Summary

ether.fi is seeking community support for adding its Liquid Restaking Tokens (weETH) to Venus Protocol on ETH Mainnet. In addition, anyone who deposits weETH on Venus will accumulate ether.fi and EigenLayer points to be used for future incentives.

Rationale:

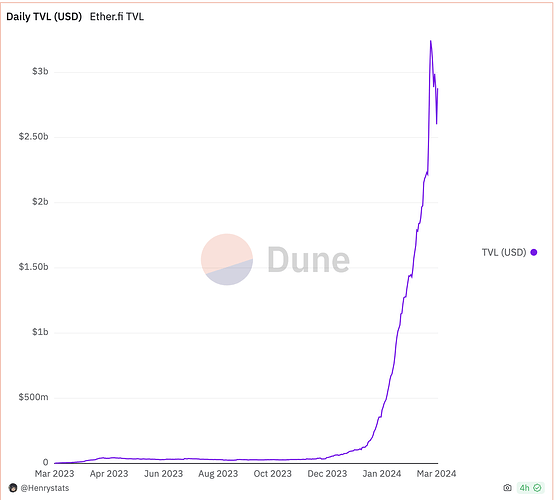

eETH is an LRT that allows users to stake their ETH, accrue staking rewards, and receive additional rewards through native restaking on EigenLayer. As of February 21st, approximately 474,234 ETH ($1.4B) in TVL has been deposited into the ether.fi protocol. You can view additional ether.fi stats on https://dune.com/ether_fi/etherfi

Users are given eETH on a 1:1 basis with a minimum deposit of 0.001 ETH. As mentioned above, ether.fi is also the first LSP to natively restake on EigenLayer — a move that helps improve network efficiency and provides stakers with additional rewards for their network contributions. ether.fi has also launched a series of partnerships with DeFi protocols to incentivize users and drive liquidity to various platforms.

ether.fi is the first decentralized, non-custodial delegated staking protocol with an LRT (eETH). One of the distinguishing characteristics of ether.fi is that stakers control their keys. Those who work on the protocol strive for the following:

-

Decentralization is the primary objective. ether.fi will never compromise on the non-custodial and decentralized nature of the protocol. Stakers must maintain control of their ETH.

-

The ether.fi protocol is a real business with a sustainable revenue model. The team is in this for the long haul. No ponzinomics f*ckery.

-

ether.fi will do the right thing for the Ethereum community, always. If and when the team messes up, ether.fi will own it and course correct quickly.

weETH is a non-rebasing wrapped version of eETH designed to interact with DeFi protocols.

Liquidity mining incentive for weETH suppliers

The ether.fi team will bootstrap the pool with $10,000 worth of weETH liquidity and incentivize this pool with $5,000 of weETH for an initial period of 30 days to kickstart the market on Venus.

Motivation

This move is intended to improve asset diversity on Venus and increase liquidity in the ecosystem. By integrating weETH into their markets, Venus Protocols allows its users to earn ether.fi and EigenLayer points which will be used for future incentives, in addition to lending APY on their holdings.

Conclusion

Adding support for weETH allows Venus to be a first-mover in capturing the restaking market. This provides users with a wider range of investment opportunities that match exceeding demand for LRTs.