As laid out in our RWA strategy proposal, we divide the journey in three prongs. The first one is to get back to the peg and enable VAI minting which is waiting on the PSM (soon!). The third one is to work on the Credix proposal which will take more time. This post will detail our progress on the second prong, which is about increasing VAI utility through RWA (Real World Assets).

Summary

- Put some treasury assets to work investing in bIB01 token (t-bill ETF, 5% annual yield)

- Bootstrap VAI-bIB01 liquidity using $1M from the treasury to put VAI as the centerpiece of RWA liquidity

About bIB01

bIB01 is a token provided by Backed Finance tracking the price of the IB01 ETF. It is designed as a structured product under the DLT Act of Switzerland. US citizens are not allowed to use it. Steakhouse has invested time and capital digging into the product and will release a full risk assessment in the near future.

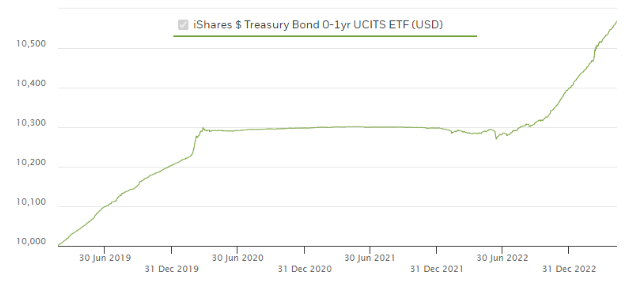

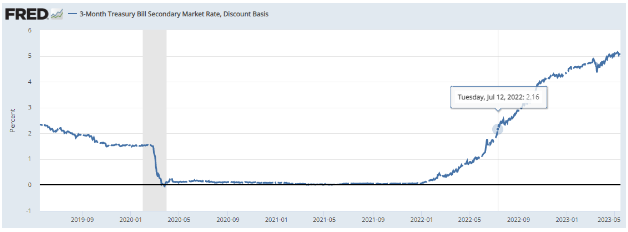

At this stage, suffice it to say that the performance (graph below) follows the 3-months t-bills yield (second graph below). There is duration risk, but it is quite muted and not really significant when yields are above 4% like they are these days.

Current yield is around 5%. It is important to note that Backed charges 50bps on minting and burning operations but no fees otherwise. Therefore, assuming rates stay constant, a bit less than 1 quarter of holding the product is needed to cover the minting/burning costs (it is not a short-term product due to those fees).

Putting VAI as the Centerpiece for RWA liquidity

We have been in discussion with Backed Finance and they can provide their products on BNB Chain should there be demand. Pancake Swap is also willing to push them forward.

There is an opportunity to achieve two goals at the same time:

- Earn yield on a portion of Venus treasury assets

- Establish VAI as the centerpiece for RWA trading

If VAI becomes the USD-stablecoin with bigger liquidity and less slippage to transact to other kinds of assets (DeFi like BNB or RWA like bIB01), it will have more utility for people that will consider switching to use VAI. Moreover, liquidity provision on AMM will increase the outstanding VAI.

There are 3 options:

- Providing a PSM-like module for bIB01. This solution would require quite some time to implement and would remain unconnected from the PCS interface.

- Providing a PCS v3 ranged pool. This solution would be quite efficient but is technically complicated. Also, operationally, we would need to move the range as bIB01 is increasing in value.

- Providing a PCS v2 pool (full range). This solution is not very efficient (most of the liquidity would be badly mispriced), but is technically and operationally simple.

A proposal could be to use the treasury to acquire $1M of bIB01 token from Backed (through a market maker, possibly using the limit order feature of PCS).

1M VAI would be minted from the system. The whole PCS pool would be valued at $2M, therefore not undercollateralizing VAI.

A $2M VAI-bIB01 LP seems to be a minimum. Indeed, V2 pools are quite capital inefficient. Even with a $2M pool a $5000 buy or sell order would move the price by 50bps. Adding 30 bps (0.3%) trading fees, that’s an 80 bps (0.8%) cost. As a reference, $5500 is the minimum mint order for Backed.

We don’t expect this strategy to generate a lot of trading fees quickly. The key value here is to provide VAI utility as a bridge to Real-World Assets. The $1M bIB01 would also generate $50k per year at the current rates (but cost at least $10k for fees) instead of USDC which is not generating anything.

Providing liquidity for a security like bIB01 comes with some regulation issues. We are still exploring the best avenues for executing this in a safe way through external legal counsel. For instance, we could decide not to offer frontend access to the relevant smart contracts.

Next steps

Assuming the community is interested in this proposal, Steakhouse will continue working on the actual implementation.

Should this pool work well and get arbitraged, it would be possible to withdraw the USDT-VAI LP provided earlier this year to stabilize VAI.

If Venus succeeds at bootstrapping VAI-bIB01 liquidity, it will also be possible to add bIB01 as collateral on Venus which would be the first USD yield bearing asset there.

Make your voice heard!