Summary

ether.fi is seeking community support for adding its Liquid Restaking Token eBTC to Venus Protocol on ETH Mainnet. In addition, anyone who deposits eBTC on Venus will accumulate Babylon, Lombard, Ether.fi, Symbiotic and Veda points as part of ongoing incentive campaigns.

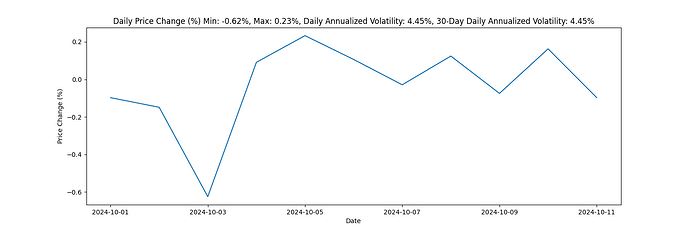

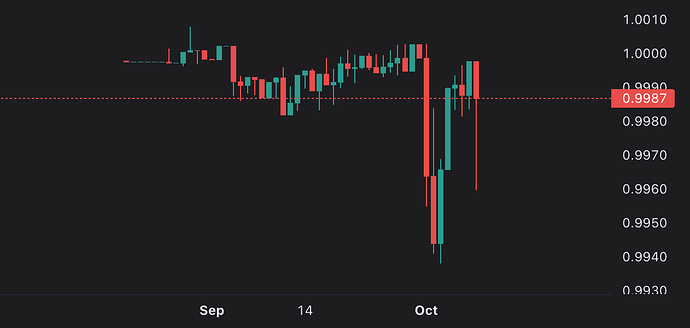

eBTC is ether.fi’s flagship Bitcoin-backed liquid restaking token. Created to service the growing demands of alternate collateral within restaking, eBTC simplifies yield optimization and expands utility. eBTC is backed by LBTC, through a partnership with Lombard, to bring the first dual yield (staking + restaking) Bitcoin product to market. Staking will be conducted through Babylon, with restaking serviced through a combination of Eigen Layer, Symbiotic, and Karak. Users are able to deposit LBTC, WBTC, FBTC, & CBBTC.

Rationale:

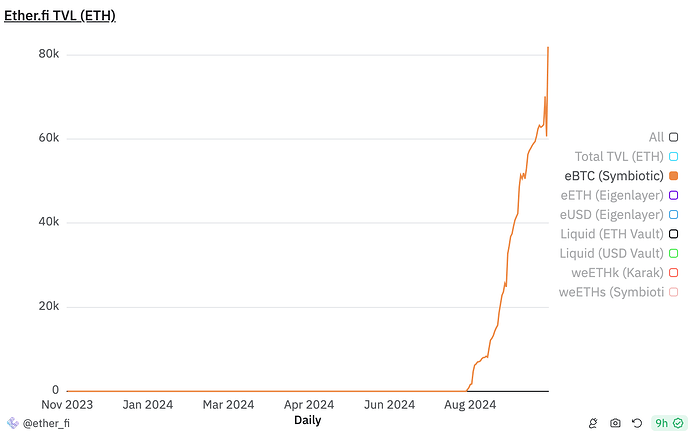

eBTC is an LRT that allows users to restake their BTC, accrue staking rewards, and receive additional rewards through restaking on EigenLayer, Symbiotic and Karak. As of Oct 4th, approximately 2,300,000 ETH ($5.8B) in TVL has been deposited into the ether.fi protocol with 2500 BTC ($150M) dedicated to the eBTC LRT. You can view additional ether.fi stats on Dune.

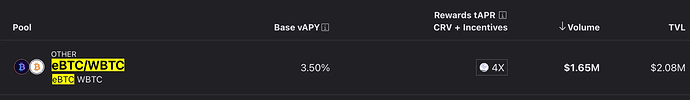

Users are given eBTC on a 1:1 basis with their chosen BTC deposit asset. As mentioned above, ether.fi is also the first LSP to natively restake on EigenLayer, Symbiotic, and Karak — a move that helps improve network efficiency and provides stakers with additional rewards for their network contributions. ether.fi has also launched a series of partnerships with DeFi protocols to incentivize users and drive liquidity for eBTC to various platforms.

ether.fi is the first decentralized, non-custodial delegated staking protocol with an LRT (eETH, eBTC). One of the distinguishing characteristics of ether.fi is that stakers control their keys. Those who work on the protocol strive for the following:

- Decentralization is the primary objective. ether.fi will never compromise on the non-custodial and decentralized nature of the protocol. Stakers must maintain control of their ETH.

- The ether.fi protocol is a real business with a sustainable revenue model.

- ether.fi will do the right thing for the Ethereum community, always. If and when the team messes up, ether.fi will own it and course correct quickly.

Key benefits brought by the Symbiotic protocol:

- Flexibility through Modularity: Networks control all aspects of their (re)staking implementation, including collateral assets supported, node operator selection mechanics, rewards, slashing, and associated resolving mechanisms. All participants can flexibly opt in and out of shared security arrangements coordinated through Symbiotic.

- Risk Minimization through Immutability: Non-upgradeable core contracts on Ethereum remove external governance risks and single points of failure. Our simple yet flexible contract design minimizes execution layer risks.

- Capital Efficiency through Restaked Collateral and Reputation-Based Curation: A permissionless, multi-asset, and network-agnostic design enables scalable and capital-efficient sourcing of economic security. An evolving operator-centric cross-network reputation system will further enhance capital efficiency for network builders.

The ether.fi team will bootstrap the pool with $25,000 worth of eBTC and add eBTC on Venus as an integration partner to kickstart the market on Venus.

Motivation

This move is intended to improve asset diversity on Venus, increase liquidity in the ecosystem, and generate fees through borrows of other BTC assets. By integrating eBTC into their markets, Venus protocol allows its users to participate in providing economic security to differing assets, support the restaking landscape, and earn incentives in addition to lending APY on their holdings.

Token

eBTC token address: 0x657e8c867d8b37dcc18fa4caead9c45eb088c642

Audits

Conclusion

Adding support for eBTC allows Venus to be a first-mover in capturing the next wave of BTC-Fi emerging from synergies and yield sourced from BTC staking & restaking. This also provides users with a wider range of opportunities to gain restaking exposure that match exceeding demand for LRTs.