Overview

Chaos Labs supports the goal of lowering borrowing costs and improving utilization through adjustments to the IRM. While the proposal suggests moving to a single kink at 90%, our analysis shows that maintaining a two-kink structure achieves the same objectives while better containing volatility and preserving borrower stability. Below, we present our analysis and revised parameter recommendations.

Motivation

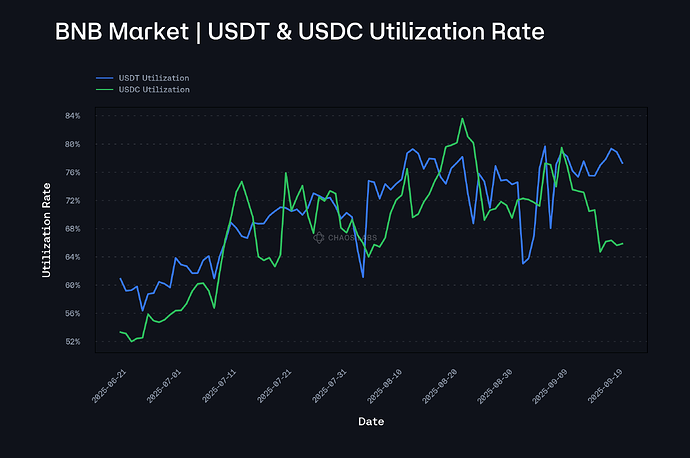

Over the past three months, both the USDT and USDC markets have shown limited momentum, aside from a brief uptick in utilization in late June to early July 2025. USDC utilization remained below 80% for most of the period and experienced a sharp drop in early September, now standing at 65.85%. USDT utilization has generally been higher than USDC’s but also stayed mostly below 80%, with no clear upward trend in the past two months. Given this demand profile, and considering Venus’s adjustments to incentives, we agree that lowering the kink APRs will reduce borrowing costs and support healthier utilization.

IRM Adjustments

We propose the following adjustments to the USDC and USDT IRM curves:

- USDC: kink1 at 80% with a 6.5% target rate, kink2 at 90% with an 8.5% target rate, and 40% at full utilization.

- USDT: kink1 at 80% with a 7.0% target rate, kink2 at 90% with a 9.0% target rate, and 40% at full utilization.

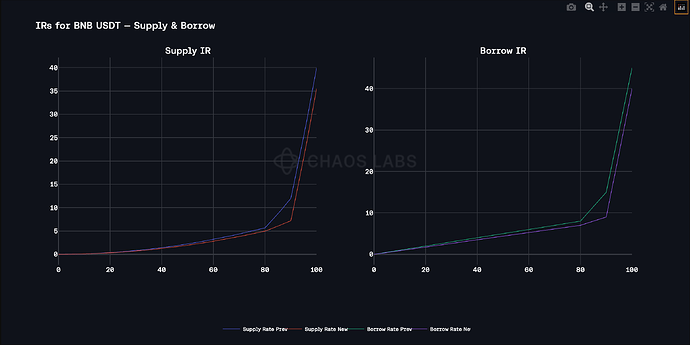

First, we believe these adjustments lower borrowing costs before kink1 and between kink1 and kink2, which can encourage higher utilization and move the markets toward a healthier balance. As shown in the figure below, the adjusted USDT curve flattens the borrow rate path before kink1 & kink2. In practice, this makes borrowing more capital-efficient and creates stronger incentives for users to increase utilization within typical utilization ranges.

At the same time, reducing the target rate at full utilization eases the severity of increases after kink2. This is especially important with the introduction of the new Stablecoin E-mode, where leveraged positions are expected to grow. A very steep slope after kink2 is destabilizing for such strategies: even small supply shifts can trigger abrupt APR spikes, which quickly push leveraged carry trades into losses and force rapid unwinds. By moderating the slope, the curve provides a smoother adjustment path that better supports sustainable leverage.

At the same time, this change does not compromise the mechanisms that protect against liquidity risk at higher utilization. The two-kink structure itself improves stability by introducing smoother, staged increases in the borrow rate. Instead of a sharp jump at a single kink, which can create sudden and punishing costs for borrowers, the two-kink model distributes the rate adjustment across two segments. This makes the path of rate increases more predictable and less disruptive to borrowers, while still ensuring strong disincentives against excessive utilization. In addition, in our proposal, slope2 is lowered slightly to reduce mid-range costs, but it remains steep enough to meaningfully raise the borrow rate as utilization moves toward kink2. Beyond kink2, even with a lower full-utilization target, the jump multiplier still drives borrowing costs up steeply, preserving a strong deterrent against excessive utilization and ensuring the system retains a robust buffer against liquidity stress.

Specification

USDT Interest Rate

| Parameter |

Current |

Recommended |

| Base Rate |

0 |

0 |

| Borrow Rate(APR) at Kink 1 |

8% |

7% |

| Kink 1 |

80% |

80% |

| Borrow rate(APR) at Kink 2 |

15% |

9% |

| Kink 2 |

90% |

90% |

| Borrow Rate(APR) at 100% |

45% |

40% |

| Reserve Factor |

10% |

10% |

USDC Interest Rate

| Parameter |

Current |

Recommended |

| Base Rate |

0 |

0 |

| Borrow Rate(APR) at Kink 1 |

8% |

6.5% |

| Kink 1 |

80% |

80% |

| Borrow Rate(APR) at Kink 2 |

15% |

8.5% |

| Kink 2 |

90% |

90% |

| Borrow Rate(APR) at 100% |

45% |

40% |

| Reserve Factor |

10% |

10% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.