Summary

This proposal recommends listing Lombard’s LBTC—a liquid-staked Bitcoin built on Babylon—as a supported asset on Venus Core Market for BSC. By adding LBTC, Venus will unlock the borrowing demand for pegged BTC assets such as BTCB to provide a foundational source of yield for BTC lending within the Venus ecosystem while fostering greater liquidity and user engagement.

- Official Website: www.lombard.finance

- Documentation: docs.lombard.finance

- Github: github.com/lombard-finance

- X Profile: x.com/Lombard_Finance

- LBTC Dashboard: dune.com/lombard_protocol/lombard

- LBTC on BSC: 0xecac9c5f704e954931349da37f60e39f515c11c1

Background

Lombard’s mission is to expand Bitcoin’s role in decentralized finance (DeFi), turning it from a passive asset into a productive financial tool. Our core product, LBTC, is a secure, liquid-staked Bitcoin token that enables users to earn yield by securing PoS networks via Babylon, while preserving the original value of their BTC. As a 1:1 BTC-backed, yield-bearing token, LBTC facilitates cross-chain movement without fragmenting liquidity, aligning Bitcoin seamlessly with DeFi use cases.

Our team includes seasoned DeFi experts from Polychain, Babylon, Argent, Coinbase, and Maple, each with deep experience in scaling DeFi ventures. Lombard is incubated by Polychain Capital, which led a $16 million seed round in July 2024 with investments from Babylon, dao5, Franklin Templeton, Foresight Ventures, Mirana Ventures, Mantle EcoFund, Nomad Capital, OKX Ventures, and Robot Ventures. In October 2024, Binance Labs further strengthened Lombard’s backing by joining this extensive list of strategic partners.

Lombard’s Security

Lombard stands as the most secure Bitcoin Liquid Staking Token (LST) protocol, addressing both custody and depeg risks.

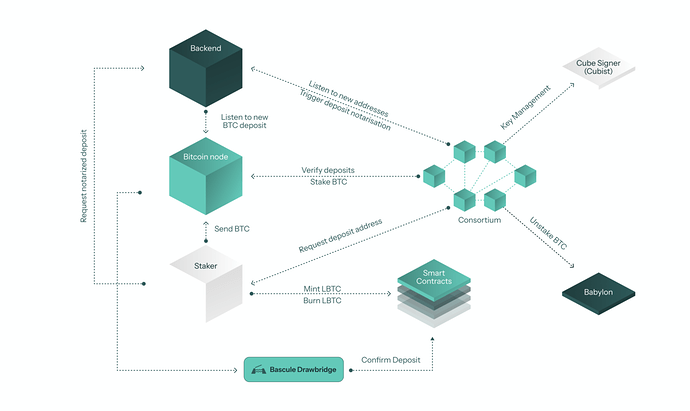

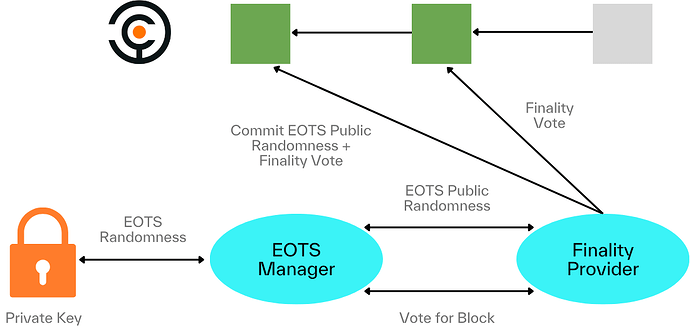

BTC Security: Lombard employs a trust-minimized, decentralized security model for BTC. Using a validator network (“Lombard Consortium”), validators notarize deposits to allow minting/burning of LBTC. Key management and a robust set of policies (off-chain smart contracts) that cryptographically restrict the actions the Lombard Consortium can take, preventing malicious actions or actions not intended by the Lombard Protocol. Multi-factor approvals and a withdrawal delay are required as an extra precaution.

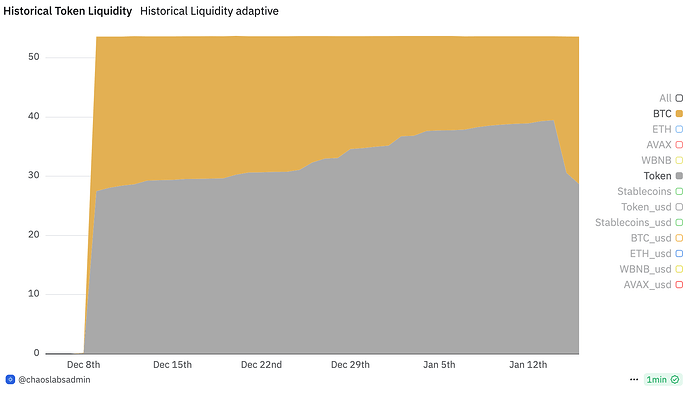

Depeg Protection: LBTC is the most liquid Bitcoin LST on the market, supported by $100 million in DEX liquidity on Ethereum, Base and BSC. With plans to expand across chains, we intend to scale in a very comparable fashion, which means that Lombard’s DEX will keep expanding exponentially. Lombard’s LBTC is exclusively backed by native BTC, is fully redeemable since launch. Additionally, Lombard was the first to introduce a proof-of-reserves oracle built in collaboration with Redstone.

Note: Historically, no meaningful price deviations ever occurred to the market price of LBTC paired against BTC-pegged assets such as WBTC and cbBTC.

Proactive Monitoring: Lombard have implemented multiple layers of active monitoring for LBTC contracts and relevant contracts across all supported blockchains. We utilize multiple RPCs and the Hexagate platform to detect malicious activities, with automated pausing capabilities and incident response via PagerDuty. Additionally, we monitor heavy DeFi allocations involving LBTC to screen for third-party market risks continuously.

Smart Contract Audits & Bug Bounties:

- The Halborn smart contract report is live on their website.

- The Veridise smart contract report can be found in the attached PDF.

- The Halborn consortium report is live on their website.

- The Immunefi Bug Bounty Program ($250k)

LBTC: The Market Leader

Beyond its security-first design, LBTC has emerged as the leading market player in Bitcoin staking, representing over 40% of the Bitcoin LST market share and serving as the largest staker on Babylon. Additionally, LBTC ranks as the fourth-largest overall BTC derivative, trailing only WBTC, BTCB and cbBTC.

-

Public Beta Launch Date: August 21, 2024

-

LBTC Market Cap: >$1.5 billion (circ. supply of 15.3k LBTC)

-

Liquidity on Ethereum: ±$70m

- WBTC/LBTC pool on Uniswap ($62m avg. monthly volume)

- cbBTC/LBTC pool on Uniswap ($13m avg. monthly volume)

- WBTC/LBTC stableswap pool on Curve ($13.5m avg. monthly volume)

- eBTC/WBTC/LBTC stableswap pool on Curve ($1.2m avg. monthly volume)

-

Liquidity on Base: ±$35m

- cbBTC/LBTC pool on Aerodrome (no significant historical data on volumes)

-

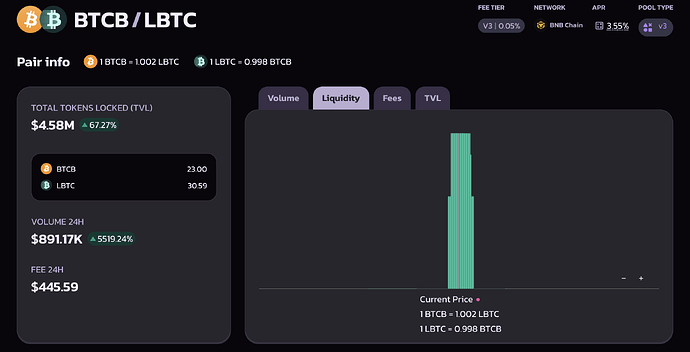

Liquidity on BSC: ±5m

- BTCB/LBTC pool on PancakeSwap (no significant historical data on volumes)

-

LBTC %TVL in DeFi: ±80%

- $100m on DEXs

- $50m on Lending markets

- $170m on Pendle (in LBTC & eBTC)

- $570m in Restaking

-

Social Channel Metrics:

LBTC Value Proposition

Yield-Bearing Collateral: LBTC provides an underlying yield from staking BTC within Babylon, making it a yield-bearing asset. Bitcoin LSTs are positioned to follow the success of yield-bearing ETH LSTs by offering BTC holders an effective way to maximize capital efficiency.

Ideal Collateral for Underutilized BTCB: Demand for leveraged LBTC exposure is consistently high across lending markets, where utilization rates for LBTC borrowing frequently reach maximum capacity. This presents a unique opportunity for BTCB lenders on Venus Protocol to unlock sustainable lending yields, addressing a gap in DeFi where BTC lending yields historically remain below 0.15% APY.

Incentives: Listing LBTC on Venus opens the door for users to tap into a range of incentives from leading BTCfi protocols, including Lombard and Babylon. LBTC deployed on Venus earns Babylon Points and benefits from Lombard’s Lux program, providing a 3x Lux boost for LBTC collateral on Venus.

Lombard Ecosystem Flywheel: Integrating LBTC within Venus feeds into a powerful “flywheel” effect within the Lombard ecosystem, enhancing its value proposition across DeFi. In just two months since launch, Lombard has demonstrated strong network effects, establishing exclusive partnerships that benefit every protocol utilizing LBTC. Examples include LBTC’s role as the exclusive collateral for ether.fi’s LRT eBTC and the Lombard DeFi Vault, built in partnership with Veda and uniquely incentivized by Corn. These strategic integrations create additional opportunities for protocols integrating LBTC to access net new liquidity and unique incentives.

Conclusion

This proposal outlines a strategic opportunity for Venus Protocol to tap into a rapidly growing BTCfi ecosystem, onboarding the leading asset within the category - LBTC. With over 40% market share in Bitcoin LSTs and ranking as the third-largest BTC derivative, LBTC combines secure, yield-bearing capabilities and robust liquidity.

Adding LBTC will tap into high borrowing demand for BTC-pegged assets like BTCB, providing a strong yield source for BTC lending and enhancing ecosystem liquidity. Venus users will gain access to incentives from Lombard’s ecosystem, creating a flywheel effect that drives adoption, liquidity, and rewards, supporting DeFi growth.