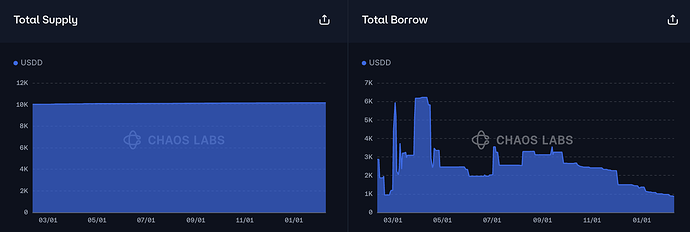

DeFi

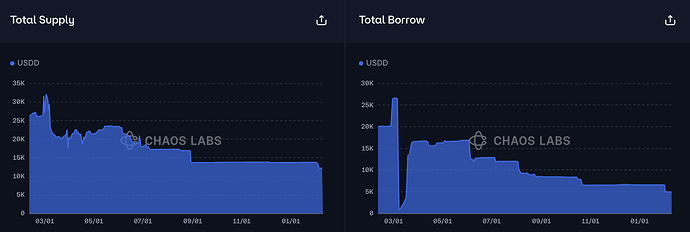

GameFi

Stablecoins

Additionally, there is virtually no borrowing against USDD, making the process of deprecating the asset significantly easier, as lowering the Liquidation Threshold will not cause large liquidations. In total, less than $4.00 is borrowed against USDD across the GameFi and Stablecoins isolated pools; USDD is not used as collateral in the other isolated pools.

Deprecation Plan

Following the above analysis, we propose the following deprecation plan:

- Pause MINT - complementary to setting supply caps to 0

- Pause BORROW - complementary to setting borrow caps to 0

- Pause ENTER_MARKET—This update will not allow users to start using USDD as collateral. It will not affect users who have already enabled USDD as collateral.

- Reduce USDD Collateral Factor/Liquidation Threshold to 0% to prevent existing users from borrowing USDD.

- Increase the Reserve Factor to 100%

We will separately provide a recommendation that assesses USDD 2.0 and its potential inclusion on Venus.

USDD 2.0

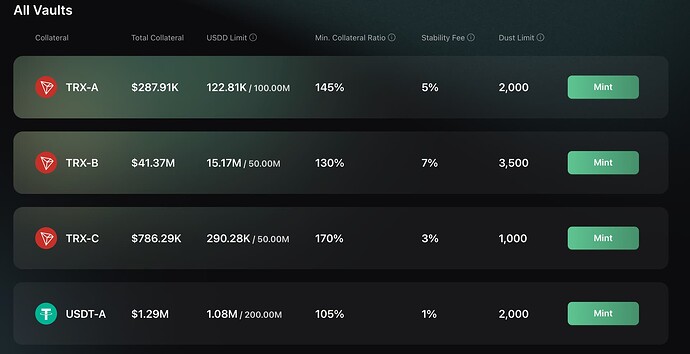

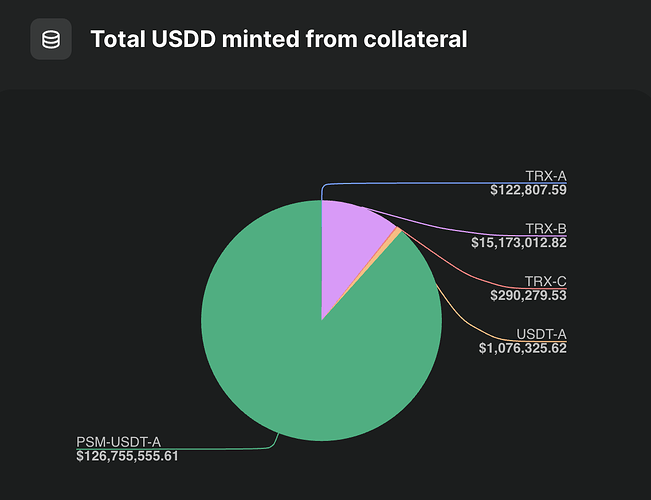

USDD uses the same contracts as Maker and currently supports two collateral assets: TRX and USDT. In total, it has four overcollateralized vaults and a PSM that currently holds 126M USDT and 173M USDD, representing the vast majority of minted USDD.

Liquidations of collateral are triggered when the LTV breaches the minimum collateral ratio shown above, triggering a Dutch auction in which “Keepers” bid for the collateral. The user is subject to a liquidation fee, currently set to 13% for all markets. The proceeds from the auction are used to repay outstanding USDD debt. Users must first stake the USDD used for purchasing collateral in the auction; this can be withdrawn at any time if the bid is unsuccessful.

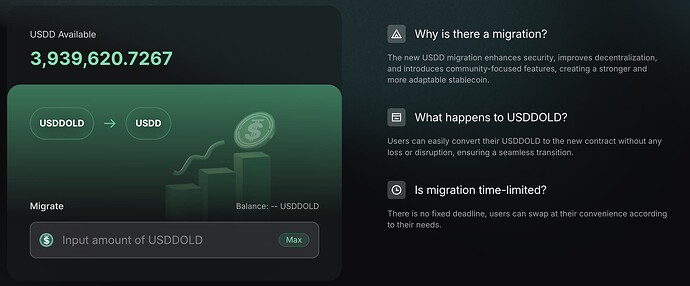

While users can use USDT or TRX to obtain USDD 2.0, it also has a migration feature. As stated on the interface, there is no fixed deadline determining when migration will be halted. Unlike the migration of DAI to USDS, there is no two-way route, meaning that USDD 2.0 does not inherit USDDOLD’s liquidity, potentially weakening its peg.

The amount of USDD 2.0 that can be obtained through the migration is held in the migration smart contract, though USDD 2.0 tokens are not sent to the contract programmatically. Instead, they have been sent by an EOA tagged as belonging to Justin Sun after being minted using USDT in the PSM.

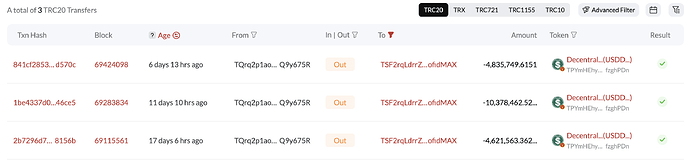

The owner of the migration contract (the Tron DAO Reserve) is then able to withdraw USDDOLD, which they have done three times.

This is a somewhat inefficient migration feature that must be facilitated by the previously mentioned EOA refilling the migration contract’s USDD 2.0 balance. While it does not present a risk to USDD 2.0, it could slow the pace of migration.

Market Cap and Liquidity on BNB Chain

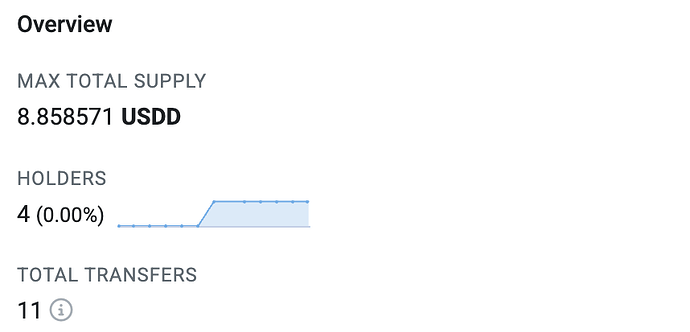

USDD 2.0 currently has virtually no liquidity on BNB Chain, with a total supply of just 8.5 as of this writing and no available DEX liquidity either.

This lack of liquidity drastically limits the functionality that we can recommend for the token, as it can neither be used as collateral nor as a borrowable asset in its current state on BNB Chain.

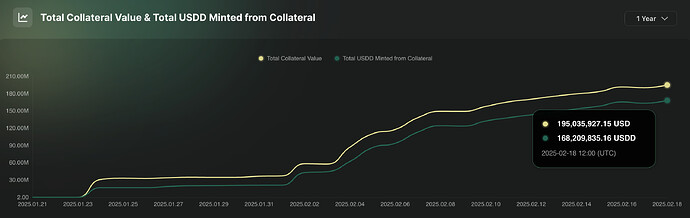

Overall, its market cap has grown rapidly, reaching nearly $170M following its launch in late January.

Centralization and Governance

While USDD 2.0 documentation refers to a Governance process, currently, the contracts deployed governing the protocol rely on a single EOA controlled by the Tron Foundation. This presents a situation in which parameters could be changed with no warning, either from direct action by an EOA, user control, or an exploit.

Additionally, some of the protocol’s contracts are not verified on the Tron block explorer. Hence, their code and functions cannot be analyzed to ensure a lack of potential risk vectors.

Collateral Factor, Liquidation Threshold, and Liquidation Bonus

These factors describe why we recommend that the asset be listed as deposit-only until its market cap and on-chain DEX liquidity on BNB Chain have grown sufficiently to assess its peg stability. Attracting deposits and supply to BNB Chain will thus rely upon incentives provided by the protocols boosting USDD.

Supply and Borrow Cap

We propose setting the supply cap at 20M, a high cap given the asset’s limited liquidity but justified by its other parameters which virtually eliminate risk.

It is not feasible to allow borrowing at this point in time, as liquidating a position with USDD debt would require a user to purchase USDD to repay the debt, potentially causing an upward depeg in USDD because of its illiquidity on BNB Chain. However, we provide starting IR curve parameters should borrowing be enabled.

Pricing/Oracle

The proposed setup of this market does not necessitate the use of a USDD oracle, as users will not be able to borrow the asset or use it as collateral. Thus, we recommend pricing it according to the existing market and transitioning to a USDD 2.0 oracle when available.

Specification

| Parameter | Value |

|---|---|

| Asset | USDD |

| Chain | BNB Chain |

| Pool | Core |

| Collateral Factor | 0.0% |

| Supply Cap | 20,000,000 |

| Borrow Cap | - |

| Kink | 80% |

| Base | 0.0 |

| Multiplier | 0.15 |

| Jump Multiplier | 3.0 |

| Reserve Factor | 25% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this proposal.