Summary

We propose the addition of tETH as a supported collateral asset in the Liquid Staking ETH Pool on Venus Protocol. By integrating tETH, Venus Protocol will enhance its collateral diversity and attract new users, leveraging Treehouse’s liquid staking token (LST) framework to boost lending and borrowing activity on the platform. Moreover, we will offer a Treehouse Nuts Boost as an incentive for users who pledge tETH as collateral on Venus.

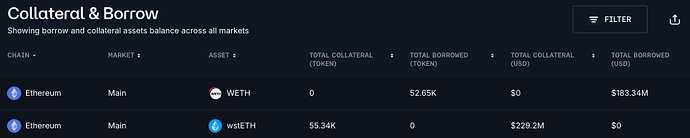

To enhance investor confidence in Treehouse Protocol, we will introduce atomic withdrawals, enabling users to instantly swap their tETH for wstETH at a 2% fee, supported by a liquidity reserve earmarked at a percentage of our TVL (currently around $5M). Our atomic withdrawals will provide our users with quick access to liquidity and also ensures that liquidators’ needs can be met.

About Treehouse Protocol

Treehouse Protocol, the decentralized arm of Treehouse Labs, is leading the charge in revolutionizing the decentralized fixed income market. Focused on building the fixed income layer for digital assets, Treehouse introduces innovative fixed income products and primitives.

Key Offerings

-

tAssets (Liquid Staking Tokens 2.0):

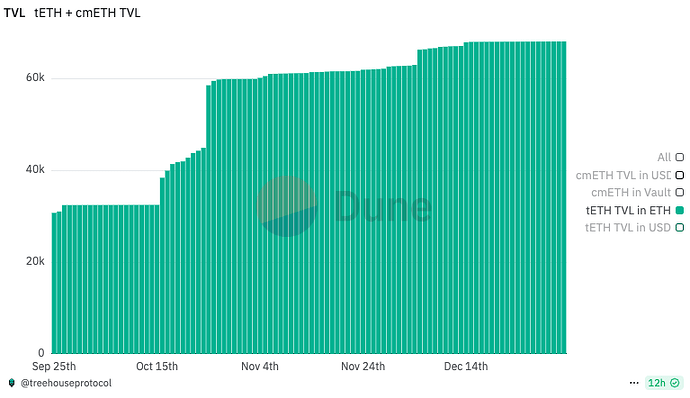

These tokens aim to unify fragmented on-chain interest rate markets for Proof of Stake (PoS) chains. tAssets provide holders with real yield beyond just the native network rewards through interest rate arbitrage on lending platforms. The first iteration, tETH, is a liquid staking token that addresses fragmentation in Ethereum’s interest rate market. tETH allows users to participate in the convergence of Ethereum interest rates while maintaining flexibility for DeFi activities. By borrowing ETH against wstETH (wrapped Lido Staked ETH), tETH amplifies potential yields by increasing the overall staked position. Since launching in September 2024, Treehouse has reached a Total Value Locked (TVL) of 340M USD and is actively expanding to other Layer 2s and chains. -

Decentralized Offered Rates (DOR):

DOR is a consensus-based benchmark system for setting reference rates in the fixed income space. It mirrors the role of benchmarks like LIBOR (London InterBank Offered Rate) and SOFR (Secured Overnight Financing Rate) in traditional finance, but with a key difference: DOR is fully transparent and objective. Traditional rates were prone to manipulation, as they relied on subjective inputs from a small panel of banks. DOR, however, leverages decentralized mechanisms to ensure accuracy and transparency in rate-setting.

Motivation

Listing tETH as collateral assets on Venus expands Venus’s collateral options to include tAssets like tETH will increase Venus Protocol utilization and contribute to long-term activity on the platform. By integrating tETH into the Liquid Staking ETH Pool, Venus Protocol will unlock new utility for tETH holders, allowing them to collateralize their assets while continuing to earn leveraged staking rewards.

Benefits

- Enhanced Activity in the LST Pool

The integration into Venus will attract stakers to leverage their tETH, increasing both lending and borrowing activity in the Liquid Staking ETH Pool. - TVL Boost

The partnership will bring tETH’s growing community and TVL to Venus while enhancing the utility of tETH. Venus users are able to leverage the benefits of tETH’s staking mechanisms. - Capital Efficiency

tETH users can earn an additional yield on their collateralized assets, driving further adoption and utility for the ETH Pool.

Specifications

- tETH Contract Address: 0xD11c452fc99cF405034ee446803b6F6c1F6d5ED8

Token Metrics

- APY: ~3.13% (based on Ethereum staking yields and interest rate arbitrage).

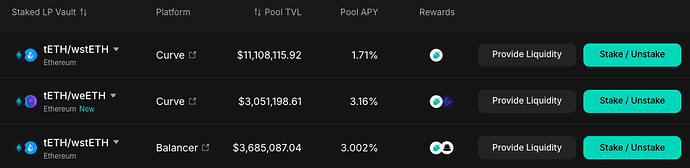

- Liquidity: Supported on Curve and Balancer, with over 15M in total liquidity deployed.