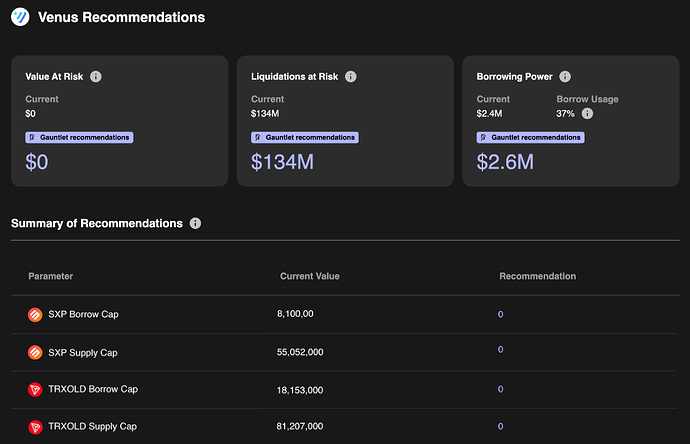

Recommendations From Gauntlet

Summary

-

SXP:

- Lower borrow cap and supply cap to 0 to prevent new positions.

-

TRXOLD:

- Lower borrow cap and supply cap to 0 to prevent new positions.

-

Conservative: No change; allow user (

...42cea138) to continue converting TRXOLD to TRX. - Aggressive: Raise TRXOLD’s borrow multiplier to 10 from 0.15, effectively raising the borrow rate APY to ~1000%.

-

WBETH:

- Conservative: Wait for the WBETH market to evolve before listing it on Venus.

-

Aggressive:

- Borrow cap: 400

- Supply cap: 500

- Reserve factor: 25%

- Liquidation bonus: 10%

- Review the rationale below.

-

XVS:

- Keep XVS parameters the same and continue monitoring liquidity.

-

DAI:

- Keep DAI parameters the same and continue monitoring liquidity.

Rationale

-

SXP

- The vast majority of remaining supplies on SXP ($4.17m) is due to one user (address ending

...947b84d0), who supplies $3.91m of SXP and has a $0 borrow balance. With SXP’s CF at 0% and supply rate at 0%, it is not clear why the user has not changed their position. - Regardless, we recommend lowering SXP’s borrow cap and supply cap to 0 to prevent new positions in SXP.

- The vast majority of remaining supplies on SXP ($4.17m) is due to one user (address ending

-

TRX

- The user (account ending

...42cea138) has been gradually converting their TRXOLD to TRX. So far they have converted a third of their TRXOLD to TRX over the course of two weeks. As such, we present two options for the Venus community with regard to completing the deprecation of TRXOLD.- Conservative: Make no changes to borrow rates and allow the user to continue converting their TRXOLD to TRX.

- Aggressive: Accelerate the user’s conversion by raising the borrow multiplier on TRXOLD. To put this into context, we calculate the days to liquidation for this user: the days it would take for this user to become liquidatable if they take no action from now on, and allow their borrows/supplies to accrue based on current borrow/supply rates (assuming prices don’t change). At current parameterization, it would take 1,580 days for this user to become liquidatable. But if the borrow rate APY were raised to ~1000% (by raising the multiplier to 10), that time reduces to 86 days. This would incentive the user to accelerate their conversion, but it would also make for an unfavorable user experience.

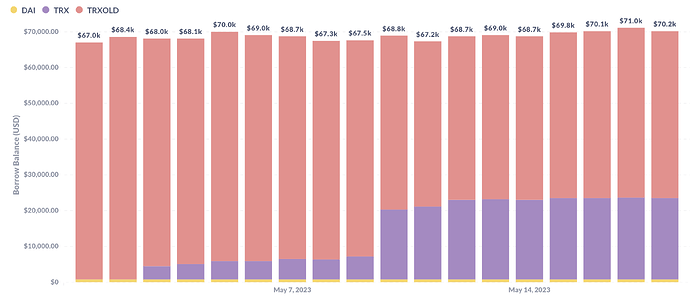

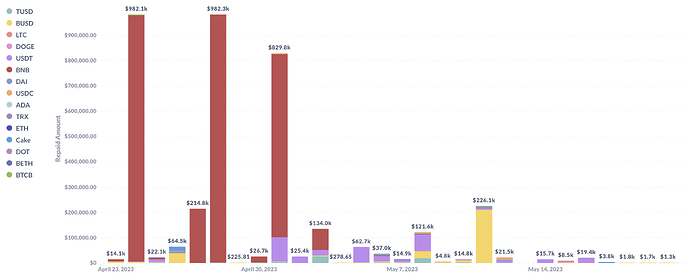

- For context, the chart below breaks down the user’s borrow composition since May 1:

- The user (account ending

-

WBETH

- Gauntlet’s standard is to avoid unnecessary risk when making parameter changes to avoid any new bad debt to the protocol; however, different communities have different risk tolerances. We defer to the Venus community on which recommendations they will choose. Below are risk averse and risk tolerant recs for WBETH. Please make sure to understand the tradeoffs and decide carefully. Review our detailed rationale in the section below.

- Conservative: Wait for the WBETH market to evolve before listing it on Venus.

-

Aggressive:

- Borrow cap: 400

- Supply cap: 500

- Reserve factor: 25%

- Liquidation bonus: 10%

-

Rationale: The parameterization of WBETH on Venus is dependent on, in part, 1) the mechanism to convert WBETH to and from BETH, 2) the oracle that Venus will use to price WBETH, and 3) the liquidity pools that support WBETH. Note that Gauntlet does not assess or manage oracle risk.

- On the first point, the risk of wrapped tokens depends highly on the cost and time needed to convert to and from their underlying counterpart; the more efficient this process, the more closely the wrapped token should reflect the underlying token. If liquidators can convert between wrapped tokens and unwrapped tokens atomically with their liquidation transaction, they are more likely to carry out liquidations. Currently, it appears the only way to wrap BETH to WBETH is through the Binance app, and the “Wrap” and “Unwrap” functions will be paused for 30 minutes daily. As such, the liquidation process might not always be seamless, which could lead to bad debt for Venus.

- On the second point, while it is outside of Gauntlet’s scope to assess or quantify risk related to oracles, we think it is worth noting this avenue of risk given that the price of WBETH will not be 1:1 with BETH. Instead, 1 WBETH will represent the price of 1 BETH + staking rewards. We encourage the community to consider this risk accordingly.

- On the third point, liquidity pools that support WBETH may not be significant concern if the conversion between WBETH and BETH is riskless. Instead, BETH liquidity should effectively determine the risk of WBETH. But the first point above may undermine this notion.

-

XVS

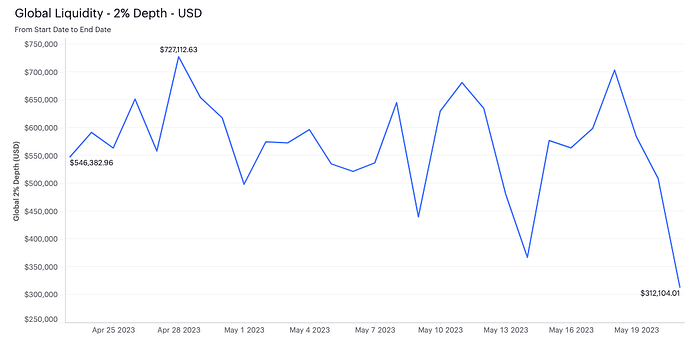

- Although XVS’s price has stabilized since it’s spike mid-April, its global liquidity (2% depth) has declined 55.6% since May 18. As such, we do not currently recommend any parameter changes for XVS. We will monitor XVS’s market conditions as they evolve.

- Although XVS’s price has stabilized since it’s spike mid-April, its global liquidity (2% depth) has declined 55.6% since May 18. As such, we do not currently recommend any parameter changes for XVS. We will monitor XVS’s market conditions as they evolve.

-

DAI

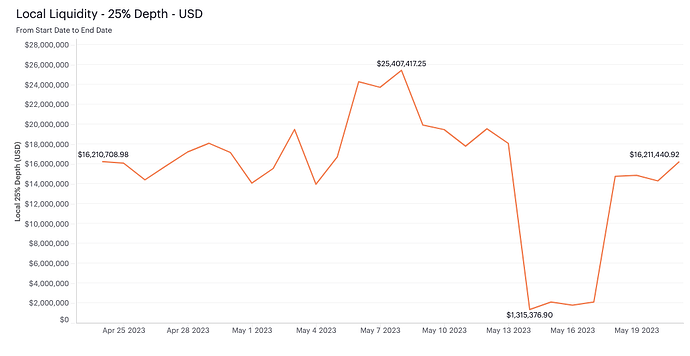

- DAI’s liquidity has recovered since its steep 92.7% decline between May 12-13. As of May 21, DAI’s local 25% depth on Venus has stabilized at $16.2m. Thus, we do not recommend any parameter changes for DAI at this time. It’s unclear what caused this decrease, but we will continue monitoring DAI’s liquidity. We will recommend risk-averse parameter changes (specifically for CF, borrow cap, and/or supply cap) if the local 25% depth comes under significant pressure again.

- DAI’s liquidity has recovered since its steep 92.7% decline between May 12-13. As of May 21, DAI’s local 25% depth on Venus has stabilized at $16.2m. Thus, we do not recommend any parameter changes for DAI at this time. It’s unclear what caused this decrease, but we will continue monitoring DAI’s liquidity. We will recommend risk-averse parameter changes (specifically for CF, borrow cap, and/or supply cap) if the local 25% depth comes under significant pressure again.

General Update

Below we provide a broader update on Venus protocol’s risk metrics.

Value At Risk

The capital potentially at risk due to insolvencies when markets are under duress (i.e. liquidation cascade, stablecoin deviation from par). VaR captures insolvency risk for two high level categories: Broad Market Downturn, and Broken Correlation (for stablecoins and Liquid Staking Tokens). It is the expected insolvencies in a ‘worst-case’ crypto market downturn, based on historical data. For more details see here.

Liquidations At Risk

The capital potentially at risk due to liquidations when markets are under duress (i.e. liquidation cascade, stablecoin deviation from par). LaR captures liquidation risk for two high level categories: Broad Market Downturn, and Broken Correlation (for stablecoins and Liquid Staking Tokens). It is the expected liquidations in a ‘worst-case’ crypto market downturn, based on historical data. We note that while liquidations can affect borrower UX, healthy liquidations are a critical part of a capitally efficient protocol For more details see here.

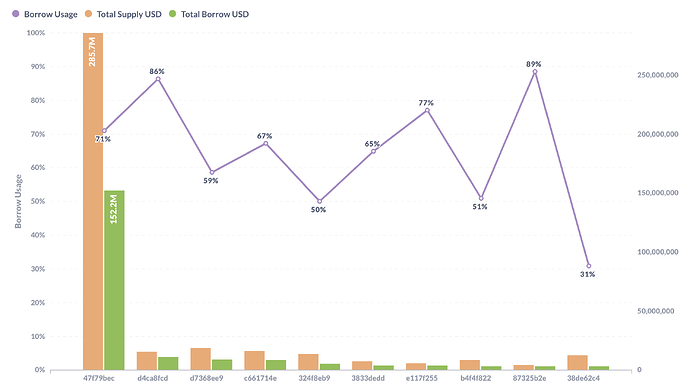

Borrow Usage

A measure of capital efficiency, it is the total available borrows based on collateral supplied to the protocol, calculated as supplies multiplied by the collateral factors (liquidation threshold) of each asset. Updated daily.

1. Methodology

Gauntlet’s parameter updates seek to maintain the overall risk tolerance of the protocol while making risk trade-offs between specific assets.

Gauntlet’s parameter recommendations are driven by an optimization function that balances 3 core metrics: insolvencies, liquidations, and borrow usage. Parameter recommendations seek to optimize for this objective function. Our agent-based simulations use a wide array of varied input data that changes daily (including but not limited to asset volatility, asset correlation, asset collateral usage, DEX / CEX liquidity, trading volume, the expected market impact of trades, and liquidator behavior). Gauntlet’s simulations tease out complex relationships between these inputs that cannot be expressed as heuristics. As such, the input metrics we show below can help explain why some of the param recs have been made but should not be taken as the only reason for the recommendation. The individual collateral pages on the Venus Risk Dashboard cover other vital statistics and outputs from our simulations that can help with understanding interesting inputs and results related to our simulations.

For more details, please see Gauntlet’s Parameter Recommendation Methodology and Gauntlet’s Model Methodology.

2. Risk Dashboard

The community should use Gauntlet’s Venus Risk Dashboard to understand better any updated parameter suggestions and general market risk in Venus. Value at Risk represents the 95th percentile insolvency value that occurs from simulations we run over a range of volatilities to approximate a tail event. Liquidations at Risk represents the 95th percentile liquidation volume that occurs from simulations we run over a range of volatilities to approximate a tail event. We would note that our methodology on borrow/supply caps is currently driven by risk modeling that is independent and additive to our risk simulations shown on the Dashboard.

3. Top Borrowers

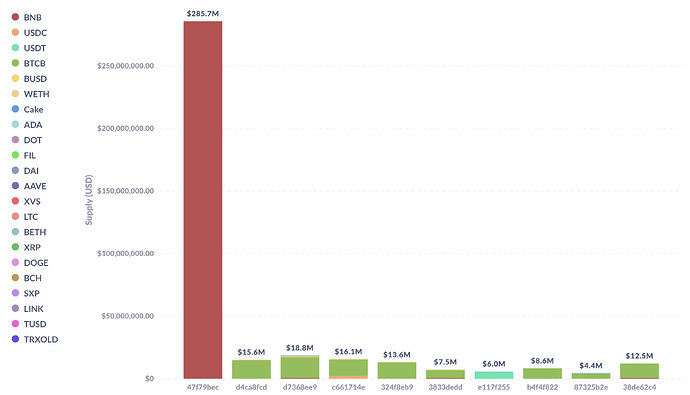

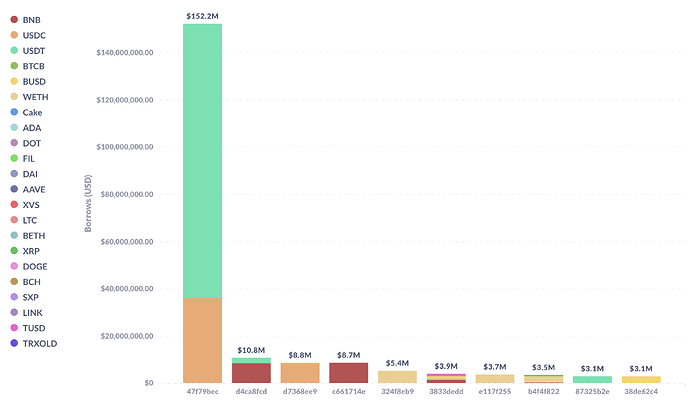

The below figures show trends in key market statistics regarding borrows and utilization that we will continue to monitor:

Top 10 Borrowers’ Aggregate Positions & Borrow Usages

Top 10 Borrowers’ Entire Supply

Top 10 Borrowers’ Entire Borrows

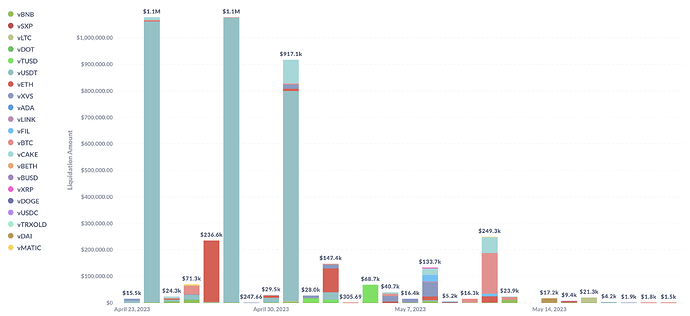

4. Liquidations

As Gauntlet tracks the state of the market and protocol, the charts below show some of the behavior we have been monitoring to ensure minimal market risk.

- April 24: Liquidations totaling $1m of supplied USDT (with repaid borrows in BNB) were driven by a 3.8% rise BNB’s price in the days leading to April 24.

- April 27-28: Venus saw a total of $1.3m in liquidation volume between April 27 and April 28, comprised mainly of a large individual $1m liquidation on April 28 of a user borrowing WBNB and supplying USDT. Two other large user liquidations of note ($233k and $31k) occurred on these dates as well, also for users borrowing WBNB. The $233k liquidation supplied ETH, and the $31k liquidation supplied USDT. These liquidations can be attributed to WBNB’s 6% price decrease between April 27-28.

- May 1: Liquidated supply totaled $917k comprising of a $791.9k user liquidation of supplied USDT (repaid borrow BNB) and a $87.7k user liquidation of supplied cake (repaid borrow USDT). The former liquidation occurred as a result of BNB’s price rising 4.5% between April 30 and May 1, and the latter liquidation as a result of Cake’s price declining by 7% on May 1.

- May 3: A total of 14 liquidations occurred on May 3 totaling $147.4k. One liquidation event comprises the majority of this total volume, for a user who was liquidated for $89.5k borrowing WBNB and supplying ETH. This particular liquidation can be attributed to a ~4% decrease in ETH’s price from May 2-3.

- May 8: Venus saw 60 liquidations totaling $133.6k on May 8. All 60 of these liquidation events were less than $25k each, the largest being a $19.3k liquidation of a user borrowing USDT and supplying Cake. The cause of this liquidation can be attributed to Cake’s ~12% price decrease between May 7-8.

- May 11: 14 liquidations occurred on May 11 totaling $249.2k. The 3 largest individual liquidations on this day were all BUSD borrows, with individual supply assets that all experienced ~5% price decreases on May 11, causing these liquidation events. The largest liquidation was $145.8k in volume, for a user supplying BTC (5.1% price decrease). The second largest liquidation for $58.7k supplied Cake (4.6% price decrease), and the third largest for $25.2k supplied ETH (5.2% price decrease).

We will continue to monitor user and protocol positions and make recommendations as needed. The charts below show the liquidations and repaid borrows of accounts liquidated in the past month.

Liquidation Amounts

Repaid Borrows

By approving this proposal, you agree that any services provided by Gauntlet shall be governed by the terms of service available at gauntlet.network/tos.