Summary:

Coinbase Wrapped Bitcoin (cbBTC) is a tokenized version of Bitcoin introduced by Coinbase. We propose introducing cbBTC as a collateral asset as a core pool on Venus Protocol.

Motivation:

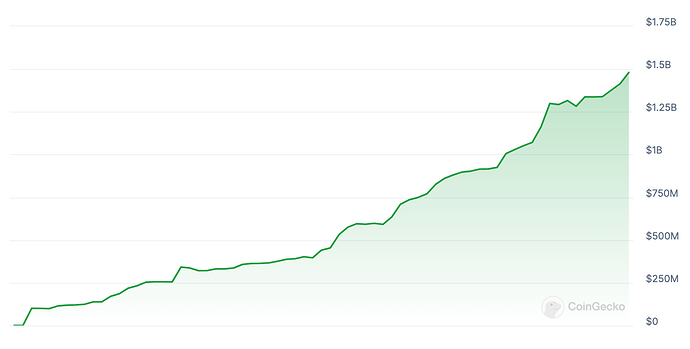

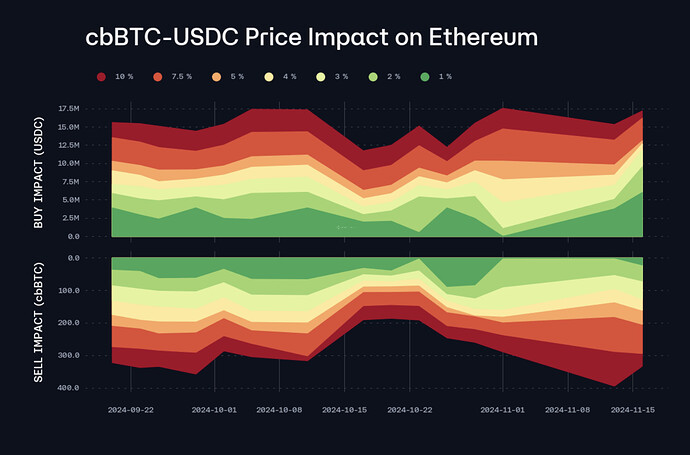

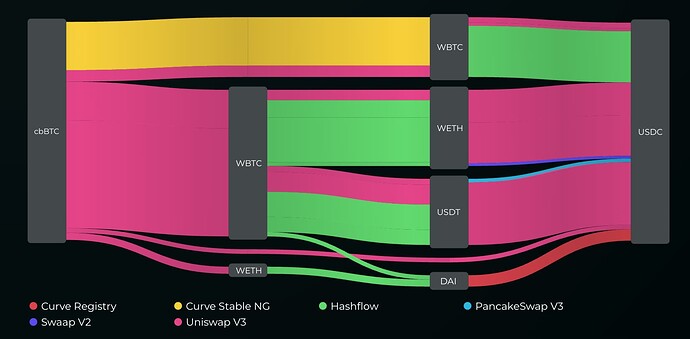

Liquidity: cbBTC has strong liquidity on Ethereum mainnet, with ~$36m at time of writing.

Market Acceptance: Coinbase is an incredibly well established CEX, and BTC is the largest crypto asset in the world. Coinbase is taking more of its products on-chain and we only expect to see cbBTC grow.

Listing cbBTC expands the asset offering on Venus, enhancing its position as a leading DeFi protocol.

Risks

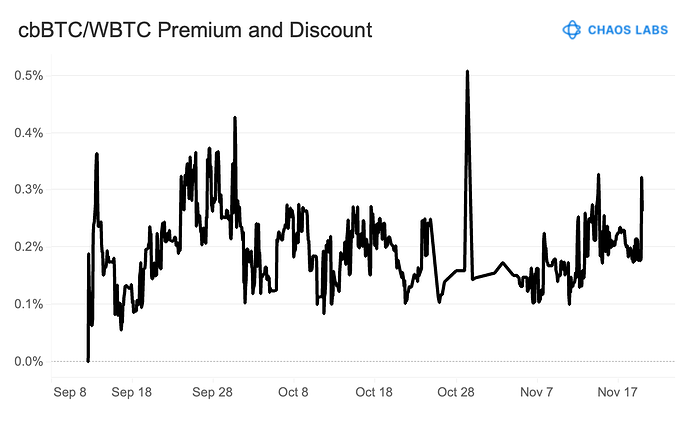

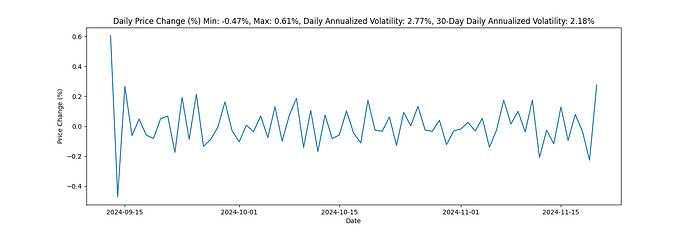

Volatility Risk: cbBTC is redeemable for BTC, 1 to 1. It therefore has similar volatility risks to BTC.

Smart Contract Risks: Any unexpected issues with coinbase custody or their wrapper contract could affect the price of cbBTC although this does not seem likely.

Benefits

Increased Asset Diversity: The addition of cbBTC provides Venus users with another asset to use as collateral or borrow, catering to different risk profiles.

DeFi Innovation: Adding cbBTC to Venus enables Venus Protocol to keep relevant in an ever changing Defi space, and enable it to capture market share of the expanding BTC Defi ecosystem.

Background

Coinbase Wrapped Bitcoin (cbBTC) is a tokenized version of Bitcoin introduced by Coinbase to enable BTC holders to access decentralized finance (DeFi) services on Ethereum and Base. Each cbBTC token is backed 1:1 by Bitcoin held in Coinbase’s custody, ensuring that it maintains value parity with BTC.

Specifications

Contract address: 0xcbb7c0000ab88b473b1f5afd9ef808440eed33bf

Oracle & Price Feeds: Implementation expected with Redstone

Community Involvement

We recommend that the Venus community support this proposal and, if agreed, request Chaos Labs to analyze and provide risk parameters for the safe integration of cbBTC into Venus Protocol.

We look forward to the community’s feedback and the successful adoption of cbBTC.