Summary

This proposal seeks to introduce ezETH as a supported asset on Venus Protocol on Ethereum Mainnet and BNB. It aims to leverage the innovative features of this reward bearing liquid restaking token to enhance the lending and borrowing ecosystem, provide further diversified collateral options, and foster greater liquidity and user engagement within the Venus Protocol.

Rationale

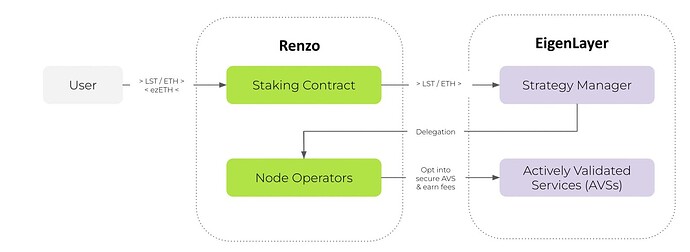

Renzo is a Liquid Restaking Token (LRT) and Strategy Manager for EigenLayer. It is the interface to the EigenLayer ecosystem securing Actively Validated Services (AVSs) and offering a higher yield than ETH staking.

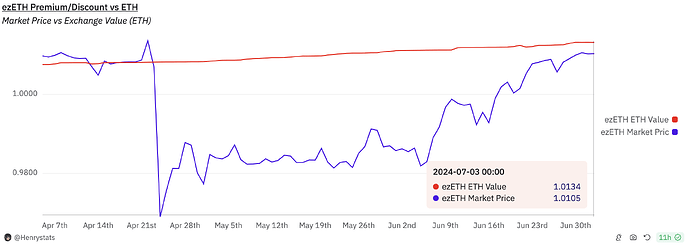

$ezETH is the liquid restaking token representing a user’s restaked position at Renzo. Users can deposit native ETH or LSTs and receive $ezETH.

Our strategy has focused on distribution and abstraction broadly speaking. Our north star is abstracting away what is otherwise a complex, nuanced, and intensive process of restaking and delegating with operators, making it as easy as possible to restake.

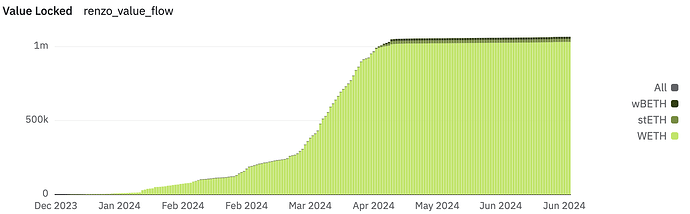

$ezETH currently has $4b+ in TVL and 125+ integrations live across 8 supported networks where we’ve brought significant value, volume, and users to a variety of participating DeFi ecosystems. We believe a listing on Venus for both networks could be one of our more important integrations thus far, and will commit to providing supplemental incentive multipliers and growth activities to funnel users to the platform where they can find additional utility for their $ezETH holdings.

References/Useful links:

Website: https://www.renzoprotocol.com/

Documentation: Intro | Renzo Protocol

GitHub Public Repo: Renzo-Protocol · GitHub

Renzo DeFi integrations: DeFi | Renzo

Chainlink ezETH Price Feed (ETH)

Chainlink ezETH Exchange Rate Price Feed (BNB)

Conclusion

With the demand for LRTs as an asset class in the current DeFi landscape along with Renzo’s pioneering focus on integrations, distribution, and chain expansion, pursuing a listing for $ezETH on Venus for both networks is a no brainer and top priority for the protocol’s growth strategy. We take great care to foster and cultivate relationships with our partners and their communities. We view this as a significant long term collaboration and we expect Venus to be one of Renzo’s top integration partners on both networks moving forward.