Recommendations From Gauntlet

Summary

-

TRX:

- Increase borrow cap to 9m tokens from 8m

- Increase supply cap to 11m tokens from 10m

- Increase CF to 0.475 from 0.45

-

TRXOLD:

- Reduce CF to 0.0 from 0.20

-

SXP:

- Reduce CF to 0.125 from 0.175

-

XVS:

- Decrease supply cap to 1m from 1.3m

- Decrease CF to 0.55 from 0.60

Rationale

For the listed assets, Gauntlet recommends the following:

-

TRX:

- To encourage continued usage of TRX instead of TRXOLD, we recommend raising borrow and supply caps to 9,000,000 and 11,000,000 respectively, as well as raising the collateral factor to 0.475. Our models indicate that the liquidity of TRX warrants borrow and supply cap increases to effectively manage risk and capital efficiency. We note that TRX’s 2% depth across all CEX and DEX sources is $24m (~400m tokens). The top 3 wallets on Binance chain hold ~256m TRX, and the top 5 wallets hold ~261m TRX. We calculate these increases in borrow/supply caps will contribute about $1,888 of additional potential reserve fee revenue annually to Venus. We also assess the risk of price manipulation with respect to collateral factor, borrow cap, and supply cap recommendations. Increasing the collateral factor from 0.45 to 0.475 continues to incentivize use of TRX relative to TRXOLD, without introducing additional meaningful risk of a price manipulation attack.

-

TRXOLD:

- In anticipation of Tron removing all TRXOLD liquidity as of April 14, we recommend reducing the CF of TRXOLD to 0.00 from 0.20. The 2% depth of TRXOLD on Binance chain is ~$124k, which allows Venus to easily absorb the liquidations of current TRXOLD suppliers.

- In anticipation of Tron removing all TRXOLD liquidity as of April 14, we recommend reducing the CF of TRXOLD to 0.00 from 0.20. The 2% depth of TRXOLD on Binance chain is ~$124k, which allows Venus to easily absorb the liquidations of current TRXOLD suppliers.

-

SXP:

- To continue the deprecation of SXP on Venus while also factoring in recent price volatility, we recommend continuing to conservatively lower CF from 0.175 to 0.125. It is unlikely for this decrease in CF to result in liquidations; SXP would have to experience a ~45% price decline in order to trigger liquidations of the two largest suppliers of SXP (addresses ending in

34cfb4f1and068e9790).

- To continue the deprecation of SXP on Venus while also factoring in recent price volatility, we recommend continuing to conservatively lower CF from 0.175 to 0.125. It is unlikely for this decrease in CF to result in liquidations; SXP would have to experience a ~45% price decline in order to trigger liquidations of the two largest suppliers of SXP (addresses ending in

-

XVS:

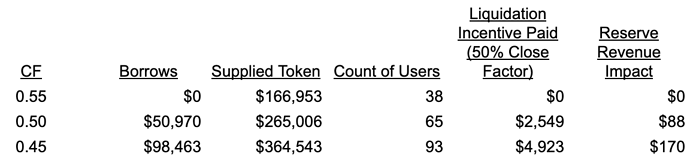

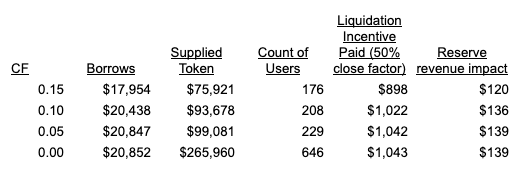

- The price of XVS spiked from $5.09 to as high as $8.93 on April 9, 2023, then declined in the morning of April 10 to ~$6.44. While there are no borrows of XVS on Venus and thus no risk of major liquidations directly due to this price action, XVS suppliers might be tempted to raise their borrow usage. This could backfire on them if the price of XVS suddenly declined, which would then potentially liquidate those users. For example, the largest XVS supplier (address ending

5567078e) tends to increase their borrows as the price of XVS rises (like when XVS rose 67.8% this year from Jan 1 through Feb 20). To discourage this, we propose lowering XVS’s collateral factor to 0.55, which would not cause major liquidatable borrows of XVS suppliers and also bring the XVS suppliers’ borrow usages near their levels prior to the price spike. It would also mean that the top 10 suppliers of XVS (totaling $3.5m of XVS) would not be liquidated unless the price of XVS declined 34.5% from current levels. See the table below for liquidatable borrows of XVS suppliers at different collateral factors. - To further discourage users who are trying to capitalize on the price change in XVS to increase their borrows, Venus can also lower the supply cap of XVS to 1m tokens from 1.3m. As mentioned, given the ongoing volatility in XVS, these users could be liquidated if XVS declined rapidly.

- Risk of a price manipulation attack on XVS is not a major concern given the current supplies of XVS are close to the supply cap.

- We will continue to monitor the situation as it evolves.

- The price of XVS spiked from $5.09 to as high as $8.93 on April 9, 2023, then declined in the morning of April 10 to ~$6.44. While there are no borrows of XVS on Venus and thus no risk of major liquidations directly due to this price action, XVS suppliers might be tempted to raise their borrow usage. This could backfire on them if the price of XVS suddenly declined, which would then potentially liquidate those users. For example, the largest XVS supplier (address ending

1. Methodology

Gauntlet’s parameter updates seek to maintain the overall risk tolerance of the protocol while making risk trade-offs between specific assets.

Gauntlet’s parameter recommendations are driven by an optimization function that balances 3 core metrics: insolvencies, liquidations, and borrow usage. Parameter recommendations seek to optimize for this objective function. Our agent-based simulations use a wide array of varied input data that changes daily (including but not limited to asset volatility, asset correlation, asset collateral usage, DEX / CEX liquidity, trading volume, the expected market impact of trades, and liquidator behavior). Gauntlet’s simulations tease out complex relationships between these inputs that cannot be expressed as heuristics. As such, the input metrics we show below can help explain why some of the param recs have been made but should not be taken as the only reason for the recommendation. The individual collateral pages on the Venus Risk Dashboard cover other vital statistics and outputs from our simulations that can help with understanding interesting inputs and results related to our simulations.

For more details, please see Gauntlet’s Parameter Recommendation Methodology and Gauntlet’s Model Methodology.

2. Risk Dashboard

The community should use Gauntlet’s Venus Risk Dashboard to understand better any updated parameter suggestions and general market risk in Venus. Value at Risk represents the 95th percentile insolvency value that occurs from simulations we run over a range of volatilities to approximate a tail event. Liquidations at Risk represents the 95th percentile liquidation volume that occurs from simulations we run over a range of volatilities to approximate a tail event. We would note that our methodology on borrow/supply caps is currently driven by risk modeling that is independent and additive to our risk simulations shown on the Dashboard.

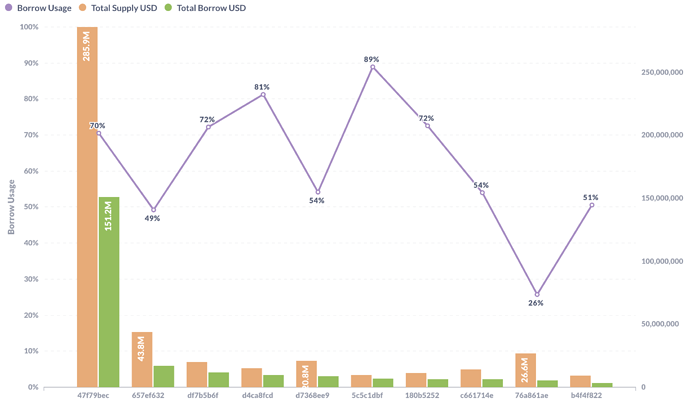

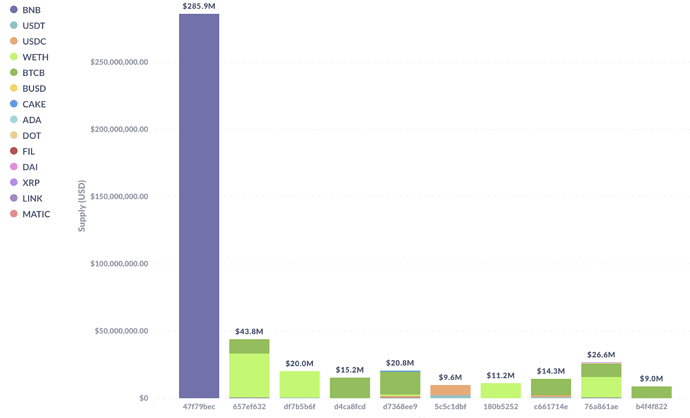

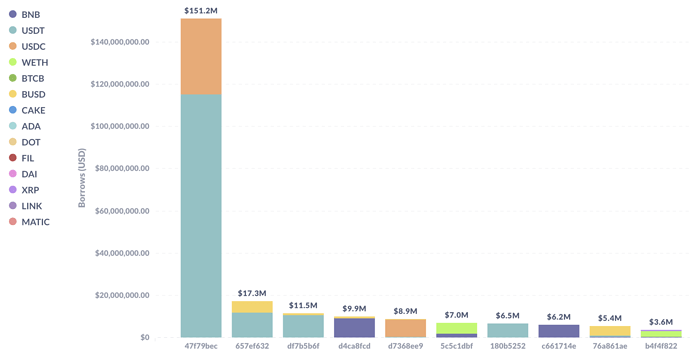

3. Top Borrowers

The below figures show trends in key market statistics regarding borrows and utilization that we will continue to monitor:

Top 10 Borrowers’ Aggregate Positions & Borrow Usages

Top 10 Borrowers’ Entire Supply

Top 10 Borrowers’ Entire Borrows

4. Liquidations

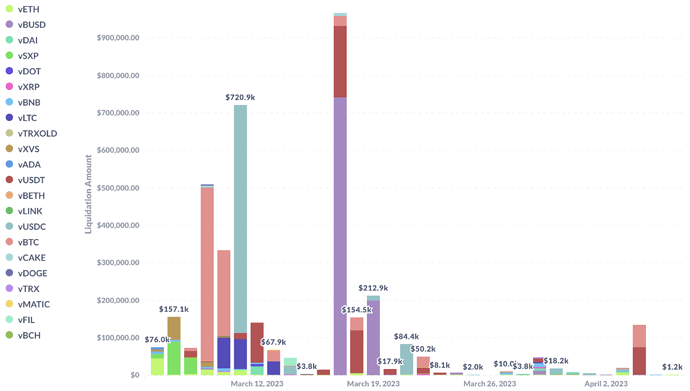

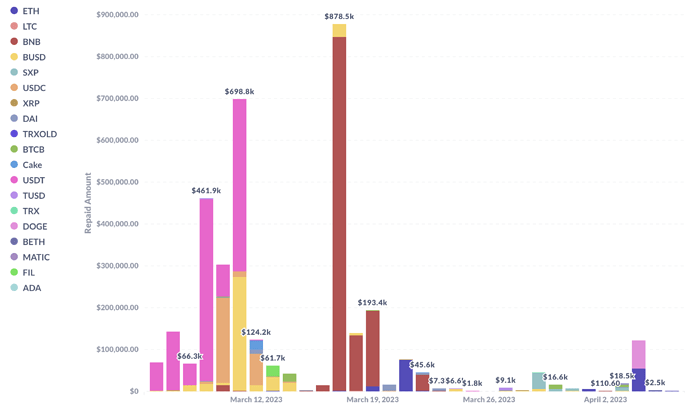

As Gauntlet tracks the state of the market and protocol, the charts below show some of the behavior we have been monitoring to ensure minimal market risk.

- March 9-10: Accounts with collateral asset BTC were liquidated on March 9 ($463k supply liquidated) and March 10 ($269k supply liquidated), due to BTC’s price falling ~8.0% between March 9 and March 10. An account with $82k of collateral asset LTC was liquidated on March 10; LTC fell 20.1% between March 9 and March 10. On March 9, $433k of borrowed USDT was repaid due to a decline in supplied BTC’s price that day. On March 10, an account with $203k of borrowed USDC was repaid, also driven by a price decline in collateral asset BTC.

- March 11: As USDC fell to as low as $0.88, accounts supplying $607k of USDC were liquidated. LTC also fell 8.9% from March 10 to March 11, liquidating $79k of supplied LTC. On March 11, the ~$699k of repaid borrows in mostly USDT and BUSD were driven by the price declines in collateral assets.

- March 17-19: Liquidations of $967k, $155k, and $213k occurred on March 17, 18, and 19, respectively, for mostly BUSD collateral assets. This was driven by an increase in the price of BNB, which rose ~12.7% between March 16-19.

- March 21-22: Liquidations of $83.5k and $27.6k occurred on March 21 and 22, respectively. The former account had borrowed ETH and supplied USDC as collateral, and was liquidated as a result of a 4.6% increase in ETH price on March 21. The latter borrowed BNB and supplied BTC, and was liquidated due to 6.3% price decline in BTC on March 22.

- April 4: Liquidations of $74.4k and $59.7k, totaling ~$135k, occurred on April 4. The former liquidation resulted from the borrowed asset, DOGE, experiencing a price spike of ~33% from April 3 to April 4. The latter liquidation, which borrowed ETH, was liquidated due to a 6% increase in ETH price on April 4.

We will continue to monitor user and protocol positions and make recommendations as needed. The charts below show the liquidations and repaid borrows of accounts liquidated in the past month.

Liquidations

Repaid Borrows

Next Steps:

- These recommendations will be put up for a VIP vote

By approving this proposal, you agree that any services provided by Gauntlet shall be governed by the terms of service available at gauntlet.network/tos.