Summary

The Venus Community proposes that Venus list the stablecoin FDUSD as a core lending market on Venus Core pool.

Rationale

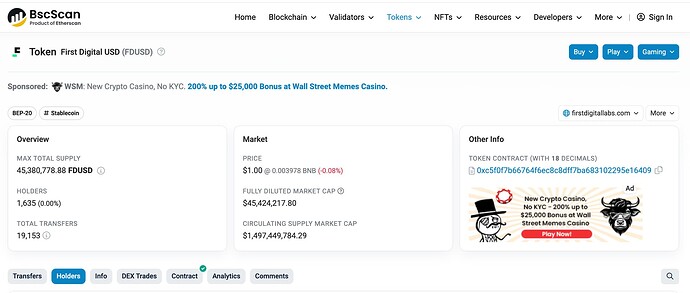

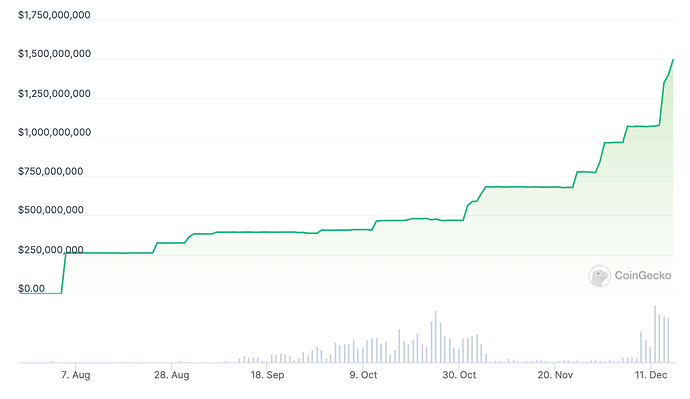

$FDUSD is now becoming a well-established, liquid and widely recognized stablecoin in the BNBChain decentralized finance (DeFi) ecosystem.

Motivations

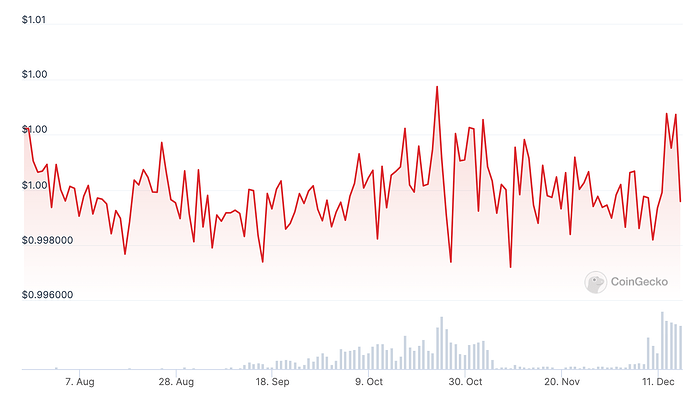

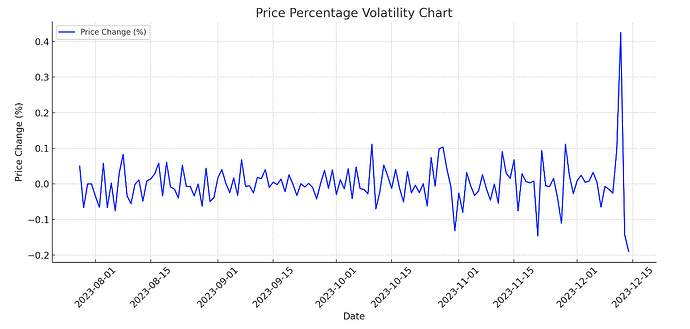

$FDUSD is a 1:1 backed stablecoin. The treasury is backed 100% by cash and cash equivalents (cash, overnight reverse repurchase agreements, and T-bills). There is no investment in any other assets. Reserves are actively managed and monthly attestations are published [here] by their team.

Stablecoins are designed to maintain a value pegged to a specific asset, such as the US dollar. By adding FDUSD, Venus can offer its users a new reliable and secure stablecoin that can be used for various transactions within the platform. Moreover, FDUSD can enhance the liquidity of the Venus core pool. The core pool serves as the fundamental liquidity provider for Venus, enabling users to borrow and lend different assets.

By incorporating FDUSD, Venus can broaden its pool of available assets, attracting more users and market participants. This increased liquidity can contribute to a more efficient and vibrant ecosystem. Additionally, the inclusion of FDUSD in the core pool will facilitate increased adoption and usage of Venus.

By offering FDUSD, Venus can tap into a larger user base that seeks stability and can leverage the platform for their needs. This would ultimately enhance the overall utility and attractiveness of Venus as a decentralized finance (DeFi) platform. Furthermore, FDUSD can serve as a hedge against market volatility. In times of heightened price fluctuations, stablecoins serve as a reliable store of value for users, preventing losses and preserving the purchasing power of their assets.

In summary, the addition of the FDUSD stablecoin to Venus core pool can bring stability, increased liquidity, broader adoption, and a safe haven for users. Incorporating FDUSD aligns with Venus goals of offering a robust, user-friendly, ever growing and inclusive DeFi platform.

Proposed Parameters

(As per Chaos Labs recommendations)

Collateral Factor

Considering the relatively short track record of FDUSD, ChaosLabs recommends starting with a more cautious Collateral Factor compared to USDT and USDC in the core pool, setting it at 75%.

Supply Cap and Borrow Cap

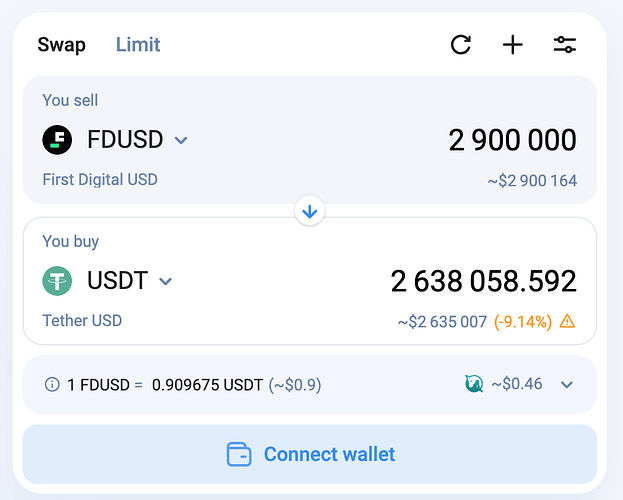

Applying Chaos Labs’ approach to setting initial supply caps for new assets, they propose setting the supply cap at 2X the on-chain liquidity available under the Liquidation Incentive (configured to 10%) price impact.

Given the current liquidity, they recommend an initial supply cap of 5,500,000 FDUSD.

IR Curves

We recommend setting the IR curve in line with those of the major stablecoins on the Venus Core pool:

- Base - 0%

- Kink - 80%

- Multiplier - 6.875%

- Jump Multiplier - 250%

- Reserve factor - 10%

As for XVS emissions, the community recommends 10 XVS/Day as an initial incentive that can be later reviewed as the market grows in liquidity and utilization on Venus.