TLDR

Gauntlet makes the following recommendations to optimize risk and capital efficiency for Venus:

- Raise BCH borrow cap to 9,000 from 7,000.

- Raise TRX borrow cap to 22,000,000 from 18,853,000.

Reasoning:

BCH’s and TRX’s borrows have nearly reached their borrow caps, and the utilization of each token has grown recently. Higher borrow caps for these increasingly utilized tokens will provide a better experience for users who wish to borrow them and yield more revenue for the protocol without adding outsized market risk.

- Supporting 2,000 more BCH (or $246k) at an APY of 10.04% could yield up to $24,700 in extra annual revenue.

- Supporting ~3,150,000 more TRX (or $206k) at an APY of 10.38% could yield up to $21,400 in extra annual revenue.

Gauntlet’s borrow cap recommendations are not only driven by growth considerations; our methodology also considers risks related price manipulation and liquidity concentration.

- We also consider the local liquidity (liquidity on the same chain) of tokens for borrow caps to ensure any given protocol is not overly concentrated with a token such that market makers and users cannot buoy its liquidity. Our methodology ensures that borrow caps of non-stablecoins do not exceed the holdings of the top 5 wallets on the same chain. Since the top 5 wallets on BNB chain hold 380k and 40m of BCH and TRX tokens, respectively, our recommendations do not present liquidity concentration risk.

As our models show that collateral factors are currently set to balance capital efficiency against market risk efficiently, we do not recommend any adjustments.

1. Methodology

Gauntlet’s parameter updates seek to maintain the overall risk tolerance of the protocol while making risk trade-offs between specific assets.

Gauntlet’s parameter recommendations are driven by an optimization function that balances 3 core metrics: insolvencies, liquidations, and borrow usage. Parameter recommendations seek to optimize for this objective function. Our agent-based simulations use a wide array of varied input data that changes daily (including but not limited to asset volatility, asset correlation, asset collateral usage, DEX / CEX liquidity, trading volume, expected market impact of trades, and liquidator behavior). Gauntlet’s simulations tease out complex relationships between these inputs that cannot be simply expressed as heuristics. As such, the input metrics we show below can help explain why some of the param recs have been made but should not be taken as the only reason for the recommendation. The individual collateral pages on the Venus Risk Dashboard cover other vital statistics and outputs from our simulations that can help with understanding interesting inputs and results related to our simulations.

For more details, please see Gauntlet’s Parameter Recommendation Methodology and Gauntlet’s Model Methodology.

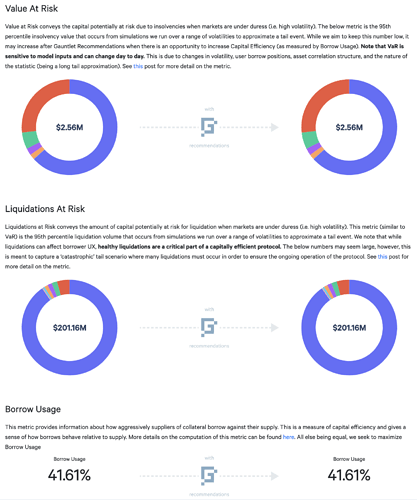

2. Risk Dashboard

The community should use Gauntlet’s Venus Risk Dashboard to better understand any updated parameter suggestions and general market risk in Venus. Value at Risk represents the 95th percentile insolvency value that occurs from simulations we run over a range of volatilities to approximate a tail event. Liquidations at Risk represents the 95th percentile liquidation volume that occurs from simulations we run over a range of volatilities to approximate a tail event. We would note that our methodology on borrow/supply caps currently is driven by risk modeling that is independent and additive to the our risk simulations shown on the Dashboard.

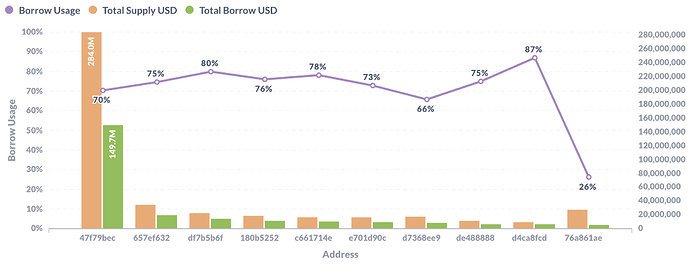

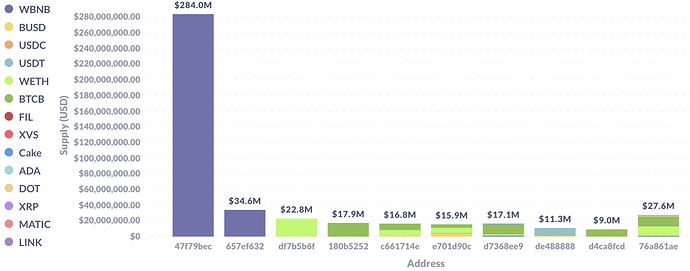

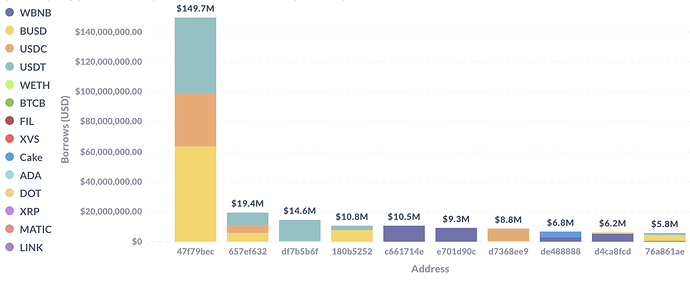

3. Top Borrowers

The below figures show trends on key market statistics regarding borrows and utilization that we will continue to monitor:

Top 10 Borrowers’ Aggregate Positions & Borrow Usages

Top 10 Borrowers’ Entire Supply

Top 10 Borrowers’ Entire Borrows

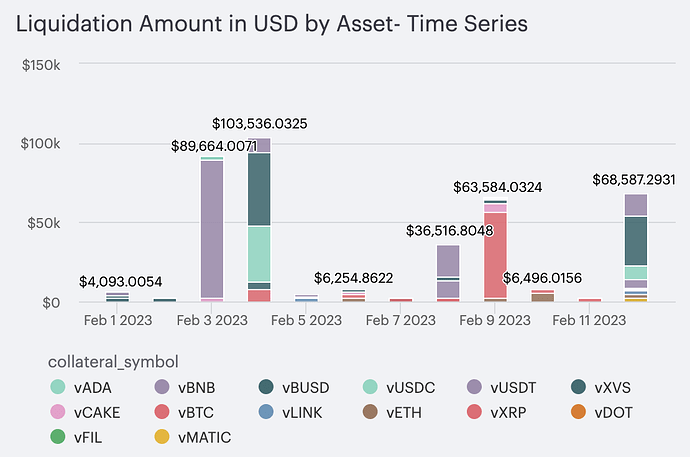

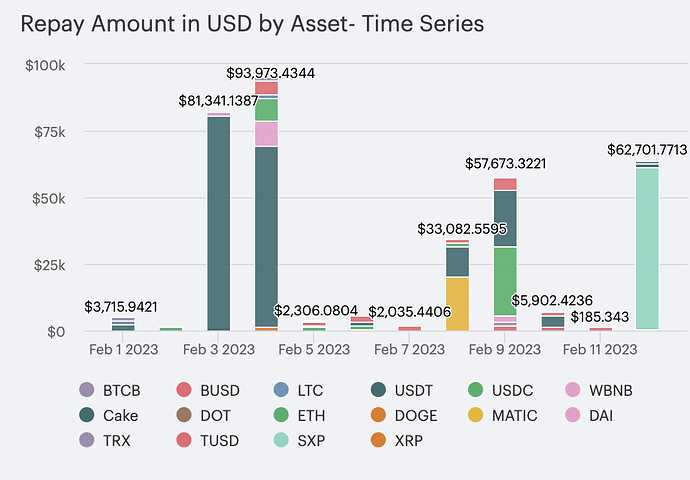

4. Liquidations

As Gauntlet tracks the state of the market and protocol, below shows some of the behavior we have been monitoring to ensure minimal market risk.

- Between February 3-4, the price of CAKE rose 11.1%, likely explaining the liquidations of borrowed CAKE tokens on those dates totaling $148.2k.

- On February 9, the price of vBTC fell 2.9%, causing a liquidation of an account supplying $54.6k of that token.

- On February 12, the price of SXP spiked ~25%, causing liquidations of around $60.9k of SXP borrows.

We will continue to monitor user and protocol positions and make recommendations as needed.

Helpful Quick Links

Please click below to learn about our methodologies:

Next Steps

- This vote will be put up for a VIP vote