Overview

Chaos Labs supports listing asBNB on the Venus Core Pool on BNB Chain. We do not recommend listing USDF at this time. Our analyses and recommendations follow.

asBNB

asBNB is an LST representing staked BNB tokens. It allows users to deposit either native BNB or StakeLab’s slisBNB token to mint asBNB. Deposits of native BNB are automatically converted to slisBNB within the protocol, and all withdrawals return slisBNB regardless of the initial input. This design exposes asBNB holders to the liquidity and slashing risks inherent to slisBNB. Both minting and redeeming transactions are processed atomically, however, the redeem can incurr a fee, that can be changed by the owner of the minting contract and which is currently set to 0.

The asBNB token contract is deployed here and the minting contract here. The protocol accrues yield from Binance Launchpool rewards, Megadrop and Hodler airdrops, and Aster’s Au Points program, which multiplies airdrop rewards for asBNB holders.

We have previously conducted a detailed analysis of asBNB here, finding that it was suitable for listing on Venus. We recommend utilizing the same parameters as were recommended then, except with more conservative collateral parameters that account for its ability to borrow uncorrelated assets in the Core pool. We recommend setting the asset’s CF to 72%, recognizing that it is inherently more risky than slisBNB, which we recently recommended listing with a 75% CF.

USDF

USDF is a decentralized stablecoin pegged 1:1 to USDT, issued by Aster through a minting process that requires users to deposit USDT collateral; there is also a Smart Mint feature which purchases USDF on PancakeSwap (rather than minting USDF) if its price is below 1 USDT.

USDT collateral is then deployed into delta-neutral yield-generating strategies executed on centralized exchanges, primarily Binance, via Ceffu’s MirrorX infrastructure. This approach isolates yield generation from market exposure by pairing spot USDT holdings with perpetual short positions, thereby aiming to maintain peg stability while generating yield.

There is relatively limited visibility into the strategies employed, and the Aster docs state that, to differentiate USDF from USDe, during “negative fee periods or bear markets, USDF will look to diversify its revenue streams such as integrating DAI lending strategies.”

USDF’s yield distribution mechanism is non-rebasing, meaning that yield is paid out to users who stake USDF, receiving asUSDF, rather than being reflected in USDF’s supply or exchange rate. This design preserves USDF’s 1:1 peg to USDT regardless of strategy performance.

Minting and Redeeming

The USDF minting contract is deployed here on BNB Chain, with the USDF token contract located here. Custody of the underlying USDT collateral rests with Ceffu, a Binance-affiliated institutional custodian employing MPC for secure asset management and off-exchange settlement through MirrorX. This custody model reduces counterparty risk relative to fully on-chain collateralization but introduces reliance on Ceffu’s operational integrity and solvency.

Redemptions of USDF must be requested, and generally take 1 to 2 days, though the documentation states that large amounts may take up to 7 days; asUSDF to USDF redemptions take 2 hours. There is a 0.1% fee for redemptions.

Strategy

The primary blocker to listing on Venus is the lack of information regarding the strategy that Aster is employing, as well as any potential future strategies it could adopt (such as the aforementioned “lending strategies”).

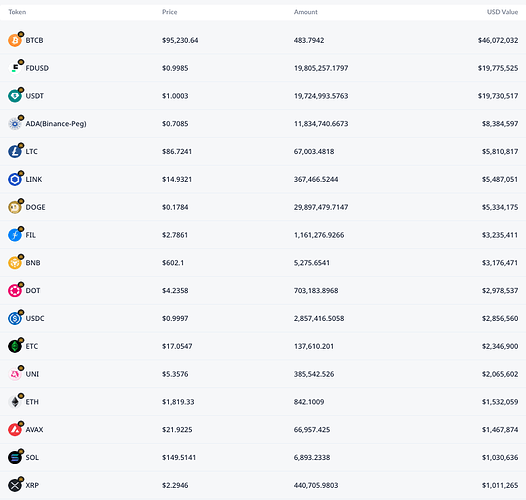

Currently, the Ceffu address associated with USDF holds a variety of assets, likely the spot positions being used to hedge perpetual futures shorts on Binance.

There is a wide variety of assets included, for example BAKE, with a market cap of just $38M and a 24-hour spot trading volume of just $5.6M, equal to its 24-hour perpetual futures trading volume on Binance of $5.6M. The inclusion of less liquid assets in this strategy creates significant additional risk relative to other similar stablecoins, which operate using only blue-chip assets for funding arbitrage.

While Ceffu’s MirrorX feature instantly reflects funds held “in a client’s designated MirrorX Sub-account at a 1:1 ratio”. However, there is no publicly available information confirming whether the “1:1 ratio” reflects USD value or token amount, though the usage of “mirror” in various blog posts implies the latter.

Binance’s public UI does not allow non-stablecoin tokens (beyond major assets like BTC, ETH, BNB, LTC, and DOGE, which have designated “coin-margin” markets) to be used as collateral on margin or futures instruments.

However, Binance does have a Portfolio Margin feature that allows a variety of assets to be used. Thus, it appears likely that Ceffu/Aster is using this Portfolio Margin System, allowing all of its spot holdings to be incorporated into a Unified Maintenance Margin Ratio. This does not eliminate risk, as for example ALPHA can only be used at a 10% collateral ratio in Portfolio Margin, but it does allow Aster to better match its spot holdings and hedges.

Should Aster provide the criteria it is using to select assets for inclusion in this strategy (ideally including some minimum measure of market cap and liquidity, as well as a minimum collateral ratio), and its target Unified Maintenance Margin Ratio, we will reassess our recommendation to not list the asset.

Finally, there is a mismatch between the value held in this wallet ($134M) and the outstanding supply of USDF ($128.9M), indicating that there may be a small buffer to protect the asset from potential drawdowns. However, this is not formalized in the documentation, and would be preferable given the highly volatile assets that appear to be included in the strategy.

Smart Contracts and Risks

The USDF smart contracts have undergone an audit by PeckShield, which identified no critical vulnerabilities. Minor issues related to gas optimization and input validation were addressed prior to deployment.

Other risks associated with USDF include counterparty risk stemming from Ceffu’s custody role, potential depeg risk in scenarios where the delta-neutral strategy underperforms or Ceffu becomes insolvent, and smart contract risk due to the absence of emergency pause functionality. The use of USDT as collateral mitigates liquidity risk given USDT’s market depth.

There is additionally the risk of a centralized exchange failure, which could lead to losses that would be mitigated by Ceffu holding the collateral funds off-exchange.

Market Cap and Liquidity

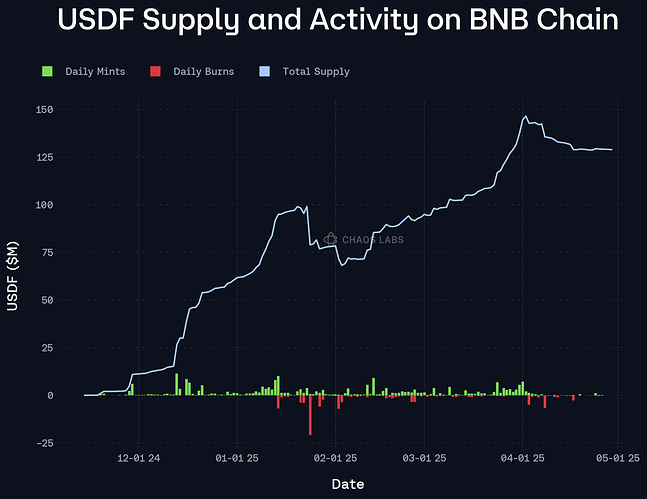

USDF’s current on-chain supply is 128.9M, with 48% of the supply staked as asUSDF. It has demonstrated a gradual upwards trend over the past five months and has handled periods of large redemptions.

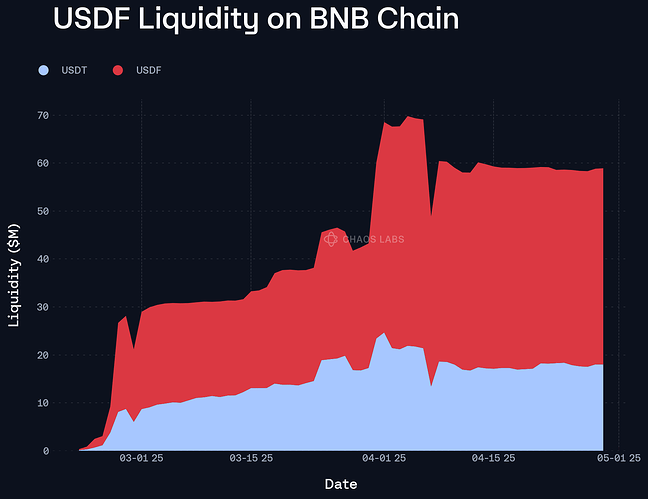

The asset’s on-chain liquidity is strong but concentrated in a single pool with USDT. However, deposits in this pool are well distributed and there have been no large fluctuations in liquidity in recent months.

USDF has demonstrated relatively strong peg stability in this pool, never depegging more than 21 bps from USDT.

Recommendation

While USDF has demonstrated promising growth and strong on-chain liquidity, we are currently unable to recommend listing the asset because of the concerns raised in the Strategy section. Should Aster provide more detail regarding their strategies, and any other strategies under consideration (especially those that do not fall under the funding rate arbitrage umbrella), we will reassess this recommendation.

Specification

| Parameter |

Value |

| Asset |

asBNB |

| Chain |

BNB Chain |

| Pool |

Core |

| Collateral Factor |

72.00% |

| Liquidation Penalty |

10.00% |

| Supply Cap |

2,000 |

| Borrow Cap |

- |

| Kink |

- |

| Base |

- |

| Multiplier |

- |

| Jump Multiplier |

- |

| Reserve Factor |

- |