Summary

Add support for the USD₮0 market on Venus Core Pool

Background

About USD₮0

USD₮0 is a bridged version of Tether’s USDT stablecoin, designed to extend USDT’s availability to blockchains where it is not natively issued. It operates on a “lock-and-mint” mechanism, meaning that USDT is locked on Ethereum while an equivalent amount of USD₮0 is minted on the destination chain. This system is powered by LayerZero’s Omnichain Fungible Token (OFT) standard, which facilitates secure and seamless cross-chain transfers.

USD₮0 is managed by Everdawn Labs and represents a standardized approach to expanding Tether assets to new blockchains. The protocol’s mission is to make Tether the de-facto asset issuer on every chain, ensuring USDT maintains its position as the most widely accessible stablecoin across all blockchain ecosystems.

How USD₮0 Works

USD₮0 operates through a sophisticated yet simple mechanism:

- Assets: USDT gets locked in a smart contract on Ethereum Mainnet

- Issuance on Destination Chains: Equivalent USD₮0 tokens are minted on the destination chain, reflecting the locked amount

- Transfers: Users can move USD₮0 across supported chains without worrying about liquidity, leveraging LayerZero

- Redemption: USD₮0 tokens can be redeemed by unlocking the corresponding USDT on Ethereum, from any supported chain, always maintaining a strict 1:1 backing

The LayerZero OFT standard ensures that USD₮0 maintains a 1:1 backing with USDT on Ethereum, and transfers are validated by a decentralized security model involving oracles and relayers. This approach reduces the complexity of cross-chain transactions while enhancing liquidity management.

Benefits

Integrating USD₮0 as collateral on Venus Core Pool will offer several benefits:

- Deep Liquidity

USD₮0 will significantly improve liquidity and trading volumes on Venus, providing users with seamless access to Tether’s stablecoin without the need for fragmented bridging solutions. The omnichain nature of USD₮0 ensures consistent liquidity across all supported networks.

- Increased Yield Opportunities

With Venus supporting USD₮0 as collateral in the Core Pool, users can unlock greater capital efficiency by leveraging their USD₮0 holdings. This integration drives higher potential returns from lending and borrowing activities, particularly for stablecoin strategies and cross-chain arbitrage opportunities.

- Innovative DeFi Strategies

The integration paves the way for the development of advanced DeFi strategies involving USD₮0 and other assets. Users can benefit from:

- Cross-chain yield farming opportunities

- Efficient stablecoin arbitrage strategies

- Enhanced liquidity management across multiple networks

- Seamless integration with LayerZero ecosystem protocols

SuperStacks Incentive Program

To mark the launch, Venus users can earn SuperStacks rewards by lending USD₮0. By participating in SuperStacks, users benefit from:

- Unique Multipliers: Special reward multipliers for USD₮0 activities

- Cross-chain benefits: Earn rewards that can be utilized across the entire USD₮0 ecosystem

- Integration Rewards: Additional incentives for early adopters who provide liquidity

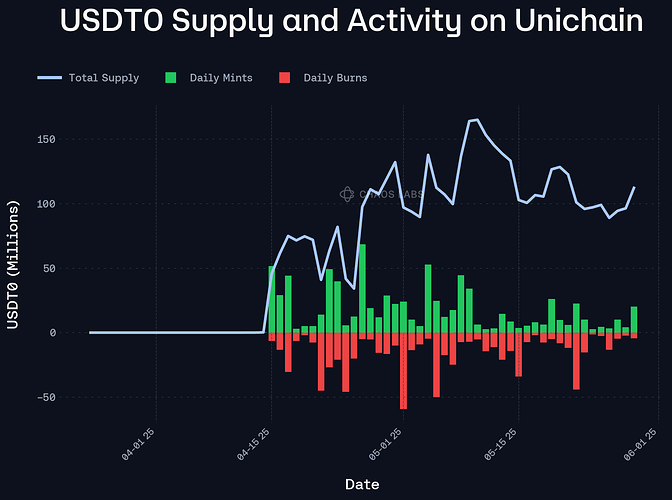

Specifications (as of 15th May 2025)

- Token Supply: 188.6M

- Unichain Token Address: 0x9151434b16b9763660705744891fA906F660EcC5

- Token Holders: 31,855 (ink) + 11,517 (opm) + 13,271 (unichain)

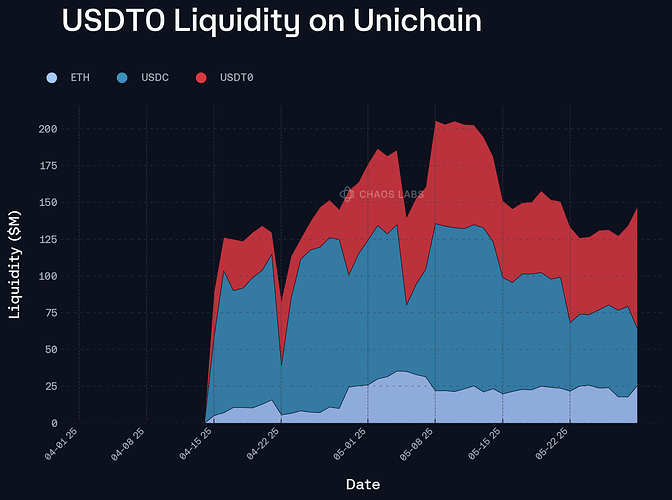

- Liquidity: $135.4M TVL

- Proof of Reserve: Backed 1:1 with locked USDT on Ethereum

- Supported Chains: Ink, Unichain, OP Mainnet

Technical Details

LayerZero OFT Integration

USD₮0 utilizes LayerZero’s Omnichain Fungible Token standard, enabling:

- Seamless cross-chain transfers without traditional bridges

- Reduced counterparty risk

- Unified liquidity across all supported networks

- Native integration with LayerZero ecosystem

Security Model

- 1:1 backing guarantee with locked USDT on Ethereum

- Decentralized oracle and relayer validation

- Smart contract security audited by leading firms

- Managed by Everdawn Labs with industry-standard security practices

Additional Information

- Website: https://USD₮0.to/

- LayerZero OFT Documentation: LayerZero V2 OFT Quickstart | LayerZero

- Github: Everdawn-Labs · GitHub

- X (Twitter): https://x.com/USD₮0_to

Implementation Timeline:

- Phase 1: Proposal submission and community discussion

- Phase 2: Technical integration and testing

- Phase 3: Governance vote

- Phase 4: USD₮0 market launch with SuperStacks incentives

- Phase 5: Full integration across Venus ecosystem

Risk Assessment

Risks and Mitigations

- Smart Contract Risk: USD₮0 utilizes battle-tested LayerZero OFT standard with proven security record

- Counterparty Risk: Minimized through decentralized oracle and relayer system

- Redemption Risk: 1:1 backing with locked USDT on Ethereum ensures full redeemability

- Regulatory Risk: USD₮0 inherits the same regulatory benefits as standard USDT

Risk Mitigation Strategies

- Continuous monitoring of locked USDT reserves

- Regular audits of smart contracts

- Transparent proof of reserves

- Partnership with established protocols and exchanges

Conclusion

Integrating USD₮0 into Venus’s Core Pool represents a strategic opportunity to become one of the first major lending protocols to support this omnichain stablecoin. This integration will deepen liquidity, attract new users from multiple blockchain ecosystems, and drive DeFi strategies in the broader ecosystem. Combining USD₮0’s robust cross-chain capabilities with Venus’ lending infrastructure, will foster significant growth in the DeFi space.