TLDR:

Gauntlet makes the following recommendations to optimize risk and capital efficiency for Venus:

- Reduce BNB Collateral Factor from 80% to 75%

- Increase Borrow Caps for BCH from 4,331 to 7,000

- Increase Borrow Caps for FIL from 122,200 to 180,000

Collateral Factor Recommendations

- BNB: Lower CF from 80% to 75%.

- To clarify, Gauntlet ran an updated analysis of the protocol and this adjustment is still being recommended.

Methodology

This set of parameter updates seeks to maintain the overall risk tolerance of the protocol while making risk trade-offs between specific assets.

Gauntlet’s parameter recommendations are driven by an optimization function that balances 3 core metrics: insolvencies, liquidations, and borrow usage. Parameter recommendations seek to optimize for this objective function. Our agent-based simulations use a wide array of varied input data that changes on a daily basis (including but not limited to asset volatility, asset correlation, asset collateral usage, DEX / CEX liquidity, trading volume, expected market impact of trades, and liquidator behavior). Existing insolvencies are excluded from our simulations and VaR and LaR numbers, since we can only mitigate risk of future insolvencies. Gauntlet’s simulations tease out complex relationships between these inputs that cannot be simply expressed as heuristics. As such, the input metrics we show below can help understand why some of the param recs have been made but should not be taken as the only reason for recommendation. The individual collateral pages on the Gauntlet’s Venus Risk Dashboard cover other key statistics and outputs from our simulations that can help with understanding interesting inputs and results related to our simulations.

For more details, please see Gauntlet’s Parameter Recommendation Methodology 1 and Gauntlet’s Model Methodology 1.

Risk Off Liquidations:

Whenever we lower collateral factors, there’s a chance that some users may immediately become liquidatable as a result. There are a number of accounts that lend and borrow stablecoins and keep their balances just slightly above the liquidation threshold.

Reducing the collateral factor of BNB by 5% would push 115 accounts from just above the collateral factor to just below the collateral factor. The accounts have a total borrow value of $13k. The top account has a borrow balance of $2.5k. Most of the accounts are extremely small with recursive holdings.

Supporting Data

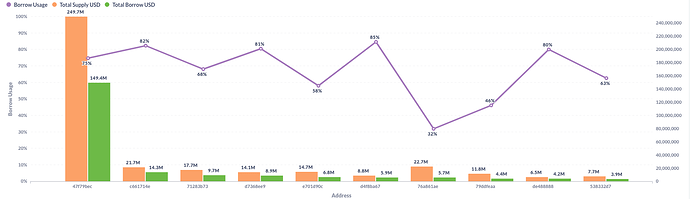

Top 10 Borrowers and Borrow Usage

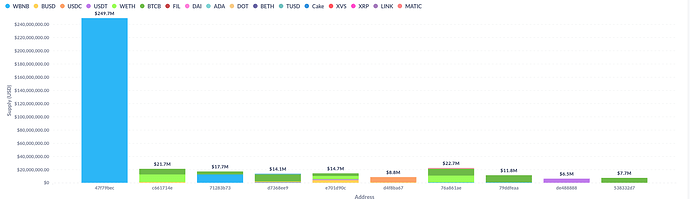

Top 10 Borrowers, Breakdown of Borrower Supply

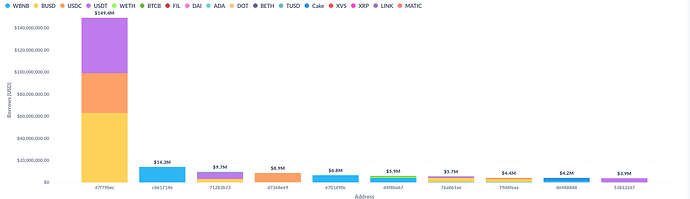

Top 10 Borrowers Breakdown of Borrows

The figures above show the distribution in risk among the top borrowers - A large amount of BNB is concentrated in one borrower, which could lead to insolvencies. Because of this, we can observe why a large portion of the VaR is in BNB.

Borrow Cap Adjustment Reasoning:

Gauntlet is adjusting the borrow caps for FIL and BCH to improve user experience, as previous caps were met. Borrow caps will continue to be monitored and incrementally updated to maintain protection against manipulation.

Risk Dashboard

The community should view the Gauntlet’s Venus Risk Dashboard to better understand the updated parameter suggestions and general market risk in Venus.

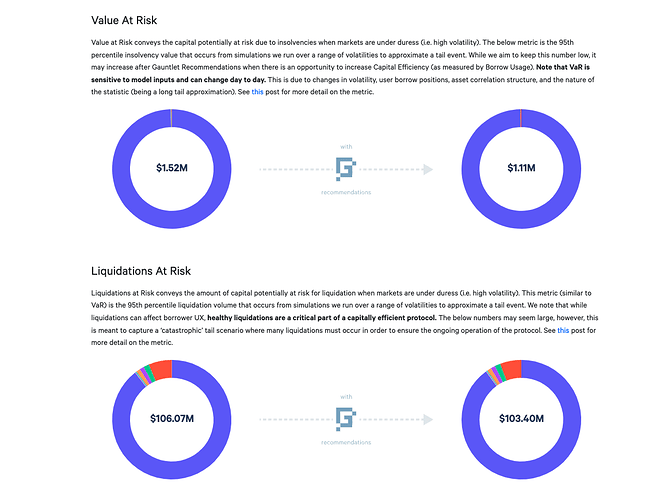

Value at Risk represents the 95th percentile insolvency value that occurs from simulations we run over a range of volatilities to approximate a tail event.

Liquidations at Risk represents the 95th percentile liquidation volume that occurs from simulations we run over a range of volatilities to approximate a tail event.

Helpful Quick Links

Please click below to learn about our methodologies:

Next Steps

- Gauntlet will put our recommendations up for a snapshot vote