Summary:

EIGEN is a universal intersubjective work and governance token for the Eigenlayer ecosystem. We propose to list EIGEN on Venus Protocol Ethereum Core Pool.

Motivation:

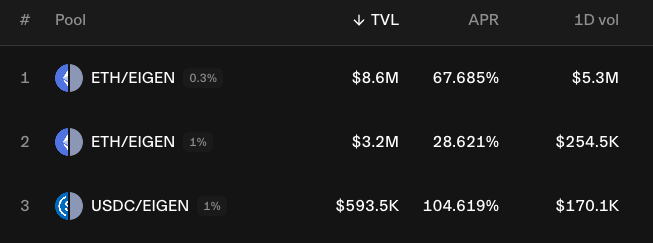

- Liquidity: EIGEN has strong liquidity on Ethereum mainnet, with ~$12m at time of writing.

- Market Acceptance: A widely distributed token, with its recent transferability unlocked, EIGEN positions itself as an asset that can drive significant volume and utility to Venus Protocol.

- Listing EIGEN expands the asset offering on Venus, enhancing its position as a leading DeFi protocol.

Risks

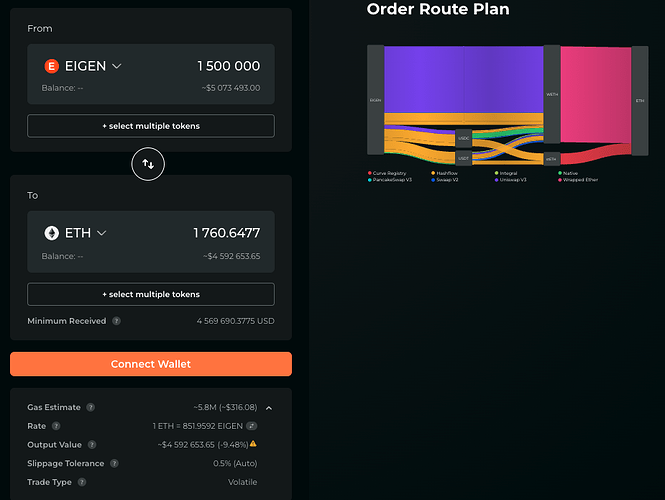

- Volatility Risk: EIGEN is a new token and like many governance tokens, is subject to price volatility which could affect the stability of the Venus platform.

- EIGEN’s liquidity is still growing. Risk parameters need to be put in place to ensure that this offering is capped inline with its liquidity.

- Smart Contract Risks: As with any new token, there are inherent smart contract risks. However EIGEN has undergone multiple audits and follows stringent security measures.

Benefits

-

Increased Asset Diversity: The addition of EIGEN provides Venus users with another asset to use as collateral or borrow, catering to different risk profiles.

-

DeFi Innovation: The inclusion of cutting-edge tokens like EIGEN signals Venus’s commitment to supporting innovative projects within the Ethereum ecosystem.

Background

EigenLayer is a restaking platform that allows ETH stakers to opt into providing security services to other decentralized protocols and services such as data availability. This model enhances Ethereum’s economic security by enabling stakers to earn additional rewards without needing to unstake their ETH. EIGEN is the governance token of the EigenLayer protocol, facilitating decisions related to protocol upgrades, parameter adjustments, and more.

Specifications

Contract address: 0xec53bf9167f50cdeb3ae105f56099aaab9061f83

Oracle & Price Feeds: Implementation expected with Redstone

Community Involvement

We recommend that the Venus community support this proposal and, if agreed, request Chaos Labs to analyze and provide risk parameters for the safe integration of EIGEN into Venus Protocol.

We look forward to the community’s feedback and the successful adoption of EIGEN.