Recommendations from Gauntlet:

-

Adjust USDC and USDT to original borrow caps from before USDC non-equivalence event.

- 124,700,000 for USDC

- 245,500,000 for USDT

-

We understand that the borrow caps for USDC and USDT were lowered to disable new borrows for those tokens during the recent volatility in USDC. It appears the situation around USDC has stabilized: aggregate liquidity (2% depth across CEX and DEX sources) has fully returned to pre-USDC non-parity levels of ~$250m. DEX liquidity has recovered to 70% of pre-USDC non-parity.

-

As such our models and analysis indicate that USDC and USDT’s borrow caps can be adjusted to their original levels would unfreeze new borrows for USDC and USDT while not introducing significant risk to Venus.

General Update

Below we provide a broader update on Venus protocol’s risk metrics:

1. Methodology

Gauntlet’s parameter updates seek to maintain the overall risk tolerance of the protocol while making risk trade-offs between specific assets.

Gauntlet’s parameter recommendations are driven by an optimization function that balances 3 core metrics: insolvencies, liquidations, and borrow usage. Parameter recommendations seek to optimize for this objective function. Our agent-based simulations use a wide array of varied input data that changes daily (including but not limited to asset volatility, asset correlation, asset collateral usage, DEX / CEX liquidity, trading volume, the expected market impact of trades, and liquidator behavior). Gauntlet’s simulations tease out complex relationships between these inputs that cannot be expressed as heuristics. As such, the input metrics we show below can help explain why some of the param recs have been made but should not be taken as the only reason for the recommendation. The individual collateral pages on the Venus Risk Dashboard cover other vital statistics and outputs from our simulations that can help with understanding interesting inputs and results related to our simulations.

For more details, please see Gauntlet’s Parameter Recommendation Methodology and Gauntlet’s Model Methodology.

2. Risk Dashboard

The community should use Gauntlet’s Venus Risk Dashboard to understand better any updated parameter suggestions and general market risk in Venus. Value at Risk represents the 95th percentile insolvency value that occurs from simulations we run over a range of volatilities to approximate a tail event. Liquidations at Risk represents the 95th percentile liquidation volume that occurs from simulations we run over a range of volatilities to approximate a tail event. We would note that our methodology on borrow/supply caps is currently driven by risk modeling that is independent and additive to our risk simulations shown on the Dashboard.

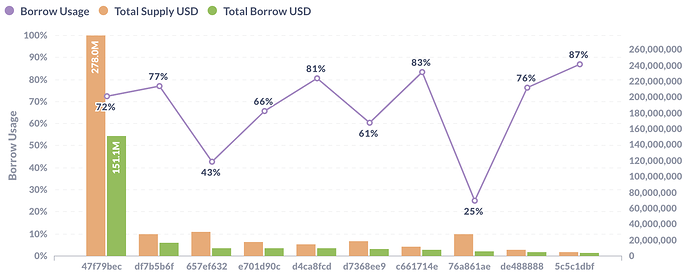

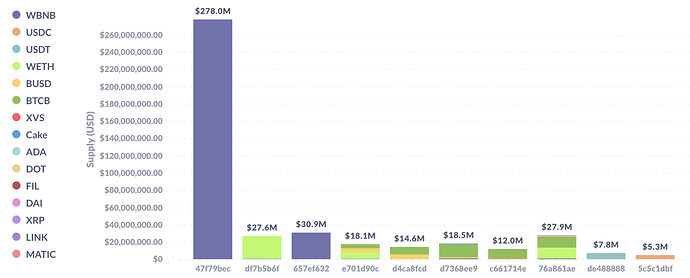

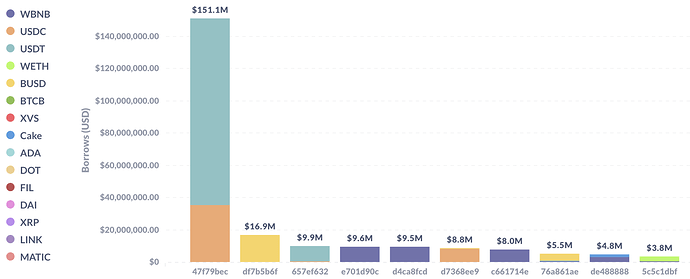

3. Top Borrowers

The below figures show trends in key market statistics regarding borrows and utilization that we will continue to monitor:

Top 10 Borrowers’ Aggregate Positions & Borrow Usages

Top 10 Borrowers’ Entire Supply

Top 10 Borrowers’ Entire Borrows

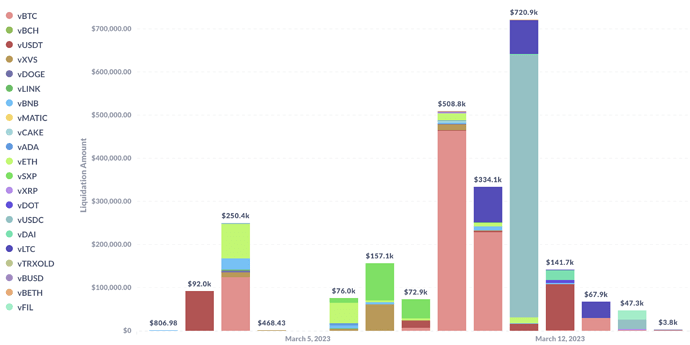

4. Liquidations

As Gauntlet tracks the state of the market and protocol, the charts below show some of the behavior we have been monitoring to ensure minimal market risk. Note that accounts with collateral asset BTC were liquidated on March 9 ($463k supply liquidated) and March 10 ($269k supply liquidated), due to BTC’s price falling ~8.0% between March 9 and March 10. An account with $82k of collateral asset LTC was liquidated on March 10; LTC fell 20.1% between March 9 and March 10. On March 11 as USDC fell to as low as $0.88, accounts supplying $607k of USDC were liquidated. LTC also fell 8.9% from March 10 to March 11, resulting in $79k of supplied LTC to be liquidated.

We will continue to monitor user and protocol positions and make recommendations as needed.

Liquidation Amounts

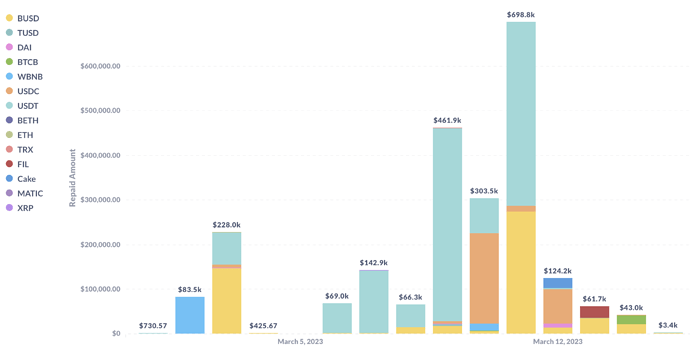

Repaid Borrows

The chart below shows the repaid borrows of accounts liquidated this month. On March 9, $433k of borrowed USDT was repaid due to a decline in supplied BTC’s price that day. On March 10, an account with $203k of borrowed USDC was repaid, also driven by a price decline in collateral asset BTC. On March 11, the ~$699k of repaid borrows in mostly USDT and BUSD were driven by the price declines in collateral assets mentioned in the section above.

Next Steps

- These recommendations will be put up for a VIP vote

By approving this proposal, you agree that any services provided by Gauntlet shall be governed by the terms of service available at gauntlet.network/tos.