Overview

Chaos Labs recommends the listing of ynBNBx within Venus Protocol’s Liquid Staked BNB Pool, below are our analysis and recommendations for initial risk parameters.

Liquid Staked BNB Pool

We recommend listing ynBNBx in the BNB Liquid Staked Pool rather than the Core Pool to benefit from higher initial parameters, as the pool consists of BNB and BNB-correlated assets. The higher initial risk configuration proposed in this recommendation, is possible thanks to the increased correlation between the assets in the pool and enables users to engage more efficiently in leveraged yield-farming strategies.

Technical Overview

ynBNBx is a MAX LRT developed by YieldNest. Unlike ynETH and ynBNB, which we analyzed before, which primarily focus on single-layer restaking, ynBNBx integrates a range of BNB-based yield-generating strategies. It is denominated in wBNB, with wBNB as its primary yield-generating asset, and operates on the BNB L1 as its accounting layer. To further optimize yield, it incorporates additional assets such as slisBNB and asBNB. Unlike rebasing tokens, ynBNBx appreciates in value against BNB as it accrues rewards.

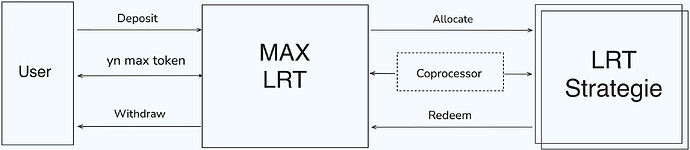

MAX LRT Architecture

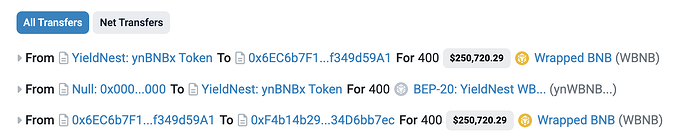

The protocol employs an ERC-4626-compliant vault structure. Deposits into ynBNBx can be made using either native BNB or wBNB, which are then converted into ynBNBx at a 1:1 ratio upon entry. At the same time, the underlying BNB is distributed between the Buffer and Kernel strategies. Withdrawals are facilitated through the Buffer strategy, which keeps a portion of the underlying assets in liquid reserves to enable immediate redemptions. However, if a withdrawal request exceeds the available buffer liquidity, the protocol requires the action of the vault manager to initiate an orderly unwinding of underlying positions within the Kernel strategy, potentially causing delays depending on market conditions and strategy lock-up periods. Otherwise, the vault manager essentially transfers “idle” accumulated WBNB from fresh deposits into the protocol utilized to mint new ynBNBx to the buffer strategy. Simultaneously, it mints an equivalent amount of buffer tokens, ensuring users can complete immediate redemptions at no additional cost. Below, we present an example transaction illustrating this process.

Source: ynBNBx Smart Contract

Importantly, unlike other LSTs and LRTs, the atomic redemption mechanism, as described above, is the sole process for redeeming and obtaining the underlying assets collateralizing ynBNBx, where the topping-up is performed at the discretion of the Yieldnest team, subject to the underlying strategy distribution.

The Kernel strategy aims to provide the protocol-advertised yield. It achieves this by converting BNB into asBNB, a token that accrues yield from Binance Launchpool rewards. Users can mint asBNB by staking slisBNB on Astherus. The staked slisBNB is converted into clisBNB by Lista DAO and used to participate in Binance Launchpools. The returns generated from these Launchpools are then converted to BNB by Lista DAO and sent back to Astherus, reflecting in the net asset value of asBNB. The Kernel strategy supports instant withdrawal for all assets except BNB, meaning that the Yieldnest team can directly redeem asBNB. Withdrawing asBNB grants users slisBNB, regardless of whether they initially deposited slisBNB or wBNB. However, converting slisBNB to BNB typically requires 7-15 days.

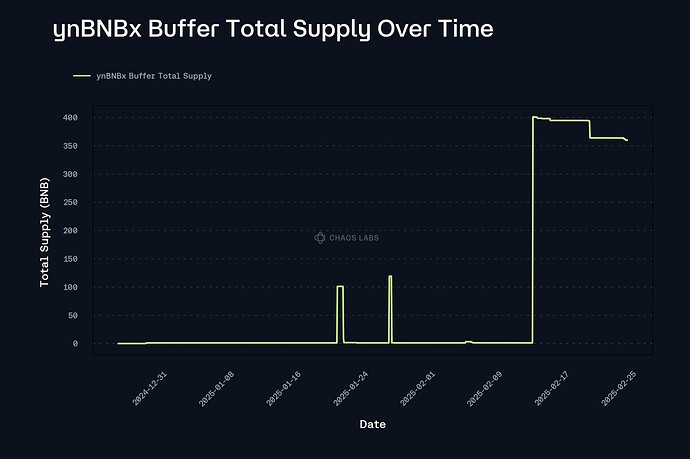

Below, we present the total supply of the buffer strategy over time. Since approximately February 10, 2025, the buffer has been replenished to 400 BNB and has remained stable over the past two weeks, supporting immediate ynBNBx exit requests up to this amount.

Market Cap & Liquidity

ynBNBx’s total supply has maintained a continuous upward trend since its inception. Over the past two weeks, the supply saw a significant increase within a short period due to a 1,900 WBNB deposit that occurred on February 13. As of the time of writing, the total supply of ynBNBx stands at 3,571, translating to a TVL of $2.2M.

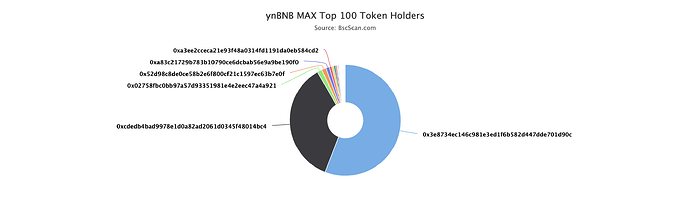

ynBNBx is distributed among 1,363 holders, with 56% of the total supply controlled by a single user, posing a concentration risk. Notably, this user is the same one who deposited 1,900 WBNB on February 13, as mentioned earlier. The second-largest holder is the THENA ynBNBx/BNB liquidity pool, which currently holds the largest liquidity for ynBNBx.

ynBNBx Holder Distribution

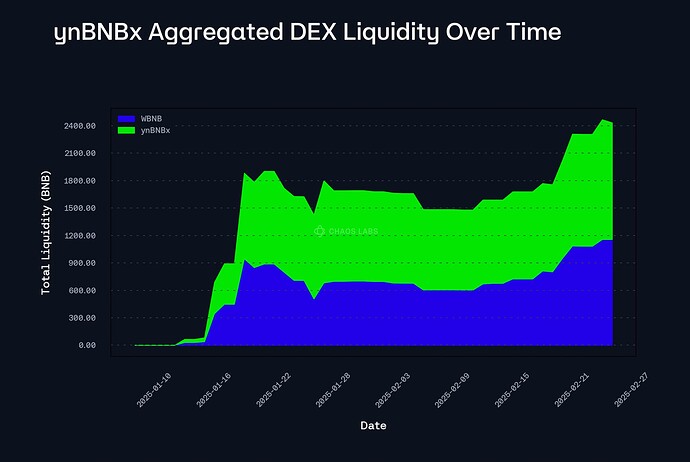

ynBNBx’s liquidity is concentrated in the ynBNBx/BNB pool on THENA. Below, we present the TVL of this liquidity pool over time. The ynBNBx/BNB pool launched on January 8, 2025. Its TVL has increased in recent days, stabilizing above 1,800 BNB over the past week. As of the time of writing, the total TVL stands at $1.4M, with 1,310 ynBNBx locked.

Collateral Factor

ynBNBx has demonstrated stable growth, and its buffer strategy ensures an immediate exit path beyond the liquidity pool. However, given the concentration risk in its distribution and the limited historical data due to its novelty, we recommend setting its initial CF slightly lower than slisBNB, at 86% for now.

Supply and Borrow Caps

We recommend setting the supply cap at 2x the liquidity available under the Liquidation Incentive. Using this methodology, we recommend an initial supply cap of 2400 ynBNBx.

Given ynBNBx’s yield-bearing nature and the historically limited use cases for borrowing yield-bearing assets, we recommend setting ynBNBx as non-borrowable at this time.

Oracle Configuration/Pricing

We recommend using the internal exchange rate between ynBNBx and WBNB through the convertToAssets function in the ynBNBx contract for price assessment, complemented by Chainlink’s BNB/USD price feed.

Specification

| Parameter |

Value |

| Asset |

ynBNBx |

| Chain |

BNB Chain |

| Pool |

Liquid Staked BNB |

| Collateral Factor |

86% |

| Liquidation Penalty |

2.5% |

| Supply Cap |

2,400 |

| Borrow Cap |

- |

| Kink |

- |

| Base |

- |

| Multiplier |

- |

| Jump Multiplier |

- |

| Reserve Factor |

- |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0