Recommendations from Gauntlet

Summary

-

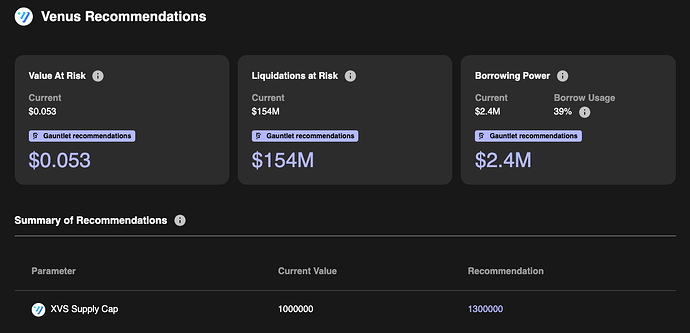

XVS:

- Raise supply cap to 1,300,000 from 1,000,000

-

TRXOLD & SXP:

- Allow users to continue to adjust their positions

- Follow up with IR parameter recommendations to reduce borrows

-

BUSD & BNB:

- Monitor market conditions and provide risk-off recommendations as warranted

Rationale

-

XVS

- While we continue to monitor XVS volatility, we recommend raising the supply cap moderately to 1,300,000 from 1,000,000 as XVS supply cap usage remains > 80%. 1.3M XVS represents < 9% of its total circulating supply (14.9M) and the combined liquidity of XVS across DEX/CEXes is ample enough to mitigate significant insolvency risk due to liquidations.

- Gauntlet will continue to monitor market conditions and recommend additional XVS parameter changes to support the Venus community without introducing significant risk to the protocol.

-

SXP

- Roughly 95% remaining SXP supply on Venus ($3.99m) is due to one user (address ending

...947b84d0), who supplies $3.79m of SXP and has a $0 borrow balance. With SXP’s CF at 0% and supply rate at 0%, it is not clear why the user has not updated their position. - While we cannot make any additional parameter adjustments to encourage this inelastic SXP supplier to reduce their supply balance at this time, we will continue monitoring this position and follow up with IR parameter recommendations that will encourage further reductions in SXP’s borrow balance.

- Roughly 95% remaining SXP supply on Venus ($3.99m) is due to one user (address ending

-

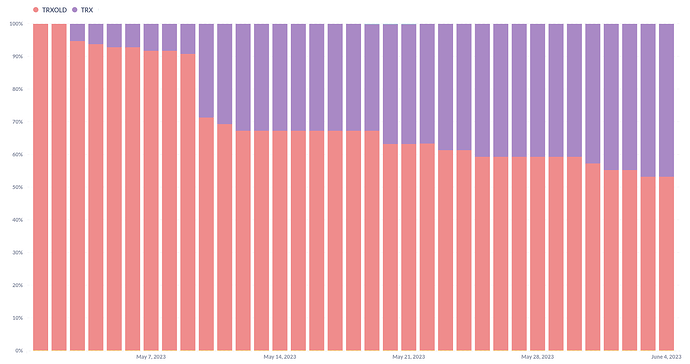

TRXOLD

- The TRXOLD borrow balance of one user (address ending

...42cea138) makes up over 90% of the total current TRXOLD borrow balance. Over the past month, this user has converted almost half of their TRXOLD to TRX:

- We will allow this user to continue to convert their position before making additional IR parameter recommendations (along with SXP) to encourage reduced borrow balances.

- The TRXOLD borrow balance of one user (address ending

-

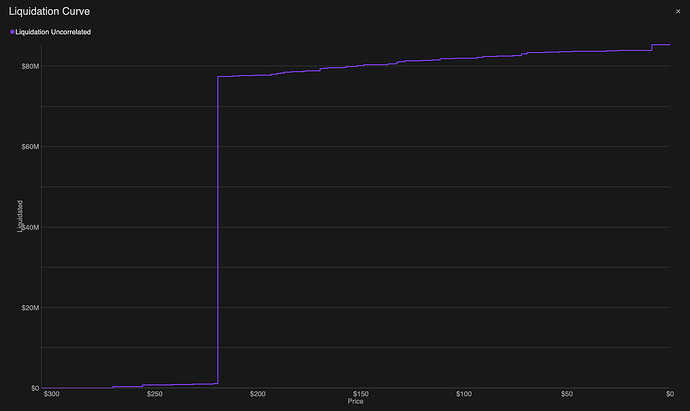

BUSD & BNB

- We closely monitor market conditions in real-time to respond quickly to dramatic drops in the price and liquidity of BUSD and BNB. While BUSD and BNB have both seen decreases in price and liquidity, these decreases do not pose an immediate, significant threat to Venus.

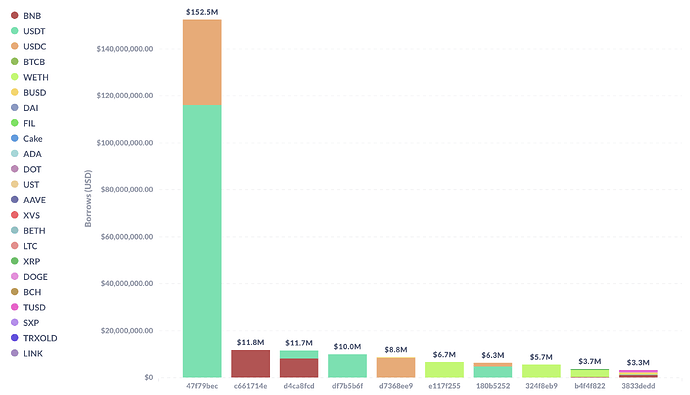

- In particular, we are monitoring the BNB exploiter position (address ending

...47f79bec), which currently has a health factor 1.27. The price of BNB would have to decline > 21% for this account to become liquidatable, at which point we estimate $78M BNB would be available for liquidation. During recent periods of volatility due to market news, we saw BNB prices drop by ~9%. See BNB’s current liquidation curve:

- We will continue to monitor both assets’ price and liquidity closely and make risk-off recommendations accordingly.

Methodology

Gauntlet’s parameter updates seek to maintain the overall risk tolerance of the protocol while making risk trade-offs between specific assets.

Gauntlet’s parameter recommendations are driven by an optimization function that balances 3 core metrics: insolvencies, liquidations, and borrow usage. Parameter recommendations seek to optimize for this objective function. Our agent-based simulations use a wide array of varied input data that changes daily (including but not limited to asset volatility, asset correlation, asset collateral usage, DEX / CEX liquidity, trading volume, the expected market impact of trades, and liquidator behavior). Gauntlet’s simulations tease out complex relationships between these inputs that cannot be expressed as heuristics. As such, the input metrics we show below can help explain why some of the param recs have been made but should not be taken as the only reason for the recommendation. The individual collateral pages on the Venus Risk Dashboard cover other vital statistics and outputs from our simulations that can help with understanding interesting inputs and results related to our simulations. To learn more about our methodologies, please see the Quick Links section at the bottom.

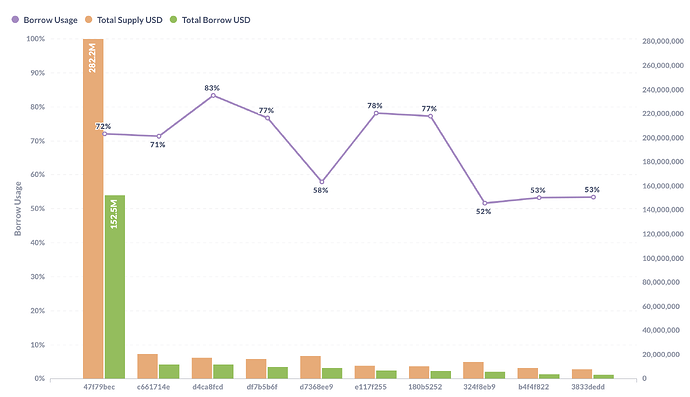

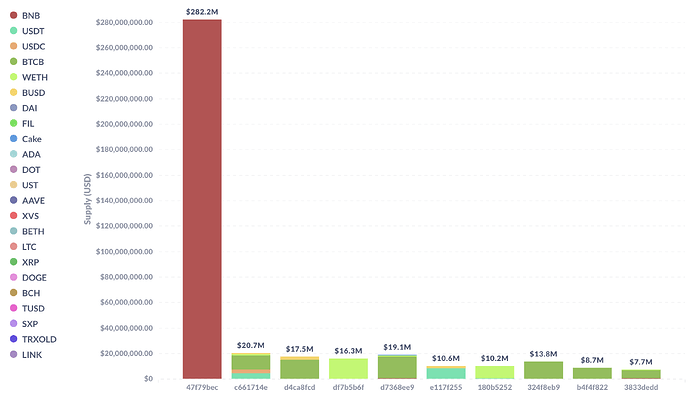

Supporting Data

The below figures show trends in key market statistics regarding borrows and utilization that we will continue to monitor:

Top 10 Borrowers’ Aggregate Positions & Borrow Usages

Top 10 Borrowers’ Entire Supply

Top 10 Borrowers’ Entire Borrows

Risk Dashboard

The community should use Gauntlet’s Venus Risk Dashboard to understand better any updated parameter suggestions and general market risk in Venus.

Value at Risk represents the 95th percentile insolvency value that occurs from simulations we run over a range of volatilities to approximate a tail event.

Liquidations at Risk represents the 95th percentile liquidation volume that occurs from simulations we run over a range of volatilities to approximate a tail event.

Quick Links

Please click below to learn about our methodologies:

Gauntlet Parameter Recommendation Methodology

By approving this proposal, you agree that any services provided by Gauntlet shall be governed by the terms of service available at gauntlet.network/tos.