Author: RociFi

Submission date: Apr 25, 2023

TL;DR

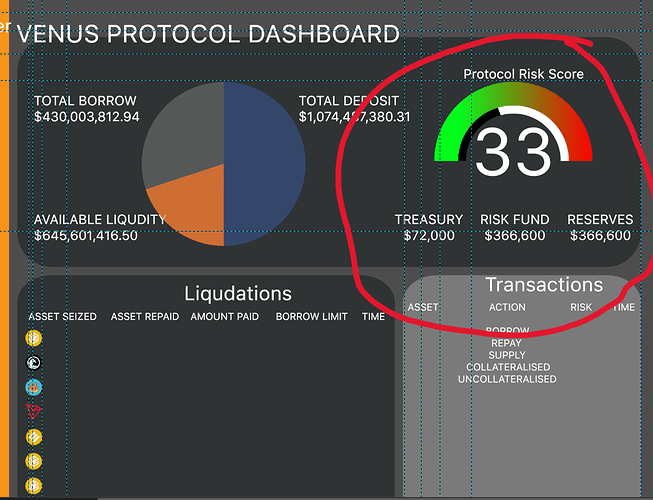

Temperature check for a simple pilot to assess if higher loan-to-value ratios on Venus would increase borrowing demand.

Opportunity

Many borrowers have expressed interest in higher loan-to-value (LTV), i.e. more capital-efficient, loans. For some borrowers, capital-efficiency is a differentiator that would make them switch from other protocols to Venus.

Capital-efficiency can be achieved by issuing loans with higher Collateral Factors and therefore, higher loan sizes, to borrowers who are less likely to be liquidated based on their historical DeFi activity.

Venus offering higher LTV loans can serve existing and new users more effectively while increasing revenue.

Solution

A potential pilot, Venus users can be offered higher capital efficiency loans on a user by user basis per their RociFi credit score. This increased efficiency benefits users with customized LTVs, generates more revenue to Venus, and isolates risk away from Venus.*

- Risk of increased LTVs, i.e. possible bad debt accumulation in liquidation spirals, is segmented to RociFi liquidity pools separate from core Venus.

About RociFi Scores

RociFi enables capital efficient lending via on-chain credit scores. RociFi credit scores (36K+) have been battle-tested on our protocol across 6000+ capital efficient loans issued within the bear market with zero bad debt from price based liquidations. RociFi’s goal is to expand this utility as a public good across DeFi as a capital efficiency layer with Venus being our primary hub.

Scores are calculated using on-chain transactional and DeFi protocols usage data across most popular EVM-compatible chains.

Deep Dive into RociFi Scoring Semantics, with examples of how various addresses are scored: Semantics of RociFi Scoring. Introduction | by RociFi | On-Chain Scores & Capital-Efficient Loans | Apr, 2023 | Medium

Capital Efficiency Examples

- The RociFi team has completed full simulation reports for Radiant Capital and Moonwell, previously, showing strong results.

- User level risk monitoring

Motivation:

Capital efficiency and risk management are at the core of all DeFi lending platforms. Simply put, if protocols have better information, they can make better decisions, which can generate higher revenue with less risk. The ability to safely increase capital efficiency should be a common good across all of DeFi with Venus being a primary hub.

Key terms

Credit scores: numerical scores representing a user’s (wallet address) creditworthiness and trustworthiness based upon their on-chain transaction history. The scale is 1 to 10 with 1 being the lowest risk (best score) and 10 being the highest risk (worst score). The scores are calculated looking at numerous DeFi protocols across 9 blockchains - not simply Venus.

Conclusion

We’d like to gauge interest before a formal vote. Please leave your thoughts in the comments!

We are open to feedback or questions regarding the idea. Thanks!