Overview

Chaos Labs supports listing THE on Venus Protocol’s Core Pool on BNB Chain. Below is our analysis and recommendations for initial risk parameters.

Technical Overview

THENA is a DEX and liquidity hub built on BNB Chain and opBNB. Its ecosystem includes THENA (a spot DEX), ALPHA (a perpetual DEX), ARENA (a social hub for trading competitions), and WARP (an upcoming launchpad designed to support new projects and tokens).

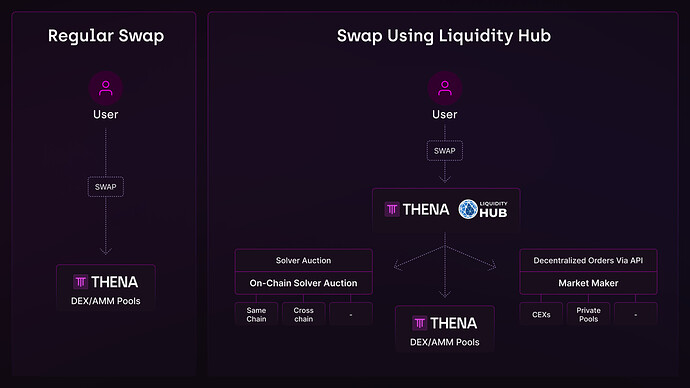

The spot DEX, THENA, uses ODOS to ensure optimal trades with minimal slippage through THENA’s liquidity pools. Also, the platform integrates ORBS Liquidity Hub, a decentralized optimization layer that allows DEXs to tap into additional liquidity sources, including on-chain solver auctions and decentralized limit orders via API. If the Liquidity Hub cannot execute the trade at a better price than the regular swap engine, the trade defaults to the AMM contract and proceeds as usual.

Swap Using Liquidity Hub

$THE is the utility token of the THENA ecosystem, serving two primary objectives: maintaining liquidity and promoting decentralized governance. veTHE, a vote-escrowed version of $THE, is issued as an NFT. Users can lock their $THE tokens for up to two years to receive veTHE. To incentivize sustained participation, the veTHE balance gradually decreases over time, reaching zero at the end of the initial lock period.

$THE Locking Mechanism

veTHE provides two primary utilities. First, holders can vote for gauges, which are pools with dynamic $THE rewards determined by weekly veTHE voting allocations. This enables them to access 90% of the trading fees and 100% of the voting incentives associated with their selected pool. Second, veTHE holders can engage in governance by voting on protocol improvement proposals.

Market & Ecosystem

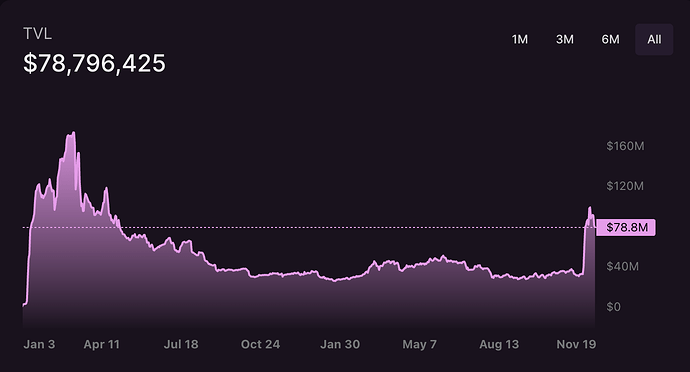

The spot DEX, THENA, demonstrated significant growth in TVL within its first three months after launch, reaching a peak of $170 million. Subsequently, its TVL declined and stabilized between $30 million and $45 million from September 2023 onward. However, a noticeable surge occurred between late November and early December 2024, with TVL peaking at nearly $100 million. As of now, THENA DEX’s TVL stands at approximately $79.69 million.

THENA DEX TVL

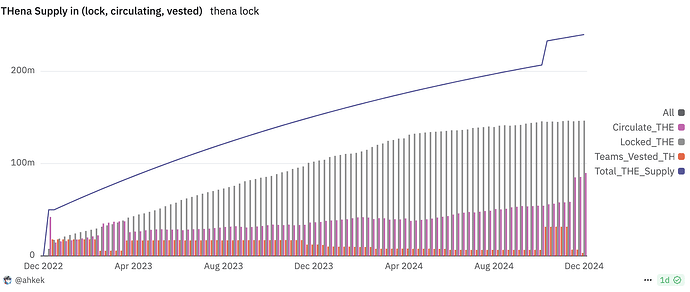

The total supply of $THE has been steadily increasing in line with its predefined emission schedule, reaching a total of 232 million $THE to date.

$THE Supply Distribution

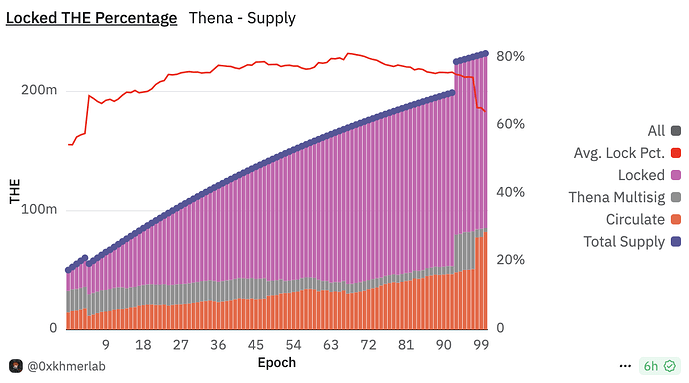

veTHE statistics demonstrate a positive locking trend among users. As the supply of $THE continues to increase, the amount being locked is also steadily rising. Overall, the proportion of $THE locked has consistently remained above 50%, stabilizing between 60% and 70%.

Liquidity

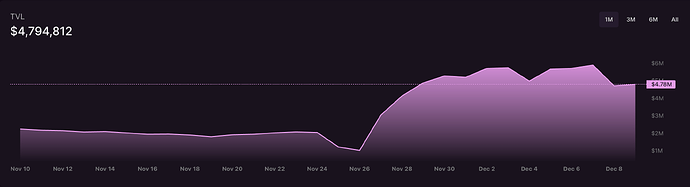

Currently, the majority of $THE’s liquidity is sourced from THENA DEX, which supports multiple $THE trading pairs and offers a total of $4.79 million in $THE liquidity.

$THE Liquidity on THENA

It’s also worth noting that THENA recently announced a partnership with Binance, and $THE was listed on the Binance on November 27, 2024.

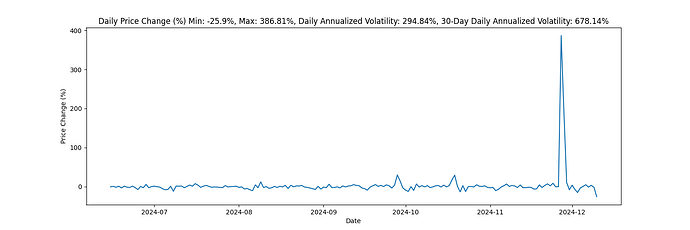

Volatility

Following the Binance listing, $THE exhibited a spike in volatility, with the daily annualized volatility hitting 294.84%. This level of volatility calls for a conservative approach to initial parameter assumptions. Adjustments will be made if future volatility decreases and the asset price stabilizes within a consistent range.

Collateral Factor

Given the above analysis, we can conclude that the THENA ecosystem remains stable and has shown steady growth recently. Additionally, the liquidity and market cap of $THE remain strong. However, due to the significant volatility of $THE, we recommend adopting conservative parameters at this time, with an initial Collateral Factor set at 55%.

Interest Rate Curve and Reserve Factor

Given $THE’s risky nature and the historically low demand for volatile assets to be borrowed except for staking, we recommend setting the kink at 45% at this moment. Additionally, we suggest a relatively higher reserve factor of 25%.

Supply and Borrow Cap

We recommend setting supply caps according to our usual methodology, at two times the liquidity available below the liquidity bonus. Thus, we recommend setting the supply cap to 2,400,000 THE, with the borrow cap set to half of this value.

Recommendation

| Parameter | Value |

|---|---|

| Asset | THE |

| Chain | Binance |

| Pool | Core |

| Collateral Factor | 55% |

| Supply Cap | 2,400,000 |

| Borrow Cap | 1,200,000 |

| Kink | 45% |

| Base | 0.0 |

| Multiplier | 0.09 |

| Jump Multiplier | 3.5 |

| Reserve Factor | 25% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.