Overview

Chaos Labs supports listing ynETH on Venus Protocol’s Ethereum Liquid Staked ETH Isolated Pool. Below is our analysis and recommendations for initial risk parameters.

Technical Overview

YieldNest is an ETH restaking yield optimizer powered by EigenLayer, offering simplicity, liquidity, and controlled AVS exposure. It simplifies restaking by handling validator selection, provides liquidity through nLRTs and LRTs for use in DeFi, and enables users to gain targeted or diversified exposure to curated AVS categories. Users can choose isolated AVS exposure, focusing on specific verticals, or diversify through basket options that span multiple categories. For example, ynETH LRT provides users with exposure to a basket of AVS categories, while the ynAI LRT only offers focused exposure to a portfolio of AI AVS.

ynETH is an nLRT that provides users with exposure to a dynamically curated basket of AVSs. It is not a rebasing token, which means ynETH starts at 1:1 to ETH and then appreciates in value against it as it accrues rewards.

ynETH Architecture

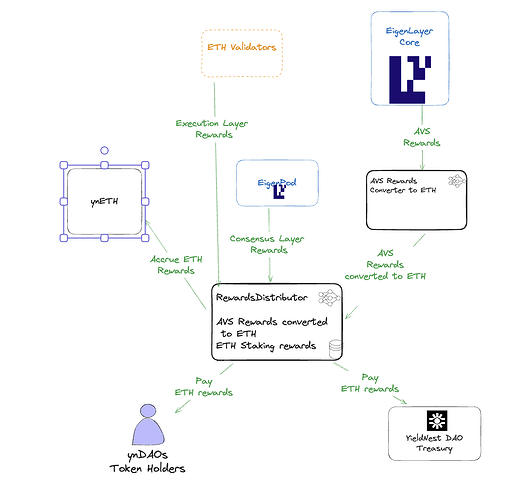

The RewardsDistributor manages all YieldNest rewards, drawing from multiple revenue sources: consensus layer rewards, execution layer rewards, AVS rewards, veYND bribes, and airdrops or one-time rewards. Currently, only Ethereum staking rewards are distributed, as AVS reward support awaits EigenLayer updates. Of the total rewards, 90% are allocated to ynETH holders, while 10% is retained as a protocol fee to support the YieldNest DAO and YND token holders. Future upgrades will enable token conversions for AVS rewards and integrate additional revenue streams, such as veYND bribes and airdrops. Until the YND and veYND tokens are released, the entire protocol fee is collected in a DAO multi-sig wallet, with the address stored at RewardsDistributor.feeReceiver.

RewardsDistributor Architecture

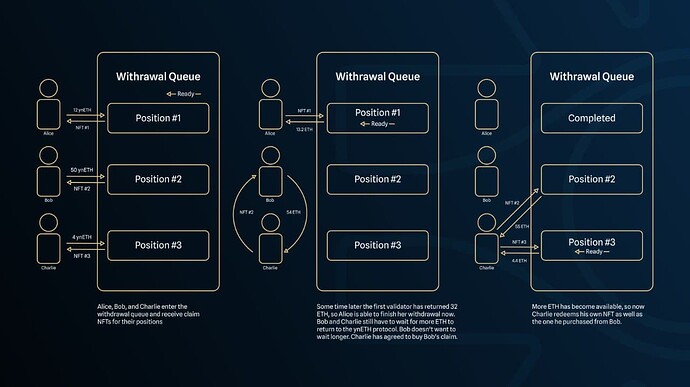

ynETH can be withdrawn/unstaked directly via YieldNest app. Withdrawal times depend on both the beacon chain process and EigenLayer’s 7-day withdrawal delay, with the longer delay determining the total time. The beacon chain process includes exiting the active set (less than 12 hours), entering the withdrawable state (~27 hours), and the withdrawal sweep (~8.5 days). For faster liquidity, users can swap ynETH on secondary platforms or sell claim NFTs.

ynETH Withdrawal Architecture

Market Cap and Liquidity

The supply of ynETH has shown a stable growth trend since the project’s inception, peaking at around 4,500 ynETH. However, in November 2024, the supply declined, and as of the time of writing, it stands at 3,367 ynETH.

ynETH Total Supply Over Time

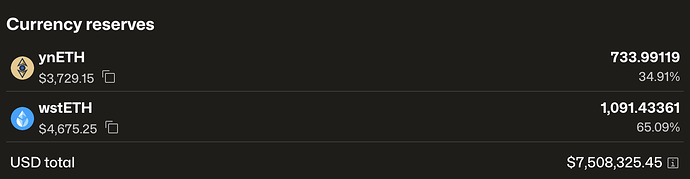

Currently, the largest DEX liquidity source for ynETH is on Curve, with a TVL of $7.51 million and daily volume of $76K, as shown below.

ynETH/wstETH Curve Pool

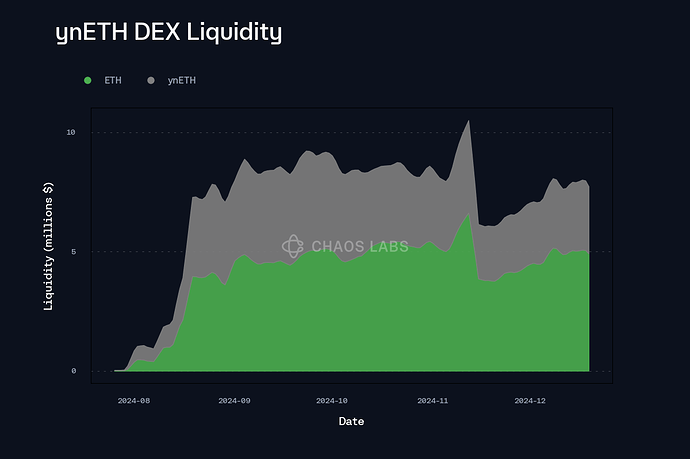

Below, we present the liquidity of this Curve ynETH/wstETH liquidity pool over time.

ynETH/wstETH Curve Pool Liquidity Over time

Volatility

The volatility of ynETH has remained relatively high, as observed in the Curve ynETH/wstETH pool, where ynETH frequently exhibits greater volatility compared to wstETH.

The total supply of ynETH is currently 3,370, with 736 ynETH (approximately 30%) in the liquidity pool. While this proportion of liquidity should theoretically support large transactions without significant price impact, our observations indicate otherwise. For instance, it consistently moves by 1.5% to 2% due to orders of just 50 ynETH. We believe this issue arises from the design of the ynETH/wstETH Liquidity Pool. The current configuration causes liquidity to be spread out rather than concentrated where it is most effective, leading to significant price movements despite the pool having sufficient funds.

LTV, Liquidation Threshold, and Liquidation Incentives

Given the above analysis, ynETH is still in its early stages. Compared to other LSTs and LRTs, its total supply has yet to reach 4K, and its liquidity remains relatively low. Additionally, not all features described in its overall mechanism have been fully implemented to date. Most importantly, as discussed earlier, the ynETH liquidity pool has parameter issues that can lead to significant price movements for ynETH. Therefore, at this moment, we do not recommend listing ynETH on Venus.

However, if listing ynETH is deemed necessary, we have proposed a set of parameters for conditional listing. Due to the aforementioned concerns, we recommend a more conservative initial CF and LT for ynETH, set at 70% and 75%, respectively, compared to other LSTs and LRTs. Also, we recommend increasing the liquidation incentive to 7.5% to account for ynETH’s high volatility.

Isolated Pool

Given the anticipated use case for the ynETH — leveraging staking yield — we recommend listing it in the Ethereum Liquid Staked ETH isolated pool.

Interest Rate Curve

As ynETH is an interest-bearing asset, we do not anticipate high borrow demand. Additionally, given its novelty, we recommend setting the kink at 45% for now and aligning the remaining parameters with those of similar assets in the pool.

Supply and Borrow Cap

We recommend setting the supply cap at twice the liquidity available under the Liquidation Incentive. Using this approach, the initial supply cap is recommended to be 180 ynETH. Given the anticipated low demand for ynETH borrowing, we suggest setting the borrow cap at 10% of the supply cap.

Oracle Configuration/Pricing

We recommend using an internal exchange rate between ynETH and ETH when accessing the price of ynETH. At the same time, since we are using internal exchange rate, the volatility of ynETH will be mitigated.

Recommendation

Following the above analysis, we conditionally recommend the following parameters for listing the asset. If the parameterization issues of the ynETH liquidity pool are resolved, thereby addressing the volatility concerns, we will revisit the situation and provide less conservative parameters.

| Asset |

ynETH |

| Chain |

Ethereum |

| Pool |

Liquid Staked ETH |

| Collateral Factor |

70% |

| Liquidation Threshold |

75% |

| Liquidation Incentive |

7.5% |

| Supply Cap |

180 |

| Borrow Cap |

18 |

| Kink |

45% |

| Base |

0 |

| Multiplier |

4.5% |

| Jump Multiplier |

200% |

| Reserve Factor |

20% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0