@JR-ARG you are spot on. ROI matters. It is a complex project and most parameters will depend on the market and Venus community.

Nevertheless, I can give you some anchors.

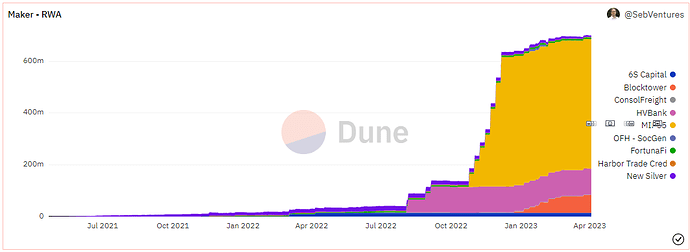

First, if we look at MakerDAO, the RWA initiative started in end 2020 and it entered 2023 by generating >$20M/year. The overall cost was most likely below $5M overall. MakerDAO has currently an excess of funding but RWA really turned a loss making protocol to a profitable one. But if you look at the chart below, you can see it was slow at the beginning. Hopefully, we know how to move faster now.

Second, if you just look at the Credix proposal, it is for 20M and assuming a 5% interest rate, this would mean $1M/year for Venus Protocol. In such case, the Steakhouse fees would be only 20%.

In both cases, you need funding so I would argue that it will lead to giving rewards (in term of VAI or XVS) which would lead to a cost on the protocol (but lower than revenues). I would also assume that we agree that, if RWA are a strategy to grow VAI, then growing VAI is more important than maximizing profitability in the short term (while the protocol should be at a profit).

@Eugenius the downside are mainly loss of capital which would be economically bad and bad for Venus reputation. Risks can be mitigated but not removed (especially the regulatory ones). I would point smart contract risk as well (obviously), but in RWA it is usually less smart contract intensive.