Overview

Chaos Labs supports listing USDS and sUSDS on Venus Protocol’s Ethereum Core Pool. Below is our analysis and recommendations for initial risk parameters.

Technical Overview

USDS is the stablecoin of Sky Protocol (formerly MakerDAO) and serves as an upgraded version of DAI. It supports 1:1 conversion with both DAI and USDC. Through the Sky.money platform, users can convert DAI to USDS at a 1:1 ratio. The process is fully reversible, allowing users to convert USDS back into DAI using the same contract.

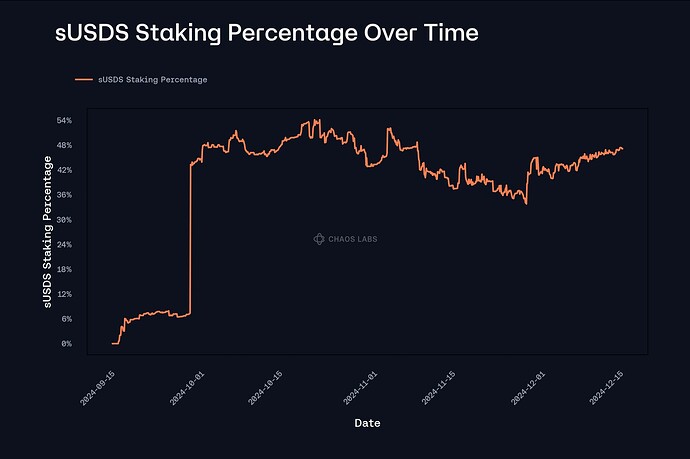

Savings USDS (sUSDS) is an upgraded version of sDAI, offering a higher yield. It is a tokenized representation of USDS staked and earning the Sky Savings Rate (SSR). While sUSDS does not have a direct conversion contract from sDAI, it utilizes the ERC-4626 token standard, enabling atomic conversion from USDS. Currently, the amount of USDS staked on Ethereum remains around 50%.

sUSDS Staking Percentage Over Time

SKY is now the governance token of the Sky Ecosystem, with an exchange rate of 1 MKR to 24,000 SKY. SKY rewards are being distributed at a rate of 600 million SKY per year to participating USDS holders, with users who registered before the launch receiving double rewards for the first month.

Market Cap and Liquidity

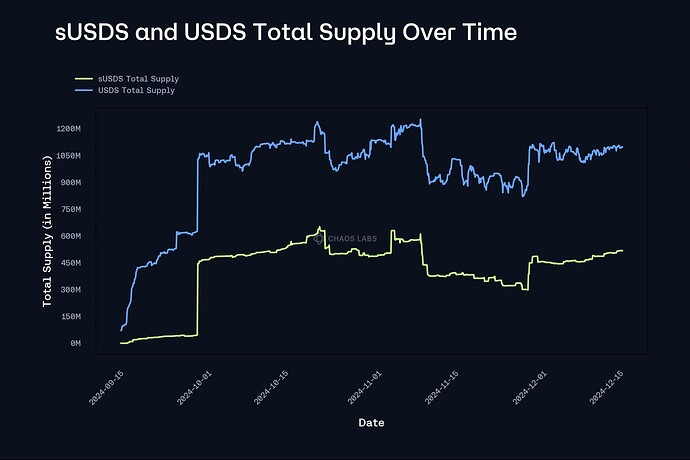

The supply of both USDS and sUSDS experienced significant growth in early October but has since plateaued, maintaining a stable range. Currently, the total supply of USDS is approximately 1.05 billion, while the total supply of sUSDS is around 500 million.

sUSDS and USDS Total Supply Over Time

Since sUSDS adopts the ERC-4626 token standard, and the Sky Protocol allows users to downgrade USDS to DAI at no slippage or fees (beyond gas costs), the liquidity of USDS and sUSDS is primarily tied to DAI. DAI maintains strong liquidity on Ethereum, currently holding a $3.48 billion market cap.

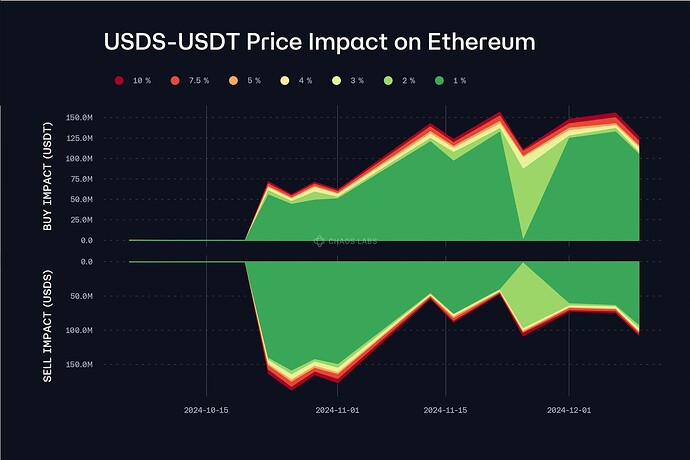

Additionally, the DEX liquidity of USDS has remained stable since November, currently enabling a 100M USDS sell with less than 1% slippage.

USDS-USDT Liquidity on Ethereum

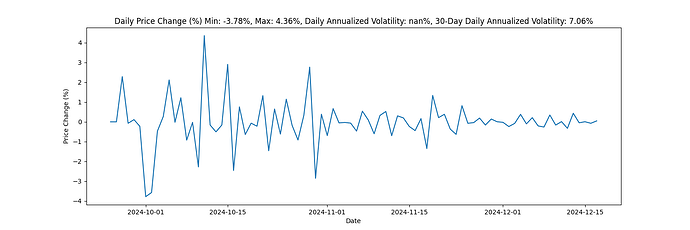

Volatility

USDS’s volatility has decreased since launch, with a 30-day daily annualized volatility of 7.06%.

LTV, Liquidation Threshold, and Liquidation Bonus

Although USDS is an upgraded version of DAI and has demonstrated relatively stable supply and liquidity, its short launch timeline and smaller supply compared to DAI warrant caution. At this moment, we recommend slightly more conservative Collateral Factor and Liquidation Thresholds for sUSDS and USDS relative to DAI on Ethereum. We recommend setting the Collateral Factor to 73% and Liquidation Threshold to 75% for both assets.

Interest Rate Curve

Because of the recent increases to the Dai Savings Rate (11.5%) and Sky Savings Rate (12.5%), as well as market activity that has boosted global stablecoin rates, we recommend setting USDS’s target borrow rate at the Kink to 12.5% and aligning the other parameters to those of DAI.

Supply and Borrow Cap

Given the yield-bearing properties of sUSDS and its lack of borrowing use cases, we expect a lack of borrowing demand for the asset. Hence, we recommend making it non-borrowable.

For the supply caps of each asset, we would normally recommend setting them according to our usual methodology, at two times the liquidity available below the liquidity incentive; we recommend setting the borrow cap at 80% of this value (equal to the Kink) for USDS. However, this would lead to caps that were significantly larger than the total market size of Venus on Ethereum. We instead recommend setting them to 1x and are prepared to facilitate cap increases. We have provided the supply and borrow cap recommendations based on this methodology below.

Oracle Configuration/Pricing

Given the atomic conversion contract and the unavailability of USDS/USD Chainlink oracles (except on Polygon), we recommend pricing USDS with the DAI/USD Chainlink oracle. We recommend pricing sUSDS using the same oracle augmented with the sUSDS exchange rate.

Recommendation

Following the above analysis, we recommend the following parameters for listing the assets.

| Asset |

USDS |

sUSDS |

| Chain |

Ethereum |

Ethereum |

| Pool |

Core |

Core |

| Collateral Factor |

73% |

73% |

| Liquidation Threshold |

75% |

75% |

| Liquidation Incentive |

10% |

10% |

| Supply Cap |

65,000,000 |

30,000,000 |

| Borrow Cap |

7,680,000 |

- |

| Kink |

80% |

- |

| Base |

0.0 |

- |

| Multiplier |

0.15625 |

- |

| Jump Multiplier |

2.5 |

- |

| Reserve Factor |

10% |

- |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0