Summary

This proposal seeks to introduce zkETH as a supported collateral asset on Venus Protocol during the ZKsync Era. By working with Dinero to enable ZKSync’s highest yielding LST to be utilized as collateral we enhance Venus’s lending and borrowing ecosystem, provide further diversity and greater liquidity.

Background and Motivation

Dinero has established itself as a pioneering force in the decentralized finance (DeFi) sector, introducing an innovative two token LST model, making it easy for users to access Defi yields via pxETH or staking yields for apxETH. zkETH is designed to be the go-to ETH asset for ZKSync, offering the highest staking yield available across DeFi. With ZKSync’s native interoperability, zkETH is positioned to expand its utility across the Elastic Chain, unifying ETH staking for users and builders. zkETH can be minted natively on ZKSync and is backed by apxETH on Ethereum mainnet.

Official Website: https://dinero.xyz/ and https://zksync.dinero.xyz/

Official dapp website: Dinero and zkETH

Documentation: https://dinero.xyz/docs

Assets

Dinero’s LST runs a two token model. When you stake with Dinero 100% of the ETH staked is put into validators, validating the beacon chain and earning staking yield. This staking yield is distributed to apxETH holders.

Users can choose to access different, higher value yield via the Dinero marketplace (Dinero) using pxETH, a non-yield bearing version of their LST. This higher yield attracts more people towards pxETH yields and causes an outsized yield opportunity for apxETH holders.

zkETH can be minted natively on ZKSync and is backed by apxETH on Ethereum mainnet.

Adding zkETH as a collateral asset will provide a high yielding LST as collateral for the Venus and Dinero communities.

Asset numbers on Ethereum:

Market Cap: $150M (at time of writing for both apxETH & pxETH)

APY: 6%

Liquidity: $70M (pxETH)

Considerations

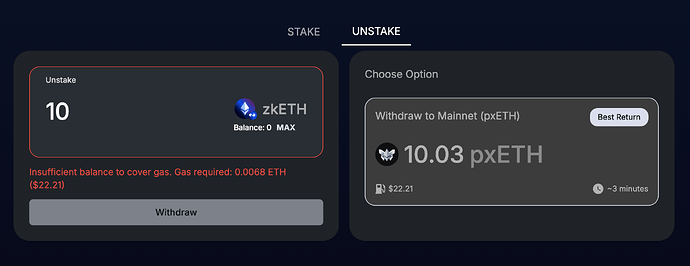

zkETH can be swapped for WETH on ZKSync or redeemed for pxETH with no fees.

Here is a technical docs for this process: https://dinero.xyz/docs/auto-px-eth-sol

Specifications :

Contract address: 0xb72207E1FB50f341415999732A20B6D25d8127aa

Oracle & Price Feeds: [TBC]

Conclusion

This proposal gives the opportunity for the Venus ecosystem to onboard the highest yielding LST on ZKSync as a collateral asset. This will enable users to take out loans at very attractive rates, as the yield generated from zkETH will counter-act a large percentage (if not all) of a users borrow APY.

We look forward to receiving feedback on this proposal and integrating into the Venus ecosystem.