Overview

Chaos Labs agrees with the proposed WBNB and BNB IRM parameters. Based on an analysis of the latest user behavior, we believe these changes will increase market utilization to more sustainable levels while preserving the current risk profile. Below, we present our analysis and recommendations.

Borrower Composition

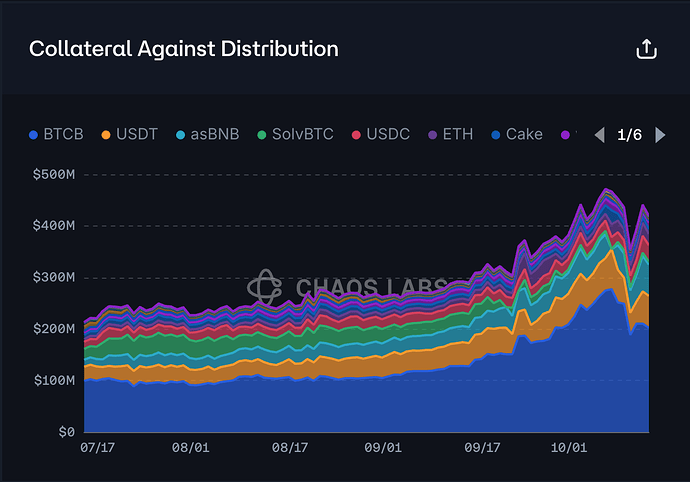

To optimize WBNB and BNB IRMs, we first need to understand their current borrower composition, which informs expected behavior and potential reactions to IRM changes. As shown below, from July 2025 to now, the top five collateral assets used to borrow against BNB have consistently been BTCB, USDT, asBNB, USDC, and ETH. As of this writing, they account for 48.07%, 16.05%, 14.26%, 6%, and 5.11% of total collateral, respectively.

Users who stake asBNB and borrow BNB are engaging in leverage-looping behavior, making them sensitive to IRM changes. We will analyze this group’s yield exposure in a later section.

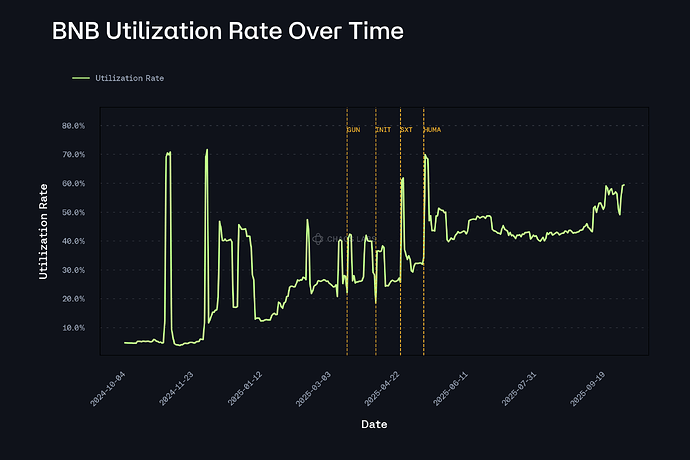

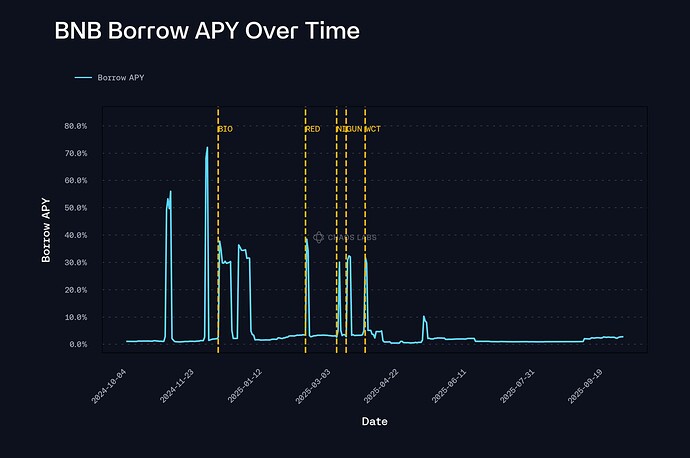

Other BNB borrowers, however, are not necessarily looping and may borrow for various purposes such as accessing liquidity, participating in BNB ecosystem incentive programs, or executing trading or hedging strategies, and therefore cannot be uniformly characterized. That said, past data shows that Binance LaunchPool has significantly influenced borrowing behavior on Venus: users borrowed large amounts of BNB ahead of LaunchPool events and locked it to harvest rewards. As shown, each time a Binance LaunchPool was announced, BNB borrowing spiked sharply. After the final LaunchPool ended in May 2025, BNB utilization no longer showed these surges and instead remained stable at around 50%.

Although no new LaunchPool events have occurred in the last five months, it is still reasonable to assume that non-looping borrowers may be attracted by other BNB ecosystem incentive programs and borrow BNB or WBNB. Therefore, in the following section, we will also examine current incentive programs in the Binance ecosystem and their yields to assess whether these rewards could materially influence non-looping borrower behavior and therefore warrant consideration in IRM design.

Borrower Incentives

slisBNB

slisBNB is the yield-bearing BNB LST issued by Lista DAO, accruing PoS staking rewards from BNB Chain validators via an increasing exchange rate. It is included in the recently proposed BNB E-Mode, and is expected to be actively used for slisBNB → WBNB/BNB leverage looping. As a result, understanding the yield profile of slisBNB is crucial for informing IRM adjustments.

slisBNB generates yield from two sources: the underlying BNB Chain staking rewards mentioned above and potential participation in Binance ecosystem incentives such as Launchpool and/or HODLer Airdrops. However, users who supply slisBNB to Venus are only exposed to the staking yield. This is because there are currently only two ways to make slisBNB eligible for Launchpool and/or HODLer rewards, and neither applies when the asset is supplied to Venus. The first method is to lock slisBNB directly in Launchpool or in eligible Binance Earn products, but doing so means the slisBNB is no longer available to be supplied on Venus. The second method is to hold slisBNB in a Binance Web3 MPC wallet, which also makes the tokens unavailable as Venus collateral. As a result, for slisBNB loopers on Venus, the only yield that can be directly realized while looping is the PoS staking yield embedded in slisBNB’s exchange rate appreciation.

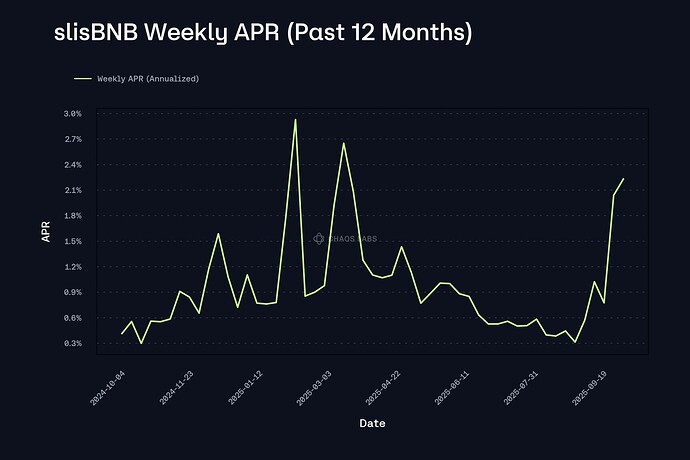

The chart below illustrates the yield behavior of slisBNB over the past year. As shown, the weekly averaged APR remained below 1.2% for the majority of the period, with notable spikes above 2% observed in January, March, and October of 2025.

asBNB

asBNB is Aster’s yield-bearing wrapper of slisBNB. It is created when users deposit either BNB or slisBNB into Aster: if BNB is deposited, it is first converted into slisBNB through Lista DAO’s liquid staking process. While slisBNB only reflects BNB Chain PoS staking rewards, asBNB aggregates additional Binance ecosystem incentives on top of this base yield. These include Binance Launchpool rewards, Binance HODLer Airdrops, Megadrop rewards, Au Points, and past campaigns such as Lista DAO CAC S3.

Among all the rewards that asBNB is exposed to, only the rewards from Binance Launchpool are directly reflected in asBNB’s internal value. When users mint asBNB, the underlying slisBNB is sent to Aster’s YieldProxy. The YieldProxy convert the slisBNB into clisBNB and delegate it to Binance’s MPC wallet, allowing the position to participate in Launchpool farming without any user action. As Launchpool rewards accumulate, they are then converted back into BNB and restaked into slisBNB. The YieldProxy sends the additional slisBNB to the minter contract, increasing the total amount of slisBNB backing the existing asBNB supply. As a result, the exchange rate (1 asBNB → slisBNB) increases, and the value of asBNB rises over time.

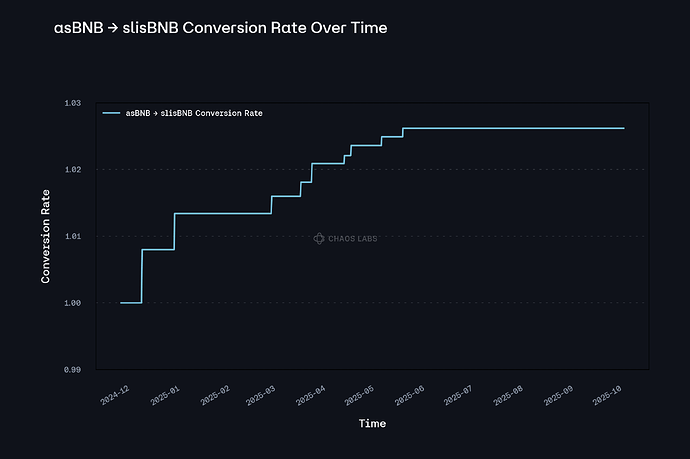

As a result of this mechanism, after the final Launchpool event ended in May 2025, asBNB stopped accumulating rewards into its backing, causing its exchange rate to flatten. As shown, the conversion rate from asBNB to slisBNB has remained unchanged over the past five months.

The second category of asBNB rewards comes from Binance HODLer Airdrops, Megadrop rewards, Au Points, and Lista DAO CAC S3. These rewards are not auto-compounded into asBNB’s value and must be manually claimed by users. Among these, Au Points and Lista DAO CAC S3 have already concluded, and Megadrop has not taken place in the past five months.

Therefore, the main remaining source of additional yield for asBNB is participation in Binance HODLer Airdrops. Although eligibility for HODLer Airdrops typically requires the rewards to be claimed by wallets directly holding asBNB, after communicating with the team, we confirmed that users staking asBNB on Venus can also gain exposure to these rewards. Based on data from the past three months, the yield from HODLer Airdrops for asBNB has averaged around 10%. Combined with approximately 1% staking yield from slisBNB, the total asBNB yield can be estimated at around 11%.

Binance Ecosystem

Binance Earn

Binance Earn is the overarching platform that aggregates all yield-generating products on Binance. Simple Earn is a product under Binance Earn that offers principal-based yield with two formats: Flexible and Locked. Flexible Products allow users to subscribe and redeem at any time, with rewards accruing every minute directly into the balance. Locked Products require committing assets for a fixed term to earn higher APR; early redemption is allowed but forfeits all accrued rewards, and standard redemption takes less than 72 hours. Over the past year, the APR of BNB Flexible Products has stayed below ~0.06%, and the highest APR offered by long-duration BNB Locked Products has remained below ~0.6%.

In addition, Binance Earn also includes Advanced Earn, which offers several higher-yield, higher-risk structured strategies. Dual Investment allows users to lock in a future buy or sell of an asset at a target price. Smart Arbitrage hedges futures vs. spot to capture funding fees. On-Chain Yields gives access to DeFi protocols with Binance handling on-chain operations. Discount Buy lets users buy crypto at a discount or earn APR if not executed. However, due to the inherent complexity, higher risk, and active user involvement required by these strategies, broad participation is naturally limited. As a result, using these yields as a direct benchmark when setting borrow rates is unreasonable. Therefore, we do not elaborate on these yields further in this report.

Binance LaunchPool

Binance Launchpool lets users lock assets (mainly BNB) to farm new project tokens before listing. During a defined farming period, Binance takes hourly snapshots of each user’s locked balance and the total pool; rewards accrue every hour based on proportional share. Users can claim at any time, unlock instantly with no delay, and all assets plus unclaimed rewards are automatically returned after the period. BNB held in Simple Earn Locked/Flexible or On-chain Yields also counts automatically (unless pledged as loan collateral). Rewards are paid in the project’s native token, and listing follows shortly after. However, as mentioned above, given that Launchpool has been inactive for over five months, we will not treat Launchpool yields as a benchmark in this IRM update. If Launchpool resumes in the future, we will reassess its yield and determine whether further IRM adjustments are warranted.

HODLer Airdrop

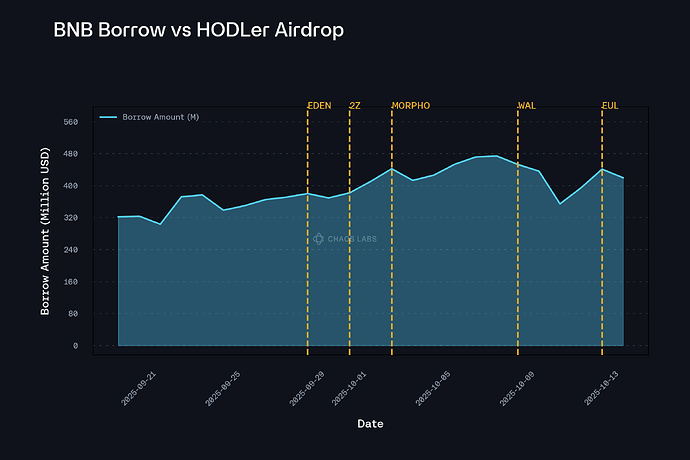

Binance HODLer Airdrops is a program that retroactively rewards BNB holders with newly listed project tokens based on historical snapshots of their BNB balances. Users do not need to take ongoing actions; participation is automatic as long as their BNB is subscribed to Simple Earn (Flexible or Locked) or On Chain Yields during the snapshot window. Binance takes multiple randomized balance snapshots over several days, then allocates the airdrop proportionally using each user’s average BNB balance. This means users do not receive advance announcements of HODLer Airdrops before the eligibility snapshot period begins, which significantly reduces the likelihood of users borrowing large amounts of BNB or WBNB in the short term just to qualify. As shown in the chart, the yellow lines mark the announcement times of the last five HODLer Airdrops. It is clear that BNB borrowing did not increase following these announcements.

MegaDrop

Binance Megadrop is a token launch platform that gives users early access to new project tokens before listing by combining BNB Earn products and Web3 quests into a score-based reward system. Users participate by either locking BNB in Simple Earn Locked Products (longer duration = higher score) or completing quests through the Binance Web3 Wallet, with final rewards based on each user’s Total Score = (Locked BNB Score × Web3 Quest Multiplier) + Bonus Points. Scores are calculated using hourly balance snapshots and updated daily, and users can boost returns by completing all quests to activate multipliers. After the participation window ends, the system finalizes scores and airdrops the project’s native token directly to users’ Spot wallets.

Unlike HODLer Airdrops but similar to Binance LaunchPool, Megadrop announcements are made before the event begins, giving users strong incentives to borrow BNB and lock it in Simple Earn to earn points. However, just like LaunchPool, the last Megadrop event (KERNEL) ended in April 2025, and no new events have occurred since. Therefore, in this IRM adjustment, we will not factor in potential Megadrop incentives influencing user borrowing behavior.

IRM Recommendation

Chaos Labs supports the proposed WBNB and BNB IRM changes.

First, the discontinuation of Binance Launchpool and MegaDrop has materially reduced borrowing demand for BNB. As shown, when LaunchPool was active, users were willing to borrow BNB at high costs, even at rates above 30%. With those programs no longer available, high borrow rates now only suppress utilization. Flattening the IRM curve for WBNB and BNB is therefore appropriate, as it lowers the cost of borrowing and supports healthier market activity.

In addition, the proposed IRM will not introduce borrow rate volatility or liquidity risks. First, the removal of LaunchPool and MegaDrop has eliminated the primary driver of short-term borrowing spikes in the Binance ecosystem. Current initiatives such as HODLer Airdrops and Simple Earn do not create incentives for users to borrow large amounts of BNB in a short time to boost rewards. As a result, borrow rate volatility is naturally reduced. Therefore, narrowing the spread between the two kinks is reasonable, as it promotes healthier utilization without adding risk.

Second, based on our analysis of current BNB incentive programs and the yield profiles of asBNB and slisBNB, we assess that setting the target borrow rate at 11% does not pose a material liquidity risk. Although asBNB’s average yield is around 11%, which could, in theory, push BNB and WBNB utilization to 90%, the portion of yield from HODLer Airdrops is highly volatile. This component does not consistently average 10% and has fallen as low as 6%. Consequently, it is unlikely that rational users would push utilization to such high levels or borrow at rates of 10% or 11%, as this carries the risk that BNB borrow rates could exceed the asBNB APR, leading to losses. This view is supported by post-May 2025 data, where BNB utilization has remained around 50% and peaked at approximately 60%, corresponding to a borrow rate of only 2.78%.

Market Migration

In the current proposal, the target borrow rate at Kink1 for WBNB is set at 5% to encourage market migration through arbitrage. We believe creating this spread is reasonable. As long as the new supply rate in the WBNB market exceeds the borrow rate in the BNB market, users are theoretically incentivized to borrow BNB at a lower rate and supply it into the WBNB market. The larger the spread, the more BNB users will be motivated to supply to the new market. However, the trade-off is that achieving a higher supply rate requires setting a higher target borrow rate at Kink1, which could in turn suppress utilization.

The introduction of E-Mode in the WBNB market can help address utilization issues. However, the effectiveness of this approach depends on the current yield of asBNB, which is derived from three components: slisBNB staking yield, Launchpool rewards, and HODLer Airdrops.

Launchpool has been inactive for the past five months, and its contribution can therefore be excluded. The slisBNB staking yield has averaged 0.98% over the past year, which we consider the baseline return. The additional yield from HODLer Airdrops depends on the share of asBNB converted during each event; based on data from the past three months, we estimate this component at approximately 10%. Combining these sources, we find it reasonable to assume an effective asBNB yield of around 11%. Under this assumption, the E-Mode Yield Optimization chart is updated as follows:

Max Loop, $100 asBNB as initial capital:

| Scenario |

LTV |

Borrow Rate |

Leverage |

asBNB Exposure |

Strategy Yield (APR) |

| BNB |

72% |

2.5% |

3.57x |

357 |

32.85% |

| WBNB |

90% |

5% |

10x |

1000 |

65.00% |

The above analysis shows that, given the current asBNB yield and WBNB market borrow rate, if asBNB users employ maximum looping, the WBNB market will remain more attractive than the BNB market due to the benefits of E-Mode. In other words, WBNB market utilization will not be negatively affected.

In fact, with an average asBNB yield of around 11%, the borrow rate at 80% utilization in the WBNB market could be pushed higher without negatively affecting utilization. However, our analysis shows that the portion of asBNB yield derived from HODLer Airdrops fluctuates significantly and does not consistently average 10%, with lows around 6%. Therefore, to ensure that WBNB market utilization remains above the kink 1, we consider 5% a reasonable starting point. If continued monitoring indicates that asBNB yields remain consistently near or above 10%, the WBNB market borrow rate can be adjusted upward accordingly.

From a market migration perspective, with a 5% target borrow rate and 80% utilization, the WBNB market offers a 3.4% supply rate, higher than the 2.5% target borrow rate at the same utilization level in the BNB market. This creates an approximate 0.9% spread that supports market migration and could theoretically push BNB market utilization to around 81%.

Furthermore, given that the 80% utilization borrow rate in the WBNB market enables users to achieve higher strategy yields relative to the BNB market, optimal market efficiency could drive WBNB utilization toward approximately 84%, where looping yields between the two markets converge. At this utilization level, the WBNB supply rate reaches 5.2%, further widening the spread between the WBNB supply rate and the BNB borrow rate, thereby strengthening the incentives for market migration.

Finally, while BNB borrowers can loop asBNB to achieve higher yields, cross-market arbitrage still offers enough incentives for users, as this strategy avoids the liquidity risk associated with asBNB looping, which requires a 7 day withdrawal period.

That said, the effectiveness of this market migration framework hinges on WBNB utilization achieving the targeted 80%. In a fully efficient market and under the current configuration, this outcome is expected. However, if utilization remains below expectations post-implementation and the anticipated spread fails to materialize, Chaos Labs will reassess and adjust the WBNB borrow rate as necessary to restore optimal utilization.

Specification

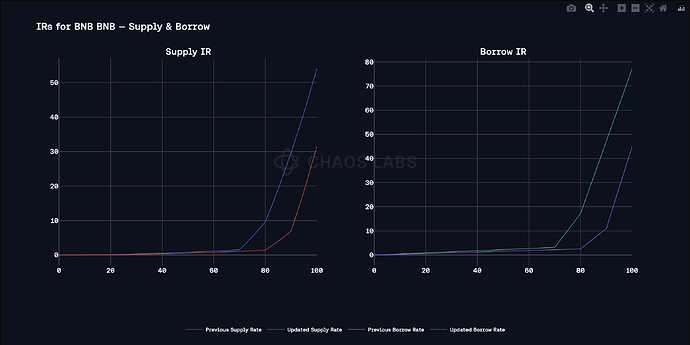

BNB Interest Rate

| Parameter |

Current |

Recommended |

| Base Rate |

0 |

0 |

| Borrow Rate(APR) at Kink 1 |

3.15% |

2.5% |

| Kink 1 |

70% |

80% |

| Borrow rate(APR) at Kink 2 |

17.15% |

11% |

| Kink 2 |

80% |

90% |

| Borrow Rate(APR) at 100% |

77.15% |

45% |

| Reserve Factor |

30% |

30% |

WBNB Interest Rate

| Parameter |

Current |

Recommended |

| Base Rate |

0 |

0 |

| Borrow Rate(APR) at Kink 1 |

3.15% |

5% |

| Kink 1 |

70% |

80% |

| Borrow rate(APR) at Kink 2 |

17.15% |

11% |

| Kink 2 |

80% |

90% |

| Borrow Rate(APR) at 100% |

77.15% |

45% |

| Reserve Factor |

30% |

15% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.