Proposed updates:

- Reduce WBETH XVS reward from 34.355 XVS per day to 17 XVS per day.

- Increase supply cap: Supply Cap = 1000WBETH,

- Increase borrow cap: Borrow Cap = 800 WBETH

Rationale:

-

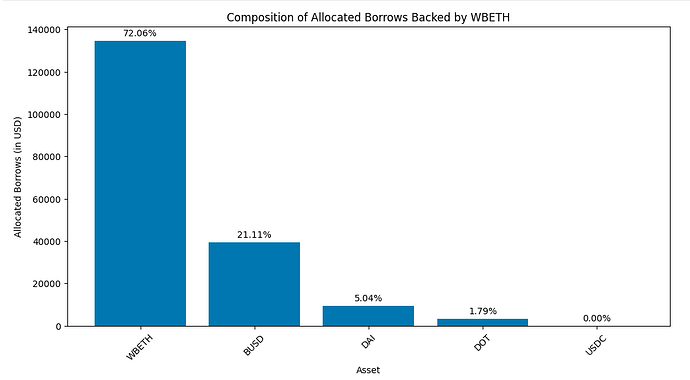

We noticed that the overall supply APY is 6.74% (2.47% APY + 4.27% distribution APY) while the overall borrow APY is 2.19% (-5.67% APY + 7.82% distribution APY i.e. borrowers are getting 2.19% instead of paying). This creates an opportunity for user to reach leveraged long position of WBETH by recursive supplying and borrowing of WBETH with risk free return. It is consistent with a market profile we conducted on WBETH: 72% of WBETH backed loan are WBETH itself.

To eliminate the positive borrow apy and ensure the interest rate curve can function better, we propose to reduce the XVS reward for WBETH market from 34.355 XVS per day to 17 XVS per day. As a result, the borrow APY will become (-5.67% + 3.91% = -1.76%)

-

The following are the facts we take into consideration to decide on the supply cap:

- PancakeSwap V3 liquidity 321 tokens (grew 34% from 239 as of a week ago)

- Total supply of WBETH is 50.95K https://bscscan.com/token/0xa2e3356610840701bdf5611a53974510ae27e2e1

- Selling 500 WBETH to PancakeSwap V3 for USDT results in 30% price impact.

Given the growing liquidity in PancakeSwap V3, the supply cap is set to be twice as high as the amount corresponding to 30% slippage.

-

For the borrowing cap, it is set such that when both the supply and borrow caps are hit, the utilisation rate is slightly higher than the kink of the interest rate curve. The objective is to ensure the interest rate can function to incentivise supply and borrow activities. Thus borrow cap is set at 800 WBETH.

We welcome any questions and discussions. Feel free to leave a comment or message us. Thank you!