Summary

The Lista DAO team proposes that Venus list Lista DAO’s decentralized stablecoin, lisUSD, as a core lending market on Venus Core pool of BNB chain.

Background

About Lista DAO

Lista DAO is the leading liquid staking and decentralized stablecoin protocol originally built on the BNB chain. Users can undergo staking and liquid staking on Lista, as well as borrow lisUSD against a variety of decentralized collateral assets.

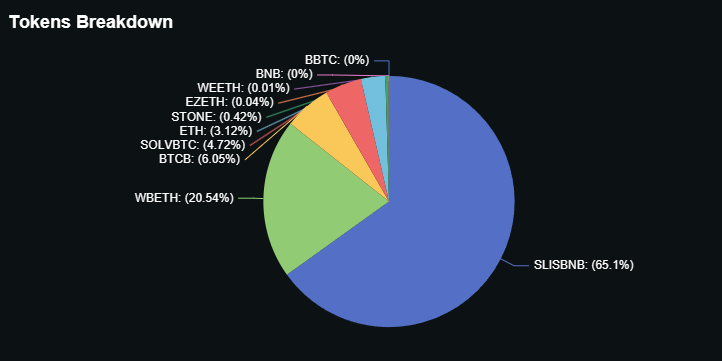

Lista consists of the following major components working in conjunction:

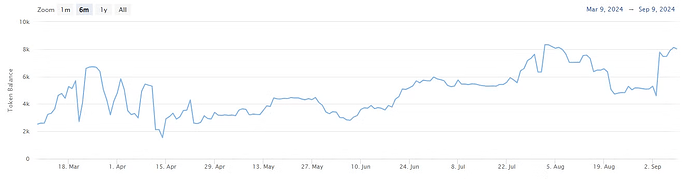

- BNB liquid staking token, slisBNB

- Decentralized stablecoin, lisUSD

On June 20, Lista DAO became the second project that got listed on Binance through the Binance Megadrop platform. See announcement here.

About lisUSD

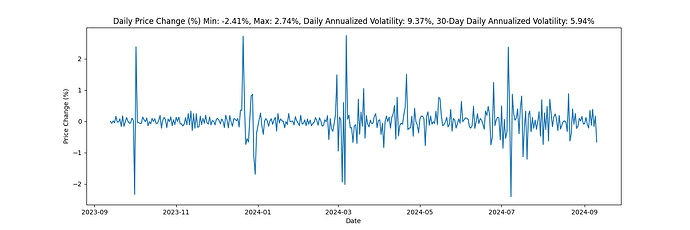

lisUSD is a decentralized, unbiased, collateral backed destablecoin soft-pegged to the US Dollar. Users who have collateralized their assets via Lista are eligible to take out a loan in lisUSD against their collateral. lisUSD is generated, backed, and kept stable through collateral assets that are deposited into CeVault functioning as the Lista collateral vault.

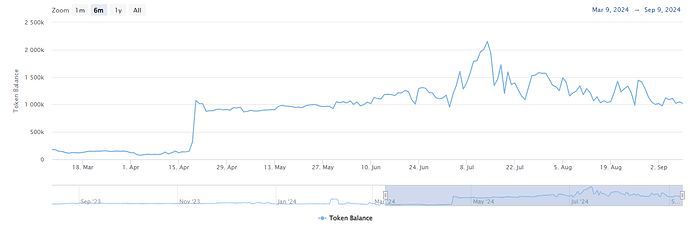

Currently the total lisUSD borrowed amount has reached over $35M, with over $185M collateral value, ranked as 4th largest CDP among all the chains in terms of TVL, only behind Maker DAO, JustStables and Liquity according to Defillama.

There is already a strong ecosystem and mass adoption of lisUSD on BNB chain with the integration of major Defi protocols such as Pancake Swap, Venus, Thena, Kinza, APX, Ether.fi, Renzo, Stakestone, Solv, Bouncebit etc, the onchain liquidity of lisUSD has reached around $20M.

Benefits

Supporting lisUSD on Venus Core Pool will bring several benefits:

- Enhance liquidity on Venus

Lista DAO will mint around $5~10M lisUSD upon the approval of the proposal on Lista DAO governance , the newly minted lisUSD will specially be supplied for Venus core pool.

- Borrowing lisUSD at a discounted rate

Lista DAO will work hand in hand with the Venus team to dynamically adjust the borrowing rate of lisUSD on Core Pool to ensure that users can borrow lisUSD from Venus at a relatively low rate compared to other stablecoins as well as other platforms. Lista DAO will adjust the supply of lisUSD dynamically and subsidize in LISTA tokens to make the loan interests attractive to the communities

- Multiple layers of yield opportunities for users

Lista DAO will provide additional incentives in LISTA tokens to incentivize the supplying and borrowing of lisUSD on Venus, furthermore, users who borrow lisUSD will be able to enjoy up to 40% apr through lisUSD’s Defi integrations.

- Innovative Defi strategies

Integration of lisUSD on the Venus core pool will also allow a variety of possibilities on Defi strategies, therefore further increasing the demand for supplying and borrowing lisUSD, as a result, higher protocol fee will be generated for Venus.

Bootstrap Liquidity

Minimum $5m in lisUSD upon Lista DAO community’s approval.

Specifications

lisUSD’s price feeds is available on Binance Oracle

lisUSD is native BEP-20 token

Token Address:

lisUSD: 0x0782b6d8c4551b9760e74c0545a9bcd90bdc41e5

Additional Information

Website: https://lista.org/

Github: https://github.com/lista-dao

Audit: Security | Lista Docs

Twitter: x.com

Medium: Lista DAO – Medium

Telegram EN: Telegram: Contact @ListaDAO