Summary

It has been approximately one year since the last revision to Venus Tokenomics and given the continuing evolution of the market, it’s time to reevaluate an optimal distribution of income given the protocol’s current and future needs.

This proposal seeks to address the unequal distribution of income between rewards and treasury reserves. It lays out a comprehensive plan to optimize the income distribution, in order to better cater to the protocol’s needs and safeguard its sustainability.

The key highlights of the proposed changes are as follows:

- Redistribute protocol reserve revenue allocation to:

- 40% Risk Fund

- 40% Treasury Reserve

- 10% XVS Vault Rewards

- 10% Venus Prime Token Program

- Redistribute liquidation and other product development distribution to:

- 50% Risk Fund

- 40% Treasury Reserves

- 10% XVS Vault Rewards

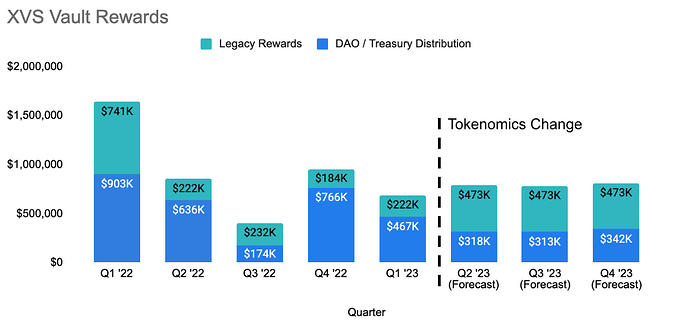

- Make use of the savings from the two rounds of 50% XVS emission cuts to double the XVS vault legacy rewards currently set at 525 XVS/Day, with the aim of maintaining or even enhancing the vault rewards.

- Adjust the Venus Prime program (Soulbound Token) rewards. Initial rewards for this program have been 20% of accumulated product revenues since Q4, 2022. These rewards currently exceed $750K, which are expected to significantly increase the APYs for eligible participants. We propose to reduce the program’s revenue allocation to 10% to balance rewards while preserving attractive APYs and incentivizing user participation.

The expected outcomes are an increase in treasury reserves, sustainable reward emission rates, sustainable Venus Prime (SBT) reward incentives, and maintenance of an attractive APR for XVS Vault stakers.

Methodology of Analysis

To bring forth these recommendations, the proposal has assessed the existing tokenomics of the Venus Protocol, considered the past changes and their impact on the ecosystem, and analyzed the market dynamics and trends. Currently, revenue distribution is as follows:

Protocol reserve revenue distribution:

- 40% Risk Fund (including financing)

- 20% XVS Vault Rewards

- 20% DAO Operations & Funding

- 20% Venus Prime Token Program

Liquidation and other product development distribution:

- 48% Risk Fund (including financing)

- 26% XVS Vault Rewards

- 26% DAO Operations & Funding

The proposal is to change this distribution to the following:

Protocol reserve revenue distribution:

- 40% Risk Fund (No change)

- 40% Treasury Reserve (+20% change)

- 10% XVS Vault Rewards (-10% change)

- 10% Venus Prime Token Program (-10% change)

Liquidation and other product development distribution:

- 50% Risk Fund (+2% change)

- 40% Treasury Reserves (+14% change)

- 10% XVS Vault Rewards (-16% change)

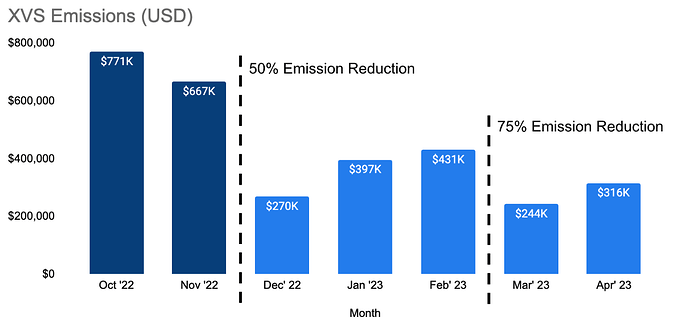

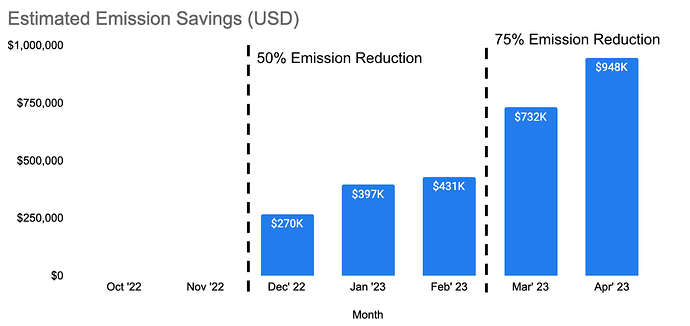

This change is possible if we consider the savings from the protocol’s October and February 50% XVS emission reduction, which accounted for an estimated amount of more than $2.7M. With this, we propose re-allocating these savings towards XVS vault stakers, enhancing rewards without compromising on the token emission rate.

Results and Conclusions

The proposed revisions in Venus Protocol Tokenomics are expected to yield positive results for the Venus ecosystem, ensuring a fairer distribution of income and enhancing the platform’s sustainability.

Figure 1: This graph represents the reduction in XVS emissions since October considering the execution of the reduction in Nov ‘22 followed by another 50% reduction in February.

Figure 2: This graph illustrates the savings from the emission reductions, estimated over $2.7 million.

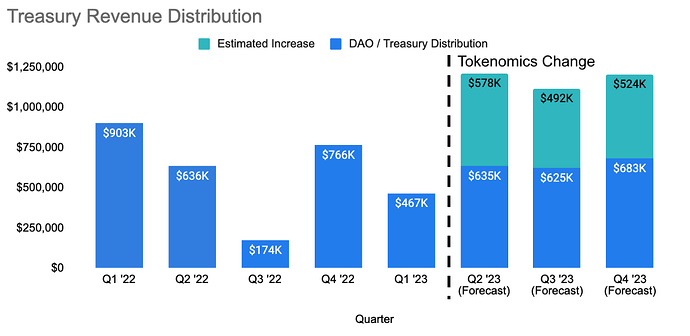

Figure 3: This graph predicts the increase in treasury reserves with the proposed redistribution. The surplus will serve as a safety net for the protocol’s ongoing and future operations, audits, and development team financing.

Figure 4: This graph depicts the change in rewards for XVS vault stakers due to the reallocation of saved emissions and new legacy reward distribution. This approach is anticipated to maintain or even increase the current APR, thus keeping the vault attractive for stakers.

The introduction of these changes will bolster the long-term stability of the Venus Protocol. It will provide the necessary financial buffer for potential risks, support new product development, and assure reasonable rewards for stakers.

Ultimately, this proposal envisions a thriving and sustainable Venus Protocol, one that is prepared for more upcoming releases and all safety considerations with ample budget for audits and a dedicated development team.