Summary

A proposal to adjust parameters in the Liquid Staked BNB Pool on BNB Chain.

Motivation

We have observed consistently low deposits and utilization of BNB in the Liquid Staked BNB Pool. Below, we propose changes to better optimize this pool for looping.

Analysis

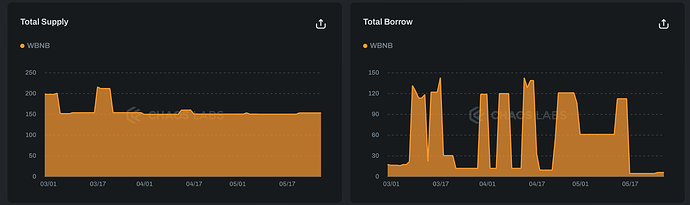

The amount of BNB supplied and borrowed in the Liquid Staked BNB Pool has been low over the last 90 days.

Optimizing the pool will involve making borrowing BNB cheaper, encouraging users to loop their BNB LSTs, thereby increasing utilization. Increasing the overall size of this market will also help to reduce rate volatility when new borrows are opened or closed.

CF and LT

First, we recommend increasing the Collateral Factor and Liquidation Threshold for all LSTs in the pool, noting that VIP-293 introduced new oracles for LSTs on BNB Chain, reducing the likelihood of liquidations. This will increase the capital efficiency of these markets and allow users to increase their looping to enhance yield.

WBNB IRs

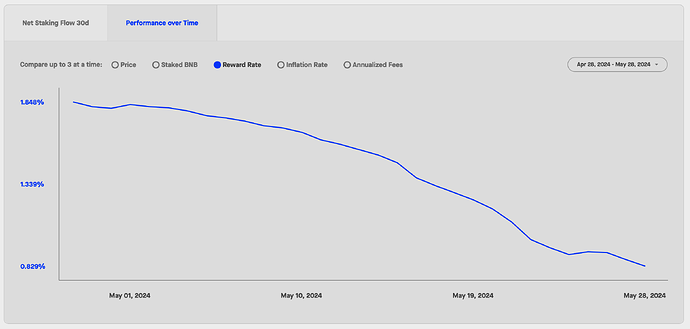

Regarding WBNB, we recommend increasing the Kink to 90%, lowering the Base IR to 0% and decreasing the Multiplier to 0.9%, targeting a rate of 0.81% at the Kink, just below current BNB staking APYs. This makes it more likely that the BNB borrow rate will be below its staking yield, making looping profitable.

Additionally, given the relatively low staking APY, we recommend reducing the Reserve Factor to 5% to ensure that rates remain attractive to BNB suppliers and borrowers.

LST IRs

Given the limited use case for borrowing LSTs in the pool, we do not recommend an update to the IRs.

LST Supply and Borrow Caps

Following an examination of on-chain liquidity, we also recommend decreasing the supply cap and borrow caps for stkBNB, which are currently set to 2,500 and 250, respectively; the supply cap is only 2% utilized. We recommend decreasing the supply cap to 50 stkBNB and the borrow cap to 0 stkBNB.

We do not recommend any further changes for supply and borrow caps in this pool.

Specification

BNB LST Pool

| Asset | Collateral Factor | Liquidation Threshold | Base | Multiplier (Annualized) | Jump Multiplier (Annualized) | Kink | Reserve Factor | Supply Cap | Borrow Cap |

|---|---|---|---|---|---|---|---|---|---|

| BNB | - | - | 0% | 0.9% (0.81% at Kink) | - | 90% | 5% | - | - |

| slisBNB | 90% | 93% | - | - | - | - | - | - | - |

| BNBx | 90% | 93% | - | - | - | - | - | - | - |

| ankrBNB | 90% | 93% | - | - | - | - | - | - | - |

| stkBNB | 90% | 93% | - | - | - | - | - | 2,500 → 50 | 250 → 0 |